US Inflation Retreats: Will It Stay That Way?

Inflation is a puzzling phenomenon.

For decades, it has been under control in the West. Now, as we have discussed before here and here, it is rising but, thanks to the aftershocks of the pandemic, it isn't clear whether it will continue.

The problem is that inflation can pose a threat to corporate profits or standards of living but it isn't purely driven by economic issues like supply constraints or bottlenecks.

It is at least partly a psychological phenomenon. And once people (or companies) start to expect rapid price increases their behavior also starts to change and these new habits can be very sticky and difficult to arrest.

As a result, whether inflation does or does not prove to be "transitory" matters a lot for monetary policy and also regular people. A little inflation is great but too much can harm the poor or those on a fixed pension who must watch their quality of life erode.

We have published the remainder of this post on blog found here. There are 6 charts laying out the situation.

Two things are clear:

A lot of the temporary stuff disrupted by Covid-19 are falling back to earth.

The high inflation of earlier this year as a whole is moderating and doing so pretty quickly.

This cooling could be very important for the US economy and average taxpayers if it continues.

Here are two charts to demonstrate these points:

CPI used car prices -1.5% month on month, which is biggest drop since November 2016

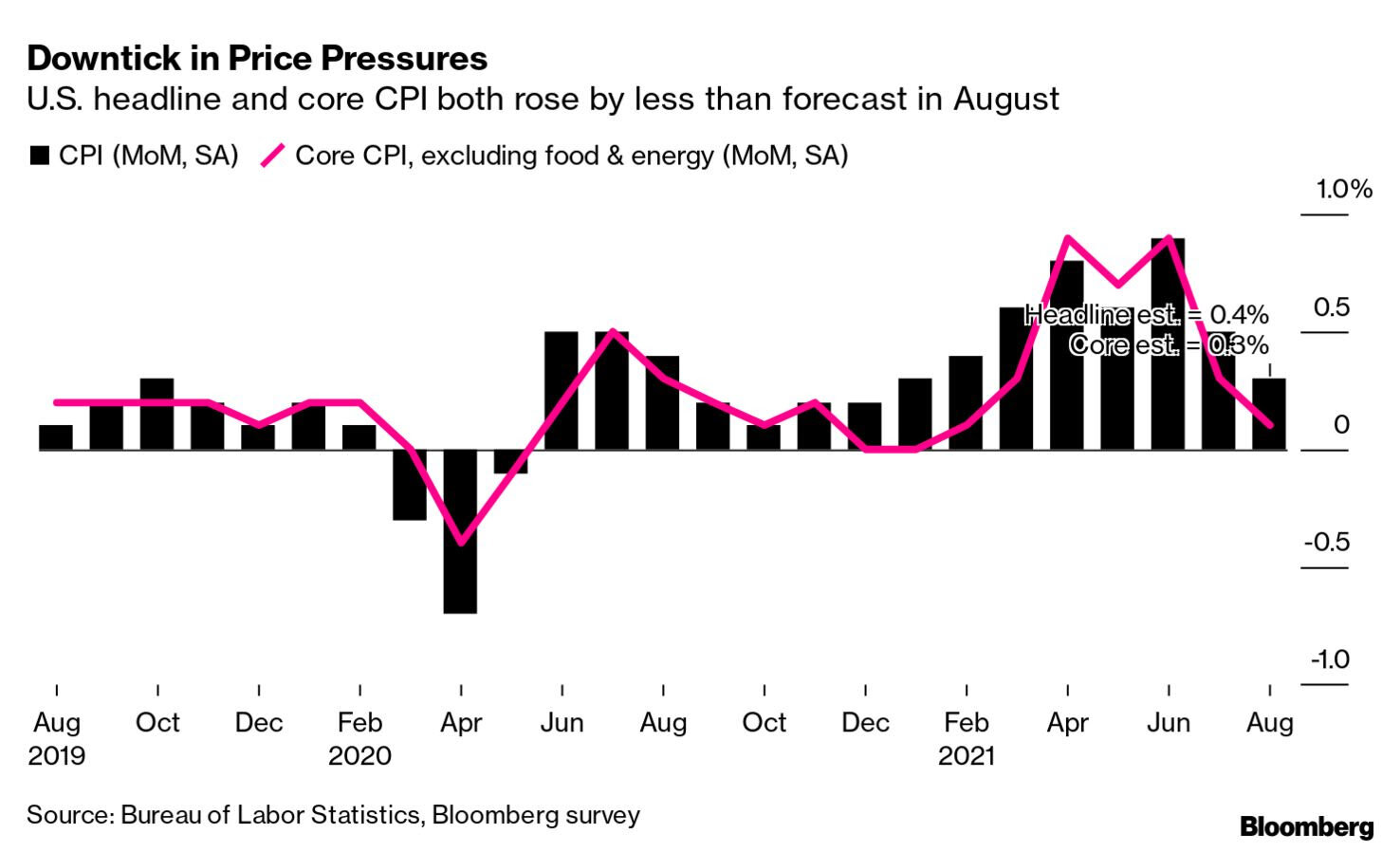

Headline inflation came in at 0.3% month on month. This compares to consensus expectations of 0.4% and is a significant drop from what the US has been experiencing this year. See here:

The problem however is that:

Inflation is still pretty high!

And it seems likely that it could bounce back up. Especially in certain pretty critical areas like rent and food.

Here are two charts to demonstrate this:

Firs, the Cleveland Fed’s trimmed mean CPI, which snips out the prices that are in the top and bottom 8% of the price-change distribution. It is quite stable historically, but it’s elevated right now.

Incidentally, it is also above the Fed's inflation target:

and here is a map of urban rent increases from Apartment List, a rental search service:

These are not small.

We have spoken before about how high house prices eventually start to feed into rents. Well, it seems to be occurring.

Away from the precise numbers or the will-it, won't-it factor the real outcome of all of this is far more psychological and the longer term outcomes are often political.

When people find their standard of living being eroded by higher costs they look for people to blame and politicians often pay the price.

There is considerable evidence that the Biden administration is very well aware of this tendency. It is leading to some of the more illogical and unfortunate political moments of the last 6 months or so.

For instance, there was:

The administration asking OPEC+ to drill more oil (to hopefully lower gas prices).

The absolutely bizarre pun-filled July 4th White House tweet about the lower price for a Independence Day cookout.

The recent claim by one economic official that "If you take out those three categories [beef, pork, and poultry], we've actually seen prices increases that are more in line with historical norms." Well.....yes?

The Bureau of Labor Statistics has started to produce new and rather targeted method of calculating inflation. Typically, when governments start to reframe the definition of a problem so it is no longer a problem, it is pretty good evidence of its existence.

It is striking that even this rather manipulated version of inflation is well above the Federal Reserve's ~2% inflation band

The hope for Biden has to be that wages will also respond and people will feel that they are making more, not just spending more.

Right now the evidence for that is pretty thin, despite all the anecdotes of bonus payments, raises and other inducements.

Whether this gap closes matters a lot and not just economically in terms of profits or politically in terms of elections - it can quickly filter through to strains in the social fabric as well.

Be interesting to see what Chair Jay Powell and the Fed say about all of this, in their meeting this week. Acting like all is well could prove not just mistaken but also costly. Stay tuned.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.