US Economic Puzzle Pt I: Is Inflation Real?!

Is Inflation here to stay? Or are we worrying about the wrong risk?

This is an excerpt taken from our weekly newsletter, in this case Pebble 3. You can sign up here, if interested.

So, will inflation be here to stay? Its a mystery and one with far more questions than clear answers right now. Even more puzzling has been the reaction of the US bond market to very strong inflation numbers (which should be very bad for bond prices).

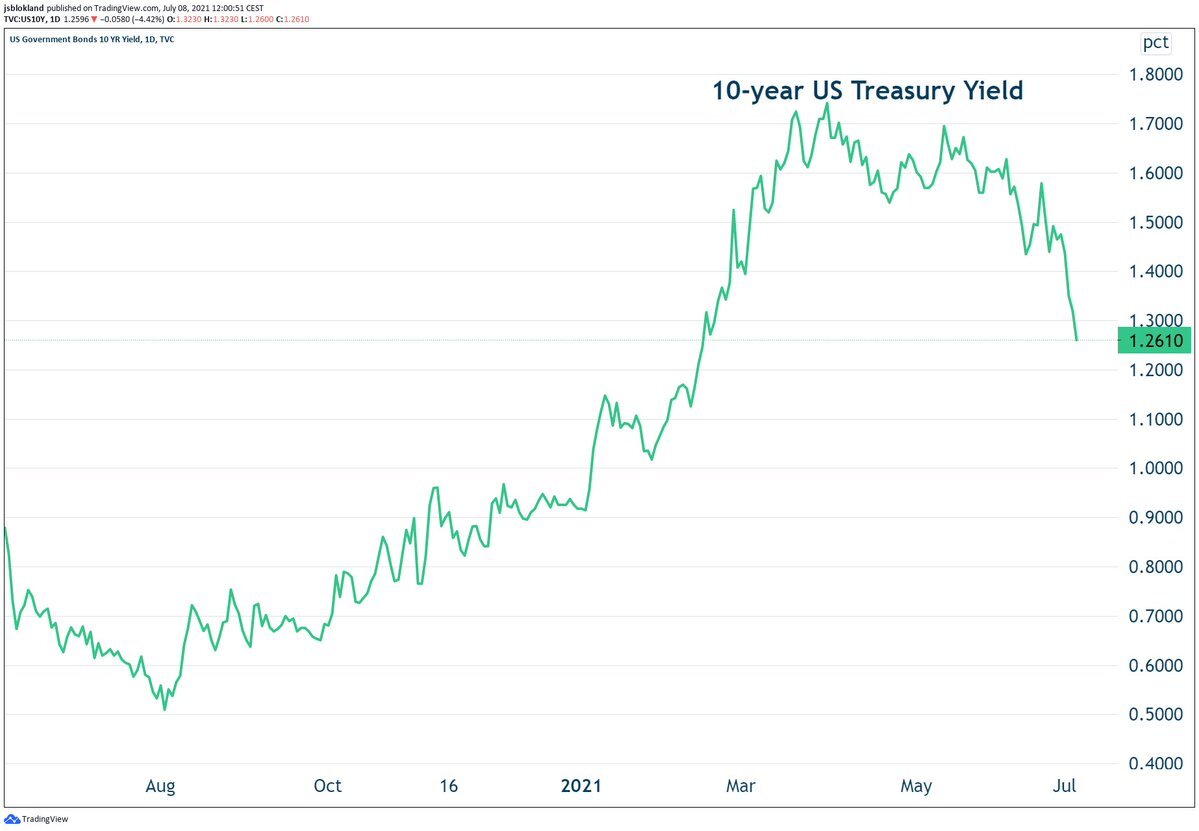

The move itself has been pretty stunning. Over the last quarter we have seen three straight months of 0.6%+ increases in headline CPI (longest streak since 2008) and yet the US 10-year yield has declined steadily and significantly to the tune of nearly 30 bps since yields peaked at the end of March (see here).

Clearly the bond market has been unbothered by the recent string of high inflation numbers and the equity markets have responded positively but what are we to make of this? And does it matter?

Well, for one thing, if the US bond market is tranquil that is very supportive for US equity markets AND if Treasury prices rally, it could be a lead on what sectors of the markets will do well. The bond market is important!

So, how should we think about this important move then? The most basic conclusion might be that these inflation numbers were already priced in by the market and most participants now expect things to moderate in the months and quarters ahead. This would be roughly in line with the Federal Reserve's view and so traders are either respecting that or feel they have to, for now.

But, if it is indeed "priced in" for now then why have Treasury bond yields themselves continued down / prices up? And so steadily?

Three reasons come to mind: 1) Short covering; 2) demand for US higher yielding debt and; 3) real money need for duration assets.

Short covering: The market was very short Treasury prices and has now had to cover those shorts and get "onside." This can lead to jumps in prices to the upside as trader positioning shifts.

Demand for higher yielding assets: A 1.70% yield for a US 10 Year bond might have nothing on the 1980s but it sure beats the low-to-negative yielding bonds in Japan and Germany (see here), two other major developed markets with comparable risk profiles. So, global buyers like the extra yield in ultra-safe US Treasuries. Their steady buying sends the prices up and the yields down.

Need for duration assets: Lastly, many institutions - including many US banks - need to hold safe paper as collateral because of regulation implemented after Great Financial Crisis. Other institutions, like pensions, have the need for longer duration assets. Collapsing yields on the other options have shifted bank demand toward Treasuries, and so these institutions have been buying hundreds of billions of them as the economy has roared back and so has their appetite for Treasuries.

These reasons and the fact that the Federal Reserve is buying $80 billion of Treasuries a month which is nearly half the bond issuance over the last 12 months (and nearly 4% of the total market (!)) could make for a persuasive case.

Who was listing these reasons BEFORE this month (or last month's) very strong inflation number?! Certainly not us....

It all adds up to what traders call a "bull flattener" which is a subject we will return to in the weeks ahead and, most importantly for now, means the sweet spot for equity markets will persist.