US Economic Puzzle Pt. II: Inflation vs Growth Scare

US Bond Market Mystery Revisited:

In an earlier blog post, we wrote about a recent economic puzzle that was, well, puzzling us.

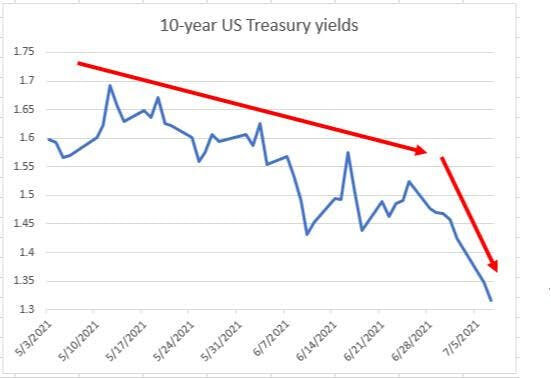

The core mystery centered on the recent trend of falling US bond yields. Bond yields move inversely to prices. So, bond yields down = prices up. US equity and bond prices have been going up together, steadily, for months. This is very weird.

This trend had led some observers - including us! - to ask: What the heck is going on?!: As we just covered, US stocks have had a great year and especially a great spring and June and inflation was very high month after month (inflation is bad for bonds) and yet US bond yields have steadily fallen....

And the move has not been small!

To use one good proxy, the US 10 year Treasury yield reached a low of 1.25% on Thursday before bouncing back to just short of 1.36% on Friday. It ended March at over 1.75%. Big move.

Nor has it been volatile.

The US 10 year Treasury yield was down 8 straight days before this Friday's bounce. In other words, the yield fell steadily for over a week.

For context:

In March, Goldman Sachs's analysis suggested that economic data should push the benchmark 10-year U.S. Treasury yield up to 1.9% by the end of 2021. They were by no means alone. I suppose it could still happen!

So, why? Three broad options:

1) Imbalances: The first possibility is that there are simply other drivers that are creating a very strong demand for US Treasury bonds. As we all know, the pandemic (and the pandemic response) has created A LOT of wacky supply and demand issues.

In the same way that markets have a shortage of semiconductor chips right now (or shipping containers or fireworks) there is also a global shortage of US Treasury bonds and so the market is furiously buying despite the high inflation and low yields. We covered some of these reasons for these imbalances in an earlier newsletter as well.

Brief reminder that any buyer is competing with the US central bank that is still buying a lot of Treasury bonds every month ($80 billion with a "B").

2) Growth: A second and frankly very related possibility is that the bond market is becoming concerned about the global economic recovery.

This might seem incredible considering that:

a) the opening is just getting going (!) and

b) everything is both very bullish and has serious "We are Back!" energy.

However, bond traders are paid to be very cautious and are often accused of seeing the downsides in every scenario. This causes the bond market to often act first, before the stock market, as the canary in the global economic coal mine.

So the argument would be that the bond market pricing in some probability of growth meaningfully slowing which makes bonds more attractive to investors.

The particular cause is hard to pinpoint but, whatever it is, Covid-19 is likely at the heart of it. Take your pick: slowing vaccine rates, rising Delta (or Lambda) variants, lack of vaccines in poorer countries or the gradual withdrawal of pandemic stimulus measures, all could be responsible in some combination or alone.

3) Inflation is Bunk: A third possibility would be centered on: this inflation stuff is actually just transitory. Everyone in a lather about rising oil prices and expensive shipping rates (guilty!) is not taking the long view and should relax. Bond yields went too high, too quickly and have now come back to earth.

Essentially, this argument says that yes, there has been some inflation recently and yes there will be more as the economy reopens and recovers but big picture, inflation will not accelerate like we have discussed before. This is a popular opinion: A full 70% of investor surveyed by Bank of America recently, believe that inflation will moderate in the quarters ahead.

Inflation is terrible for bond prices. Consistently higher inflation sends bond yields higher and erodes the value of bonds. So, removing the inflation risk means that people feel safer about buying back into bonds.

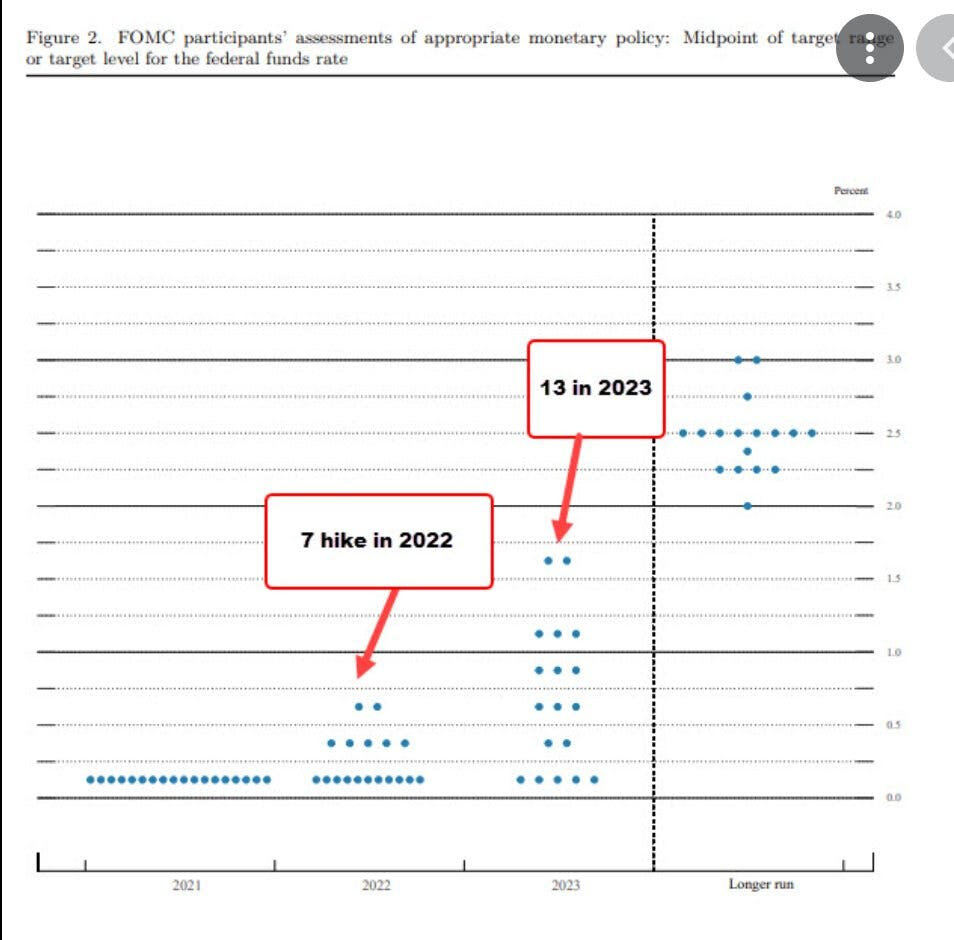

This might not be that surprising. Another way of looking at this point is that, as we detailed in Pebble 4, in June the Fed came out and very clearly signaled it was taking the high inflation numbers seriously and brought forward the dates for when it thought it would raise US interest rates. This was a big change.

As we have covered before, higher inflation expectations have caused the Fed to shift forward their expectations for interest rate hikes. There are now a majority members of the FOMC who believe we should raise interest rates in 2023 (and some who are ready to do so in 2022).

So, the conclusion might be that bond yields will decline until greater growth is more likely to occur. We need greater certainty that the end if government stimulus measures do not lead to lower growth expectations.

Takeaways - Tech vs Value:

So, blah blah, blah - what do you do though?! Tough to call!

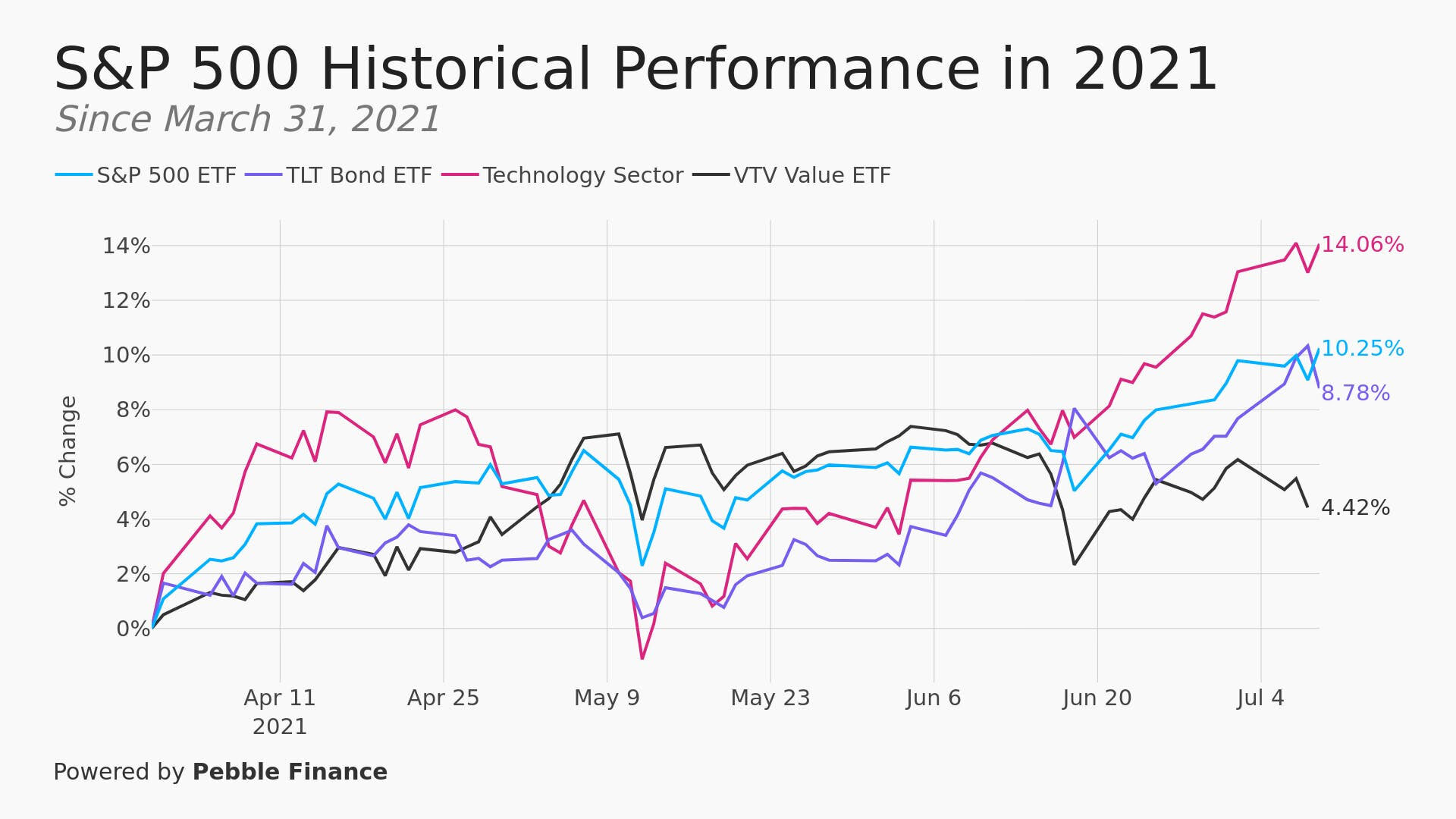

The easiest takeaway might be that lower bonds yields are very good for certain sectors of US stocks. In Pebble 3 we highlighted that FANG and the technology sector more broadly should do very well if US Treasury yields continued to fall. Well, they have! (XLK is a technology sector ETF).

Conversely, if this is the bottom and you think yields will rise as imbalances end and growth continues to do well and the Fed must raise rates then owning a value ETF like VTV could outperform. So, that tension, Tech vs Value is what to watch keenly in the weeks ahead.

In this chart you can see the S&P 500 in dark blue, the Technology Sector (XLK) in light blue and a US bond ETF (TLT) in purple all accelerating higher over the last 3 months.

The tougher takeaway is around what to watch to decide about which possible scenario could be correct:

One suggestion for what to watch for the growth scenario might be US high yield bond yields reacting. If growth scares are truly going to come about then US high yield bond prices (risky types of corporate debt) will unlikely stay at all time highs. So that could be another good canary alongside the US stock market.

For inflation we can continue to watching the US inflation numbers that come out every month. We get some new ones this week (Tuesday the 13th), which will help. This and overall growth will be important to monitor.

For imbalances, as with shipping delays these should work themselves out over time. In terms of deciding more about the absence of clear news or data and yet yields heading steadily lower that is the clearest signal. As we mentioned above, when prices head down steadily every single day then it can't be purely disappointing growth figures.

Or you, can simply watch the US bond market or the above sectors. There could be greater volatility within the US equity market as some things that have recently done well, sell off.

So, what is it?! Imbalances or a Growth Scare or Inflation is bunk?

Gun to our head, Team Pebble winces and votes for a mix 1# and 3#.

The reason? Well, as previously discussed, we see evidence of serious imbalances in the global economy and clear reasons that some of these imbalances would make the US Treasury bonds attractive - not least negative interest rates elsewhere.

And we have noticed that the drop in Treasury yields/rise in prices move ACCELERATED after June's Fed meeting. Bond investors reacted to the news of a Fed shift by saying: great, the central banks has our backs vs the inflation monster. We can safely buy these bonds and really, therefore, the one true worry is the actual Covid-19 variants and their ability to derail the recovery and hurt growth.

New, new, new lows. We will return to this in a future week.

This seems to be the situation for now. Stocks up because growth is great and bond yields down because the Fed is in control but things can change quickly. It seems likely that this Goldilocks scenario is coming to an end. Something has to break and we stand by our analysis that inflation and growth will continue to come in high.

The puzzle for next time: What if this growth scare becomes real?! What to own then? And what about gold? And bitcoin? And the US Dollar?

Stay tuned….

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.