US House Prices Have Soared, It Should Continue

Elon Musk has sold all his houses. He is going possession free, maybe, sort of. Eyebrows were raised at Pebble HQ when we discovered that, among his 7 California properties (!), the Tesla CEO previously owned four distinct Bel Air homes.

At the real risk of going off topic: one was a home was to live in and two were neighboring properties to provide privacy and protection. There was a fourth property doing something similar down the hill - the total sale price for all four just short of $62 million. #richpeopleproblems indeed.

Despite the Technoking's dramatic gesture, he is unlikely to start a trend. Home prices are a critical topic for nearly all Americans. The cost of putting a roof over our heads is something that occupies renters and owners alike and impacts far more people than the elitist stock market.

Details:

You have probably noticed that US House prices have soared - both during the pandemic and the re-opening phase. In fact, this trend is only getting worse, not better.

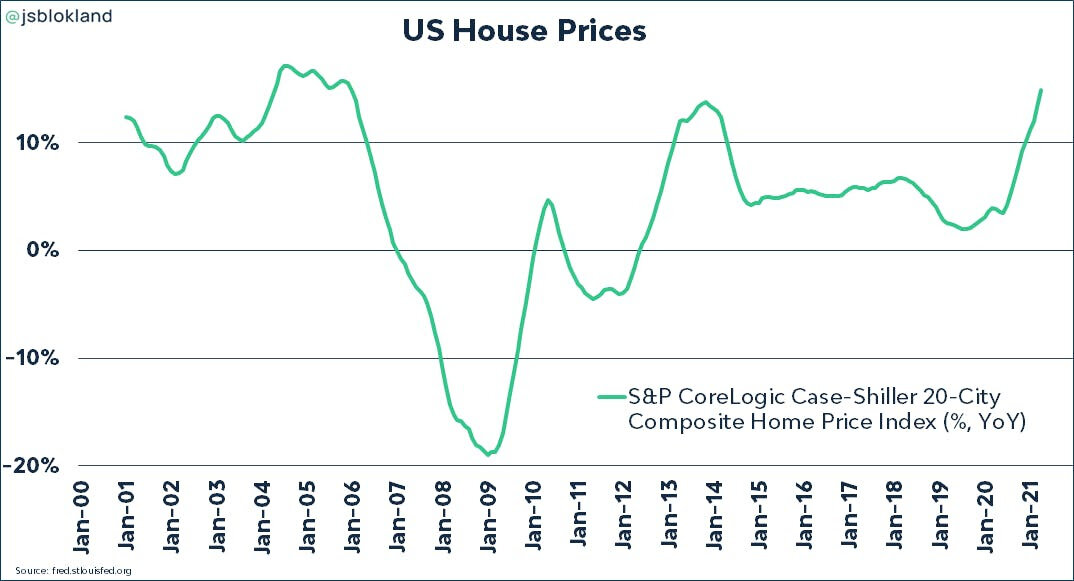

This past Tuesday, the publication of the Case-Shiller national home price index came out revealed that US home prices rose by an annual 14.6%, the fastest pace in three decades (see Chart below).

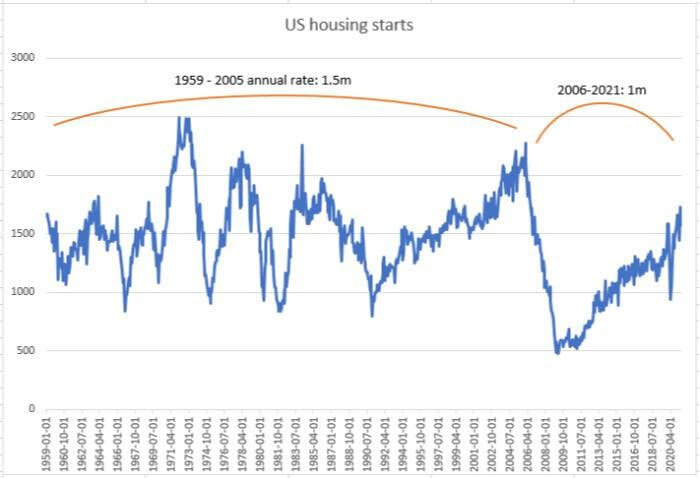

Because of a long period of underbuilding, the US has a deficit of 2-3 million homes and possibly more. That is very large (see Chart 2 below) and because we are not closing the gap very quickly it suggests housing will only get more expensive in the short term.

Right now, the US Federal Reserve also buys $40 billion of US mortgage backed securities a month as well. This is a complex operation but one of the consequences is that it keeps mortgage rates artificially low, which allows people to borrow more and adds more fuel to the hot real estate market.

US house prices jump the most in 30 years.

Not nearly enough homes have been built since the 2008 financial crisis and recession:

Why does it matter?

High housing costs will mean higher inflation - a subject we covered in Pebble Nos. 2 and 3.

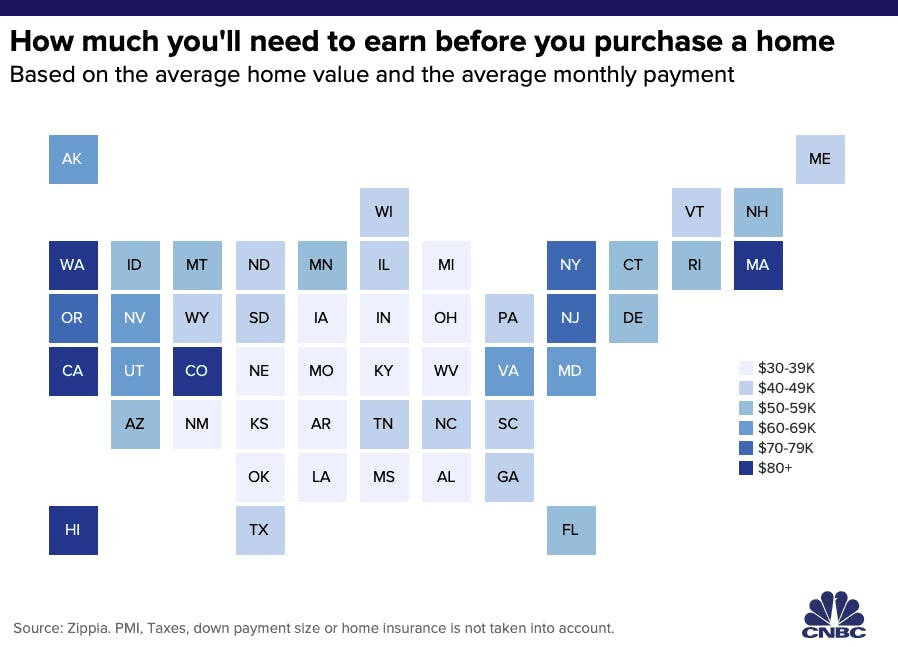

Rising house prices are good for homeowners (and real estate agents!) but are far harder on those who do NOT own houses. This is especially true because average house prices have are now outpacing wage appreciation in 90% of housing markets nationally (see Chart below). So, rapid prices increases wealth inequality and especially generational (wealth) inequality.

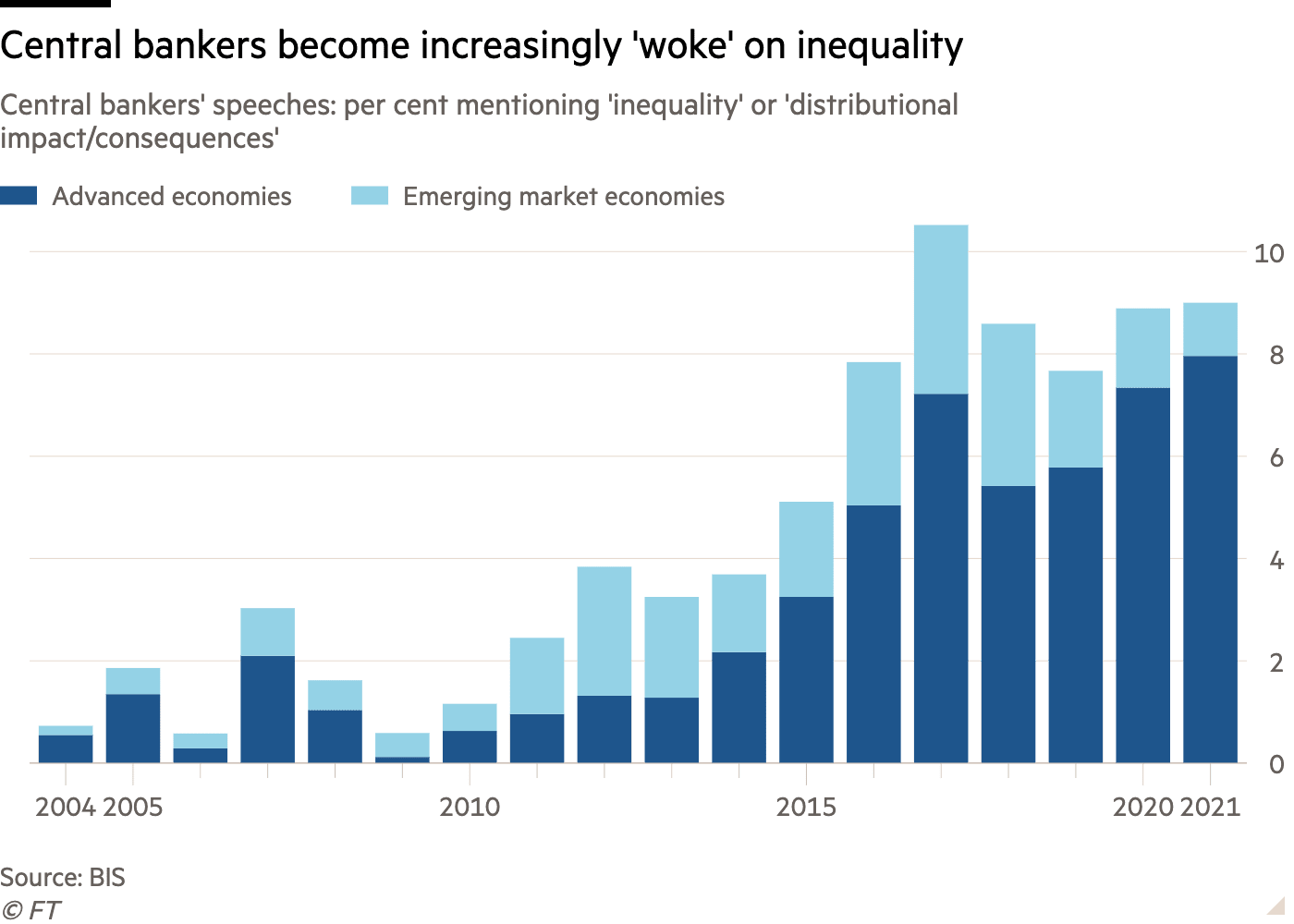

If the Federal Reserve cares about inequality - and it increasingly says it does (see Chart 2 below) - then a smoking hot housing market should concern it greatly.

In the aftermath of the Great Financial Crisis and the Fed's pivotal role in letting a huge housing bubble form, the US central bank should be far more vigilant about monitoring the housing market AND its key in overall financial stability. It is a "once bitten, twice shy" type of thing....

People's wages have to keep up with housing costs.

Cool data analysis. We think the Bank of International Settlements does neat work and you should check them out sometime. We are dorks.

Silver Lining:

If house prices continue to rise then Federal Reserve can and should take action.

We will leave their options for another non-holiday weekend edition but the silver lining is that any action could have three interlinked benefits:

keep homes somewhat more affordable and speculation from getting further out of hand.

serve as a dampener on rising inflation.

give the US construction industry time to build some of those needed homes.

Either way, if a real estate boom is on, do you not want to consider owning homebuilders? They have retreated recently perhaps because of rising expectations of a Fed taking action but long term, the market should stay very robust.