The Interesting & Significant Tension In Financial Markets, Right Now

On Wednesday afternoon, Chair Jay Powell gave a speech at the Brookings Institution in Washington, D.C.

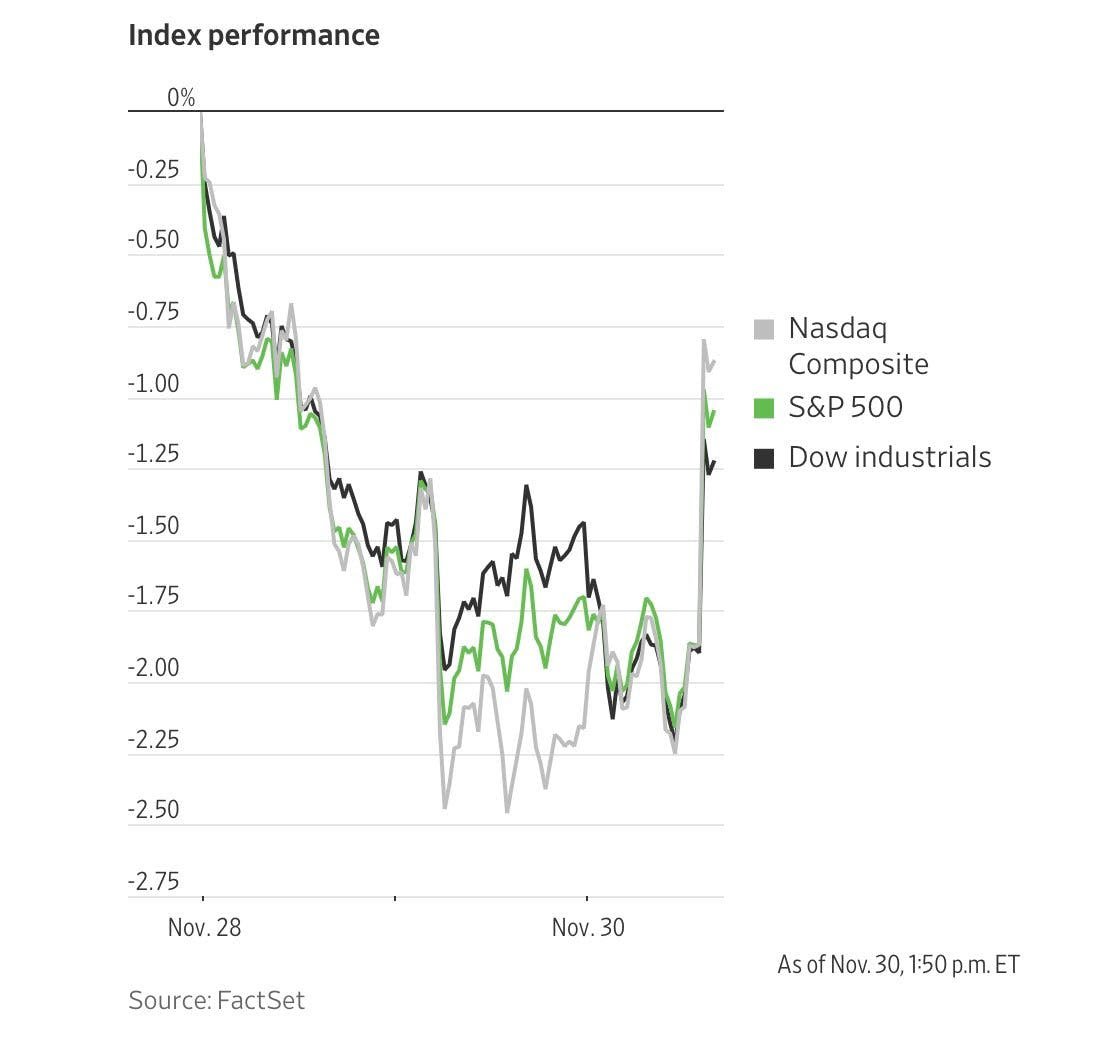

The markets must have liked what they heard:

The S&P raced from being down on the day before he began speaking to closing up over 3%.

The index of large US companies also crossed above its 200 day moving average.

That doesn't happen often.

The S&P 500 wasn't alone. Just about every major index and asset came along for the ride.

See here:

Risk is back, baby! And just in time for the holidays.

Coming on the very last day of November, this sudden leap meant that major US stock indices experienced the first back-to-back gains since 2021.

Not bad!

We were gratified because we have been calling for exactly this type of performance and also interested because this market reaction was exactly what the central banker did not want, which we have also discussed recently.

Despite Chair Powell's very evident attempt to tamp down expectations and be "hawkish" in his prepared remarks, he was forced to admit the obvious:

Yes, if inflation comes down then there will be fewer interest rate increases and there are indications of some inflationary indicators turning over.

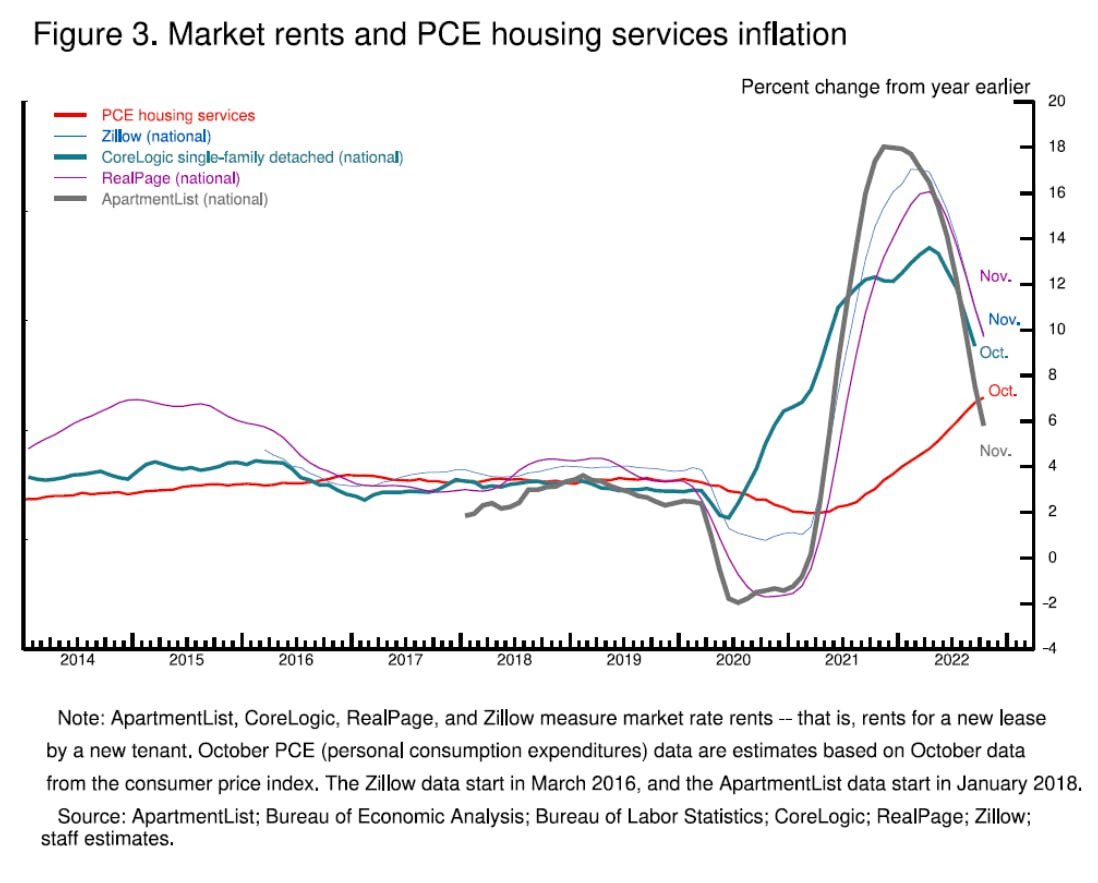

Here is the chart that he referenced. It demonstrates that many of the private market indicators for inflation are already turning over - in particular rents - and, typically, public data (the PCE data point) tends to follow with a short lag.

That was enough to launch the searing afternoon rally.

All in all, the S&P 500 and other major US indices were up over 6% for the month of November and nearly all of that came on two dates:

The US CPI inflation data release at the start of the month.

And this week's Fed Chair speech.

Inflation coming down (moderately) and the Chair of the US central bank admitting that yes, if inflation continues to come down, interest rate increases will slow.

The puzzling thing about this return to euphoria in the US stock market is the bond market has been consistently signaling a very different set of expectations.

More specifically, the US yield curve has continued to invert.

This is a bit wonkish but when the US yield curve inverts it means that shorter-term, younger debt's yield level is ABOVE that of longer-term, older debt.

In the most canonical case, the yields of US 2 year bonds are higher than US 10 year bonds. And that is the case right now.

See here:

This "inversion" is reaching extraordinary levels demonstrating a very high level of conviction that US growth will decline.

In other words, this means that investors believe that interest rates will stay elevated over the very short term today but that a recession is on its way over the short to medium.

You can see this in the yield of the US 10 year bond which has fallen steadily in November from a high of 4.21% on November 7 to below 3.50% on Thursday and Friday this week.

That is a sizable move and simply signals the expectation that:

Good times now, bad times coming around the bend.

So what are we to make of all this?

Our single biggest suggestion is to view next year with great, great caution. The chance of a real recession is not negligible.

The second is to stay alive to the possibility that it won't!

As the quote at the start of the newsletter reminds you, the markets can often be negative and yet are often very wrong.

In this case, US bond investors are feeling very pessimistic at present while stock investors are obviously looking at things far more positively.

That makes intuitive sense because the incentives for the markets are very different.

A stock's upside is limitless. It can go ever higher and so equity investors are often quite optimistic. They think about how high their assets can go and how much money they can make.

Meanwhile many bond investors think about their asset class completely differently. They think about how much they can lose. A bond's yield can theoretically only go to zero (though that has changed recently) and so its upside is capped. As a result, they are far more likely to consider the negative and worry about what could go wrong.

So, bond investors are looking at the current situation as a glass half empty and stock investors are focused on the positive and seeing the glass half full.

The big conclusion from this current dissonance in the market is that someone will be wrong. And billions - if not trillions - of dollars are on the line.

In terms of the first point, the recent - and very welcome - rally there is no guarantee that next year will continue its bounce. As ever, past performance is not indicative of future returns etc etc.

Take the recession signals seriously. They may not happen but even if not there are plenty of arguments why growth will slow in the new year. So, stay alive to the possibility that the bond market could be right.

For now, you can watch that US yield curve for which camp will end up being correct. The inversion lessens or even fully reverts to being positive (longer term yields ABOVE shorter term yields) then you know that bond investors are coming around to equity investors' view.

That isn't the only question out there, however. There is also the matter of what is doing well.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.