The Puzzle & Resilience Of The US Jobs Market (& Economy)

‘‘It is VERY premature to think about a pause in our interest rate hiking cycle’’

Jerome Powell - FOMC November press conference, 01/02/2022

As you can clearly see above, Fed Chair Jerome Powell poured cold water all over the hoped for "Fed pivot" in his Wednesday press conference. He seemed to take particular delight in emphasizing that the financial markets should not react positively to the FOMC's meeting.

The takeaway was pretty clear:

We do not care about the stock market's priorities or your 401k, we care about inflation and its long term threat to our credibility and the sound operation of the US economy.

Fair enough.

The market nose dived and ended up selling off on both Wednesday and Thursday as you might have expected.

Then, however, two days later the other shoe dropped and everything reversed!

Friday's Bureau of Labor Statistics monthly report of US Non Farm Payrolls is the best data we get on the state of the US labor market and the level of unemployment across the economy.

This report is flawed in all sorts of ways but, generally speaking, it is the best snapshot of the jobs market that we have and is therefore taken very seriously by just about everyone: investors, Federal Reserve governors, politicians and even many regular Americans.

There is a reason it is one of the few economic data points that regularly gets plastered across the front (web)page of not just the Wall Street Journal but also the New York Times, USA Today and plenty others besides:

Jobs matters, in other obvious statements.

As discussed, on Friday the numbers came out and were both positive and stronger than expectations.

This revealed, once again, the underlying strength of the US labor market and, by implication, the US economy.

The details:

US Changes In Nonfarm Payrolls Oct: 261K (estimated 193K)

US Unemployment Rate Oct: 3.7% (estimated 3.6%; previously 3.5%)

US Average Hourly Earnings (M/M) Oct: 0.4% (estimated 0.3%; previously 0.3%)

US Average Hourly Earnings (Y/Y) Oct: 4.7% (est 4.7%; prev 5.0%)

These are confusing jobs numbers in a way, with more newly employed people than expected but a higher overall jobless rate. But the takeaway is that the labor market is still hot and especially with a bigger gain in average hourly wages between this month and last month.

This re-emphasizes the challenge for Chair Powell and the other Federal Reserve policymakers:

They need the US labor market to weaken, not grow in strength (and therefore tighten). A tight labor market means that there will continue to be pressure on wages and higher wages will lead to higher inflation.

And it also raises, more generally, a puzzle:

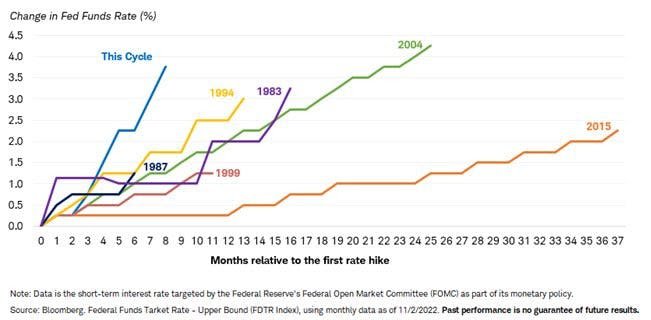

We have raised rates a lot - and steadily - for months. Indeed we have done so at an unprecedented and historic rate.

See here:

And yet the labor market has not weakened. In fact, it has done the opposite: despite there being a very tight labor market there continues to be more new jobs than layoffs.

See here:

If you had asked most market observers if the above chart was possible with multiple 0.75% rates in a row, the vast majority would have said no.

So, this is impressive from the US economy and also great news. We like the stock market doing well just as much as the next financial commentator but we like your average American being employed and a robust national jobs market even more.

We do not have a lot of clear and authoritative answers for the jobs market puzzle right now but we do note that, regardless of the reason, if the US labor market can stay super strong then the infamous "soft landing" has to be more likely than investors have expected or market commentary has emphasized.

Including, we should hurry to add, this newsletter.

This economic resilience may account for the market rallying on Friday and why, far more importantly, the market may continue to head higher in the weeks ahead.

For the other reason for Friday's strong stock market performance, we must turn to the world's second largest economy and other great global power.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.