US Industrials, Strong Like Bull, Can It Continue?

If the US yield curve is both too esoteric or too complex for you to keep an eye on there is another interesting development that could hint at both what has worked recently and could do well over the medium term going forward.

It has been noticed by a few analysts that while the stock market has rebounded sharply in the last few months the debate about whether this is another bear market bounce or the start of the next bull market run isn't the only tension occurring at the moment.

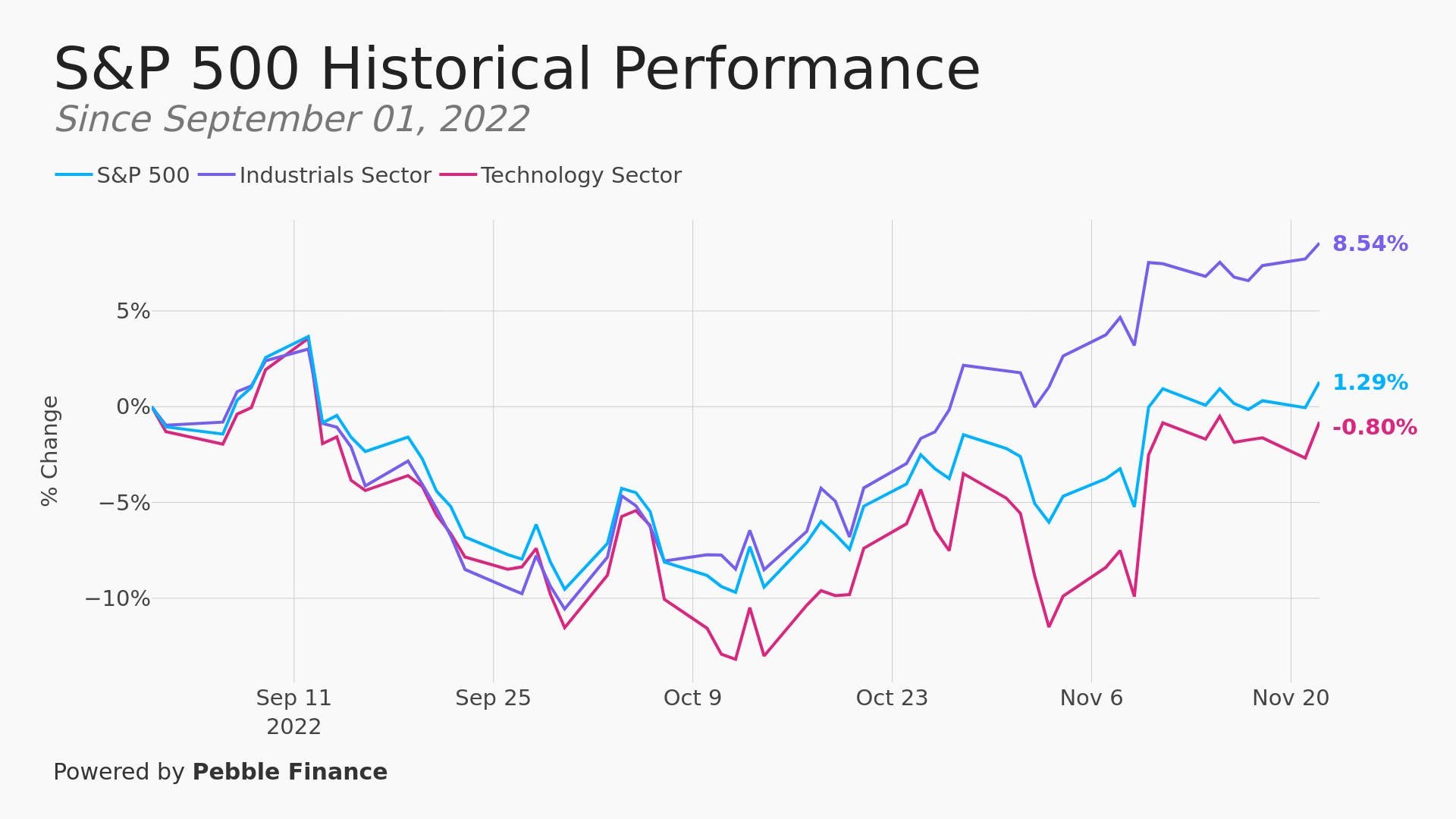

The S&P is up a meager 1.29% over the last 3 months. But the S&P 500 Industrials sector has done far better at 8.54% and is now getting close to flat at -2.49% this year compared to the S&P 500 year-to-date of -15.11%.

Meanwhile the Nasdaq or S&P 500 Technology sector has struggled mightily. Tech stocks are at 0.80% since September 1 and are still down a scary -22.88% this year.

See here:

That disparity is pretty striking but more significantly is what it says about the current regime.

The Old Economy continues to wipe the floor with the New Economy.

That suggests that investors believe growth will hang in there but inflation (and interest rates) will stay elevated.

This brings us to a final point:

The new year may bring a recession or it may bring continued growth but the really central question might be: will anything change the above trend of Industrials outperforming the index and the previously oh-so-hot technology sector?

We suspect not.

Over the short term, if interest rates come down sharply that could lead to Tech strength but the bigger picture of strong inflation should - as we have stated frequently - keep the Fed raising interest rates which means the old market regime of technology and growth stock strength will not return for long.

Friday delivered some further evidence for this investing theme as well.

The BLS report on the US jobs market was, once again, very strong.

In conclusion:

This current rally could be a great opportunity for you to clean up your portfolio and get it ready for the new year as well as the new market regime.

It could also allow you to limit your losses and lock in some gains in a tough year and also stay flexible about what could be coming around the bend.

The photo at the top of this edition is a very rare and wonderful creature, the Wild Blue Sheep, native to the Himalayas. Channel that animal for 2023 - nimble, careful, steady and yet also opportunistic.

It might need to flee to higher ground or, if it is safe, descend to lower heights. It survives in some tough terrain and you may need to, 2022 will likely not be the end.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.