Inflation Finally Does What Everyone Has Hoped For….And Now What?

Imagine if a year ago we had suggested that stocks would go up by 4-5% in a single day because yearly inflation was *just* 7.7%.

This week, that happened.

Here is why.

********

Since roughly August, investors have been constantly disappointed that the rapid and large interest rate hikes by the Federal Reserve have not really shown up in reducing the monthly inflation numbers.

Well, they finally got their wish!

This past Thursday the most important number out there for the global economy and therefore the price of most assets - foreign and domestic - came in both lower than the previous month and lower than expected.

The drop was small but both very welcome and strong "under the hood" when it came to the details.

In the Goldilocks framework the data was "just right."

The details:

US Oct Consumer Prices +0.4%; Consensus +0.6%

US Oct CPI Ex-Food & Energy +0.3%; Consensus +0.5%

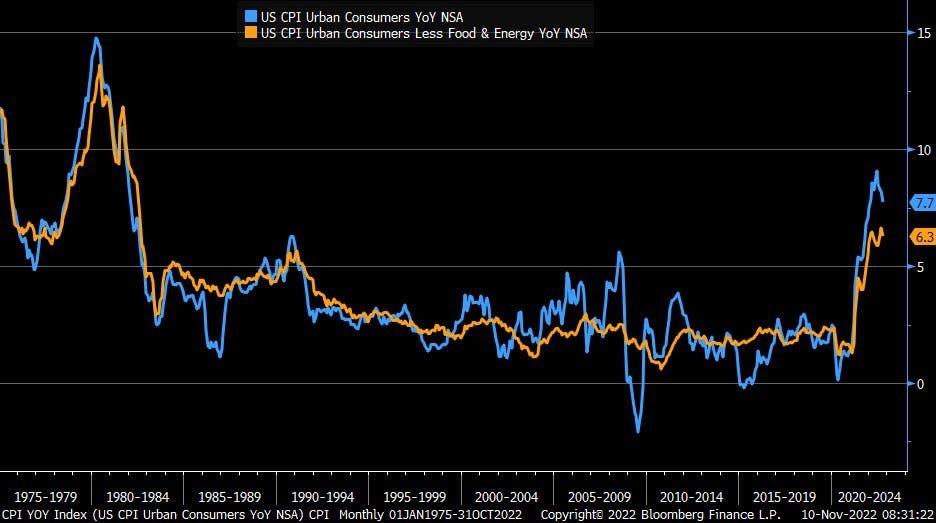

US Oct Consumer Prices Increase 7.7% From Year Earlier Core CPI Up 6.3% Over Year

US Oct CPI Energy Prices +1.8%; Food Prices +0.6%

Here is the somewhat misleading (but nicer graphically) yearly numbers:

It is a deceptively small decline, especially for what occurred afterwards....

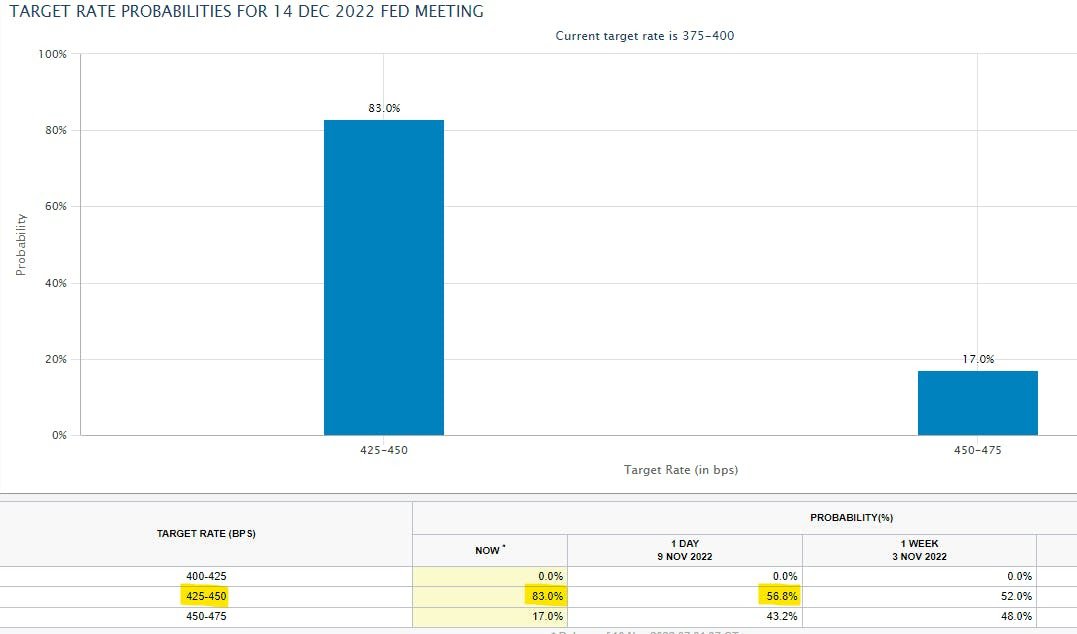

This was that stock markets roared and, more importantly, the expectation in bond markets also shifted appreciably:

The probability of a 0.75% rate hike in December collapsed and the probability of a 0.50% increase became the consensus.

This may seem small but a moderation in the expected pace of hikes will alleviate some of the presumed pressure and, more significantly still, could lead the expectation of more moderation in the future.

That is the big shift here and where investors (and prices) can get ahead of themselves. A slight moderation does not equal much of anything, necessarily but it could!

We should stress two final things, both critically important!

As we have mentioned twice before, a single good inflation number does not make for an outright victory against elevated inflation. Stay very, very open-minded about the future.

But as we tried to suggest last month, a change in the pace of interest rate hikes could be enough to lift risk assets, perhaps by quite a bit, which might even seem "irrational."

The reason for the latter is that investors will race to get ahead of the data and expect the new trend to continue. If further data points in the direction of less inflation then sentiment could get very optimistic, very quickly.

Over the last month we had a lot of pushback to our thesis that a) things could moderate and b) assets and investors could love it. That is fine, it is hardly as if there aren't real negative developments out there and we welcome the frank discussion.

But, we have been both gratified that the markets have responded as they have and remain hopeful that this could continue into year's end. This could give people the space to restructure their portfolio for the new environment, take some tax losses or, get out from being severely underwater in some now very unfashionable companies or sectors.

Despite this, we should always remain aware of the risks. Nothing is set in stone after all.

What could the risk to all this be? What could ruin this happy little narrative?

Well, besides the risk that a lower inflation print is a mirage, the biggest risk might be another exogenous shock that hurts either the global economy or sends the price of some key good (like oil or food) into the stratosphere.

And it is not as if we haven't had a few of these recently. In fact we have had a few: the pandemic was one such shock, the fiscal and political response to the pandemic was another and the war in Ukraine was a third. We would highlight that another spike in energy prices continues to be a real risk for economic growth, for inflation, for everything.

We could easily have another exogenous shock and may have been flirting with one this past week.....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.