2024 Theme: The Attraction Of Bond Proxies This Year.

Another theme we talked about a lot late last year was that investor sentiment completely flipped once the Federal Reserve indicated that it was done raising interest rates.

This happens fairly frequently but rarely as sharply as last autumn.

What was up was suddenly down and what had been down was suddenly very, very up. In the same way that fashion changes and hem lines suddenly reverse direction or palettes invert, the US stock market's laggards overnight suddenly became its darlings.

This game of opposites only strengthened in December when the Federal Reserve indicated that they were planning on cutting interest rates in 2024.

Well, we are now IN 2024 and so we thought an update was in order.

At the heart of our argument was the idea that, in a world with the US central bank was no longer raising interest rates, a very different type of company would do well.

We made this point a few times both before Thanksgiving and before Christmas. You can read our work here and here.

One of the central points we made was that smaller publicly traded companies could be in a rare place to outperform their larger and more familiar cousins. We flagged this point for two reasons:

It is always nice to do know whats doing well and could do well going forward.

Even more importantly, US small caps could be a great thing to track to monitor to see just how this Goldilocks period is holding up.

We had warned readers that these periods of small US companies outperforming large ones haven't lasted very long recently and so should be approached with great care and also serious attention.

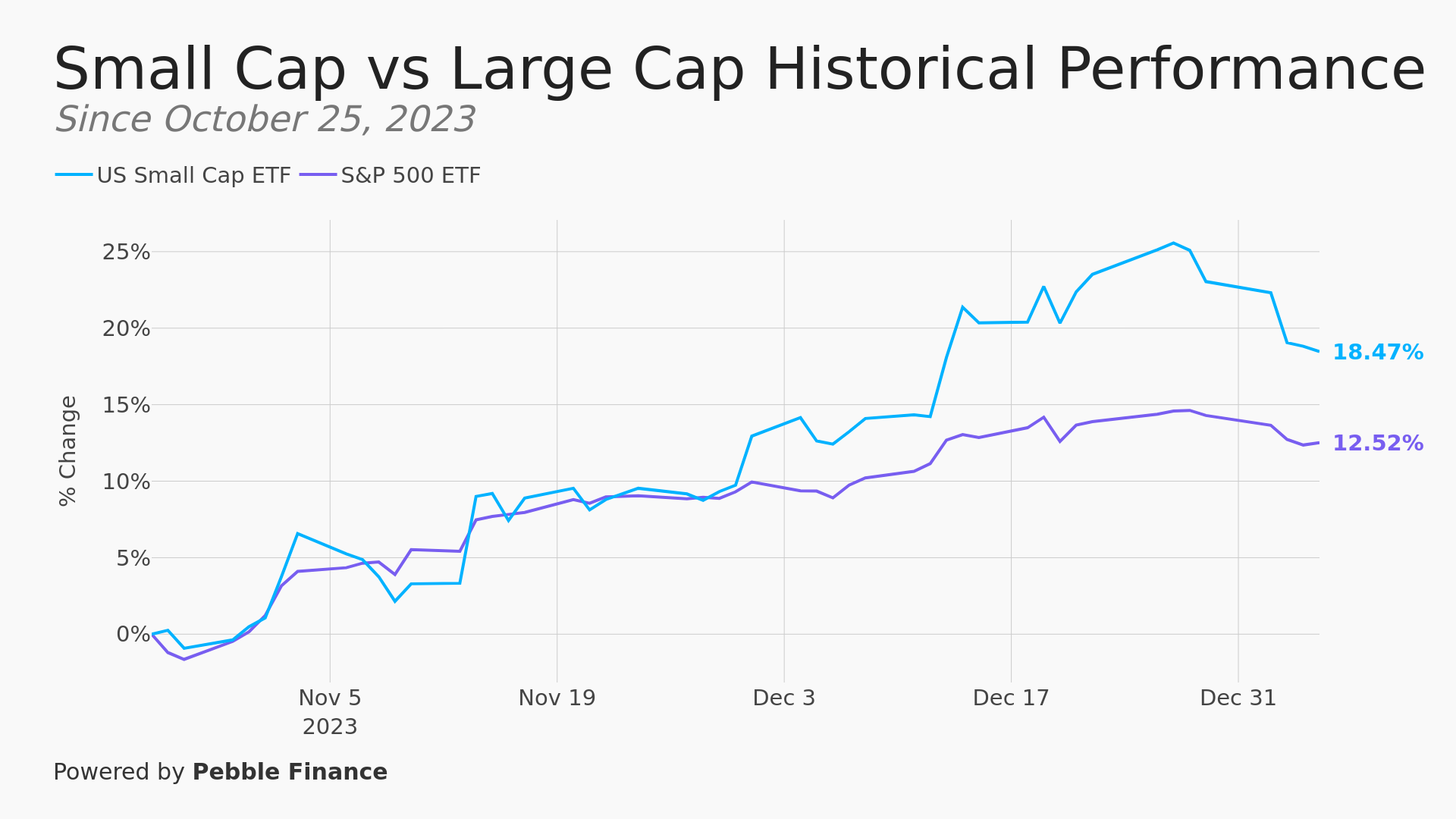

Here is an update in how these companies are doing compared to the larger company index, the S&P 500:

Still outperforming but also, as you can see recently, smaller companies are far more volatile than their larger cousins. This is a key feature of small cap stocks no matter the situation.

Partially as a result of this volatility we wanted to introduce another related idea that should prove to be more resilient than outright small cap stocks.

In short, the thesis is to buy companies that have similar characteristics to bonds. The pitch being that there are certain often overlooked companies that are both good value for money and also a nice hedge against the US economy weakening:

In other words, stocks with strong dividends and good cash flows but low growth.

The rough idea is these could be a nice sweet spot that covers two possible 2024 scenarios:

These companies should do well both right now and also if growth slows further in the year ahead.

One of the reasons we love this idea is that it is VERY unfashionable. The investing world is a big tent so we are sure others are talking about it somewhere but the idea of buying a) boring b) low growth and c) stable companies with good free cash flow is not a popular move in an investing still transfixed by the idea that AI stocks - best captured by the Super 7 Big Tech firms we have covered so often - are the place to be.

We think that this investor agreement around the big tech companies is both lazy and dangerous. It is for those reasons that we have long argued that excluding the Super 7 from your portfolio could be

Very wise at this point.

Also, practically speaking, exactly what this company was founded to accomplish.

And so if you were interesting in doing something that is very difficult to achieve elsewhere, this might be the place for you.

The argument we made back then was that the reason this could be a good ideas was that Big Tech companies were already so expensive that they would likely underperform - or worse - even if the market continued to go up.

But now we want to add to that by arguing that the stocks you really want to hold in 2024 might be less the go-go tech stocks and more the slow and sleepy bond proxies.

What is good bond proxy? In fact, what even is a bond proxy?

Well there are a few possibilities on this front. Telecoms like AT&T for one. The likes of cigarette makers like Altria for another. Both of these groups of companies are not growing very quickly but make very reliable income in good times and bad.

This makes intuitive sense: everyone needs a cell phone and people who smoke really struggle to stop!

But the juiciest bond proxy might be utility companies.

The biggest value in this sector is that no on likes on them.

Bond investors don't like utilities because, from their perspective, they are just riskier versions of bonds. Meanwhile, for their part, equity investors don't like the sector because in a world obsessed with fast growing (tech) companies, these companies don't grow fast whatsoever.

In fact they grow very slowly. This makes also intuitive sense. People will keep paying their electricity or gas bill long after they cut out other costs or reduce their spending elsewhere but it is equally unlikely that their consumption will grow by huge amounts.

BUT the interesting thing is that this combination of strong free cash flow, high dividends and reliable earnings mean that these stocks often do incredibly well when growth falters and bond yields fall (prices rise).

This obviously makes them like bonds but perhaps, for some investors, easier than bonds to buy. A low cost utility ETF is easy to purchase. A low cost bond ETF is easy but quite a bit trickier.

The reason that utilities do well in periods of slowing economic growth this are manifold:

Utilities are where investors flee for safety in a world where a recession rises in likelihood.

Utilities have high dividends which they can pay for with the reliable cash they generate.

As the cost of borrowing go DOWN, their earnings rise also rise as the cost of further investment for these companies fall.

So, even if economic growth goes down, these companies are poised to do well.

Therefore the utility sector and utilities stocks can be wonderful to own or even just to watch as 2024 gets going in earnest.

It isn't the only the US Utility sector and other bond proxies that could be very interesting this year either. Other countries' stock markets are also well poised to perhaps do well, even if the US struggles to repeat the fabulous 2023 record.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.