2024 Theme: US Small Cap Outperformance

We would like to use this space to bring together two of our previous arguments to help frame a new point:

The reasons for this is that both of these themes are getting lost in the broader excitement right now. That is unfortunate.

As our introduction this week demonstrated, the press and social media is full of stories about rising markets and a strong US economy. We got plenty of attention on both these points this week with the US inflation report on Tuesday and the Federal Reserve "monetary pivot" meeting on Wednesday

However, there is a little less focus on what, exactly, is doing best as a result of these conditions. That is regrettable because it is obscuring an insight into todays economy and also hiding a key indicator to monitor to see if anything changes.

Specifically, we are referring to something we spoke about before Thanksgiving has been still quietly gaining momentum:

US small cap share outperformance.

As a reminder, US small cap companies are companies with smaller publicly traded market capitalizations which just basically means they are smaller companies compared to the true global giants that fill up the S&P 500.

These companies often get ignored because they are, well, small and easily ignored! Even people who don't care about investing know all about the biggest US companies. The likes of Exxon, Apple, IBM, Amazon, Walmart, Ford and UnitedHealth aren't just in your investment portfolio they are in your daily life and all around you.

Compared to these giants a lot of the small caps are obscure, unsexy and, well, can seem pretty important frankly. It is just difficult for a lot of investors to get too excited about small contractors or widget makers in the middle of the country etc.

However, despite these qualities - some of which aren't actually true - we think it could be their time to shine. We first covered why we expected these small companies to outperform last month, it is most certainly still true but we thought it was time for an update and also a reminder.

The super condensed version of the thesis might be:

Small cap companies do well when interest rates come down - as they have - but growth does not.

That sweet spot has been exactly where we are headed and so, as we argued previously, this could continue for some time. As long as the economy keeps expanding it seems very probable that US investors, companies and consumers could experience:

Lower interest rates.

Looser financial conditions.

Lower inflation.

That trifecta would be splendid for just about everyone but it would be relatively better for certain sectors, industries and also, sizes of companies.

In particular it would be a dramatic improvement for small companies that must rely on market interest rates when they want to borrow - which they must do to grow. These firms are also far more vulnerable to a US economic downturn than a monstrous multinational like Apple or Pepsi or Pfizer.

Nothing changed with this thesis with the arrival of inflation data on Tuesday and the next day, the US Federal Reserve meeting. In fact, the argument only gained in strength as the inflation data came in acceptably cool and the US Federal Reserve

Here is what the S&P 500 did Wednesday afternoon. Can you spot where the US central bank had its press conference!?:

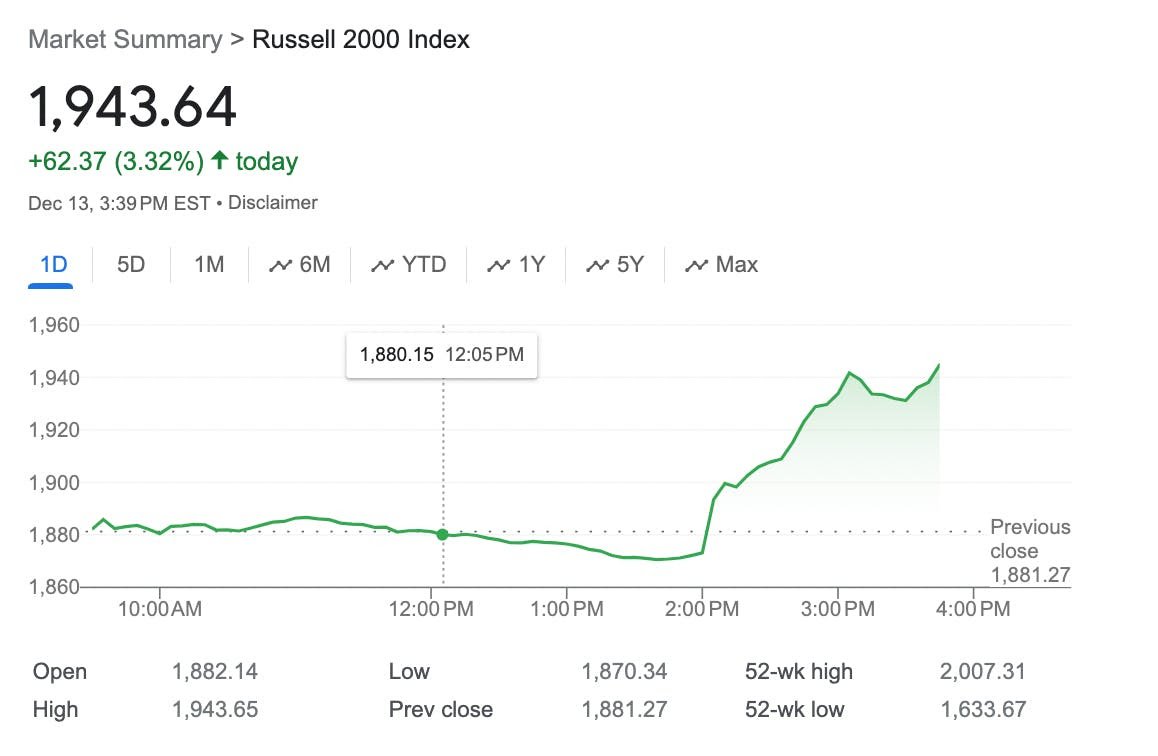

But more importantly still, here is what the Russell 2000 index of small companies did at the same time:

Quite an improvement!

More than 2x the return is a very significant difference and speaks to our exact hypothesis. The overall market is doing very well but small cap companies are doing exceptionally well.

This wasn't just this past week either. It has been occurring for well over a month now and at a decent clip.

Here is the S&P 500 vs Russell 2000 comparison going back to the October 25th Federal Reserve meeting where the "pause" became official:

So, the small cap performance we spoke about in mid-November is only gaining momentum now that we are in mid-December.

What could change this?

Slowing economic growth.

Any hint of a turn in the US economy and this small cap outperformance could vanish very quickly. So, keeping an eye on key data like the monthly jobs number but also other growth indicators like retail sales and consumer confidence will vital in the weeks. You could also simply refresh the above chart as well....

One final thought: small companies have underperformed for the vast majority of the time after the Great Financial Crisis in 2008.

HOWEVER, from 2000 to 2008 they had long stretches of serious outperformance.

So, keeping an open mind about what could be possible in this already wild and crazy decade is likely the best idea of all......

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.