US Inflation Comes Crashing Down - What To Own In The New Environment?

It finally happened:

We got a practically flawless inflation report.

On Tuesday of this week the US numbers came out and gave every investor concrete hope that the American inflation problem is licked for good.

The specific numbers are almost unimportant but just for posterity's sake:

Overall US CPI moved down to 3.2% over the last year in October. It fell from 3.7% in September. The consensus estimate was 3.3%.

US Core CPI (ex-Food/Energy) fell to 4.0% YoY, the lowest core inflation reading since September 2021. Consensus estimate was 4.1%.

The details were also great. Just about everything but shelter (rent) inflation moved lower and, as we have pointed out before, shelter inflation has a significant lag.

Here is what US inflation looks like over the medium term:

The outcomes from this drop in price rises are also clear:

The interest rate increase we thought could happen in December is not going to occur.

Most investors are now convinced that interest rate cuts are on the horizon, perhaps as early as the first quarter of next year (Goldman Sachs is saying as early as February).

The much discussed "soft landing" for the US economy is now not just likely but in view.

As a reminder: a "soft landing" is the idea that you can raise interest rates and bring down inflation without crashing the economy. It is the equivalent of smoothly landing an airplane in the middle of a gale. It can be done but requires both luck and skill to achieve.

Important to stop here and just say that this would be a pretty incredible achievement.

Despite the fastest pace of interest rate hikes ever we are now looking at an "immaculate disinflation" where inflation cools quickly and there is, at worst, only a slight increase in the unemployment rate.

Historically, this has been a very difficult feat to pull off.

Since 1960, the Fed has embarked on 12 tightening cycles, only four of which ended in soft landings: 1960-1966, 1982-1984, 1994-1995 and, most recently, 2015-2018

None of the previous occasions have had an inflation spike either.

So, while we have been pretty critical of the US Federal Reserve and its leaders over letting inflation out of the bag in 2021 and 2022 we should also be very complimentary of them when they have been able to accomplish the extremely unlikely.

We will admit to being surprised with this development and actually agree with the likes of Jamie Dimon that people are overreacting to short term numbers.

We thought that inflation would struggle to fall quite so much this autumn as rising energy and other base effects would make it challenging for inflation to truly come down.

But for the right now, this doesn't much matter frankly and we risk sounding like we have a bad case of sour grapes.

2023 has been a tough year on multiple fronts. If you were hoping for a positive surprise and a feel good ending to the year, this should qualify.

And so while it may not stay this way forever, for now none of that matters. What matters is that this inflation report launched an "everything rally."

Just about everything risky went higher and the end of the year rally in asset prices is definitely ON and boy it isn't messing around.

Bonds prices rallied hard. The US two year yield collapsed 21 basis points in a single morning and the 10 year yield wasn’t far behind at 0.19%. The latter bond has fallen from just over 5% to 4.40% in a matter of weeks. That doesn't happen easily!

Perhaps the most incredible thing is that the US bond index is now positive for the year. THAT is something few people had on their bingo cards as recently as Labor Day.

Stocks were not different. The S&P 500 rose 2% and the beaten down and very rate-sensitive small-cap Russell 2000 popped 5%. The S&P 500 index is up nearly 9% in the last 2 weeks since the last Fed meeting.

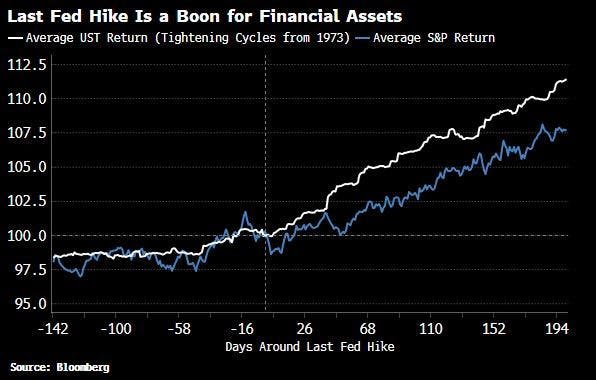

Investors were obviously excited and a lot of it comes down to the fact that they have been looking for a reason to buy bonds and also this chart we referenced two weeks ago.

All of this just means that, because, US Federal Reserve has hinted they could be done raising rates and now inflation has come in lower, everyone is trying to get ahead of this rally which, of course, just makes for a stronger rally....

The end result is that many investors are of the belief that the present conditions are good for stocks AND bonds.

This is a sort of inverse set of conditions to what prevailed in 2022 when both stocks and bonds had a terrible year.

What is happening now is everything is bouncing hard and the most beaten down sectors are doing best. Sure the Nasdaq had a good week as did the S&P 500 but the Russell 2000 index of smaller companies did far better.

It was up an incredible 5% on Tuesday alone.

Will it last? It could if the US economy stays resilient. If it turns over in the New Year then both the small cap outperformance and the market rally could quickly vanish. We will return to this in coming weeks.

That is the tension at present and is worth keeping an eagle eye on the economic data as a result. Is it really weakening or not?

We have been very bullish or optimistic about the stock market all year. Now, however, we have turned much more wary.

We don't think this is a great time to load up on risk. Instead, as we have suggested a few times before, use this opportunity to clean up your portfolio and prepare for the year ahead.

That doesn't mean sell everything. That means stocks are already very expensive and getting more so into the teeth of a lot of political, economic and financial uncertainty in 2024.

Lower inflation wasn't the only story buoying stock markets however......

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.