Why It Might Be Time Not To Own The Previously “Magnificent” Seven Big Tech Stocks

We had an important question from a reader recently:

Using Pebble, can I exclude the Super 7 Tech companies from my portfolio?

Yes, yes you can.

In fact this scenario is EXACTLY why we founded this company.

We want to empower you to be able to exclude any number of companies that either you don't want to own for personal reasons or because of some larger context.

In fact, you don't even need to construct it yourself. We have already built this theme for your convenience as well.

You can find it here.

If you don't yet have a Pebble account you can get started today right here.

When it comes to the Super 7 Big Tech giants, both scenarios we outlined above might apply:

On a personal level, you might either not like these large and oligopolistic companies or simply be financially exposed to them elsewhere.

Equally, these companies are very richly valued right now. They have performed very strongly in 2023 and could be vulnerable as a result.

So, you might want to minimize your exposure or simply avoid experiencing any future decline by removing them entirely.

Obviously, we are totally agnostic whatever you choose to do - including if you do nothing. The choice is yours. The whole point of Pebble is we do not presume to tell you what to do with your investments,

But. we do think you should be made aware that it is possible.

And also why it might be advisable.

Here is why:

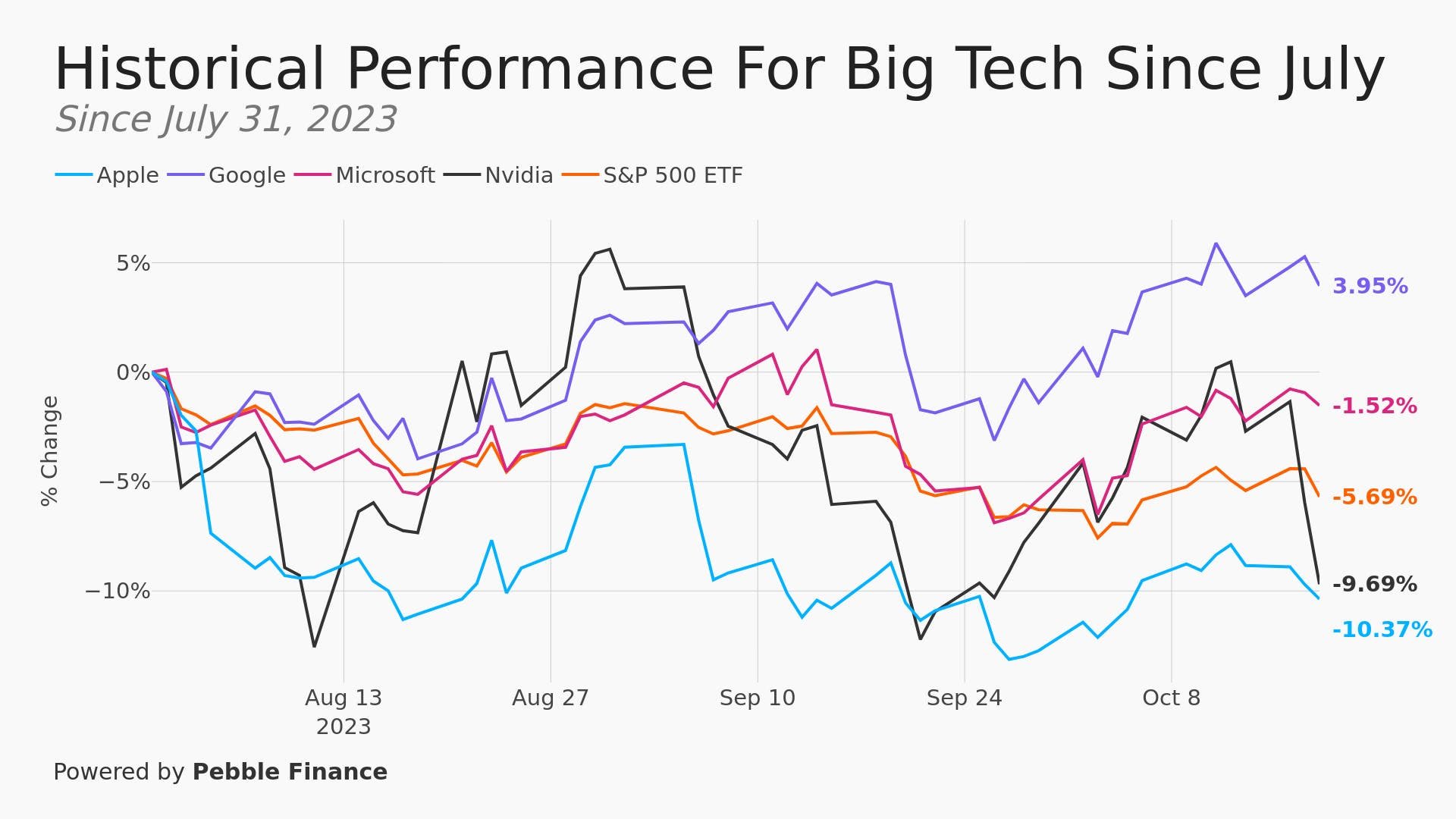

For reasons we will cover below, it has gotten harder and harder for even the mightiest of the Super 7 Big Tech companies to hold onto their gains since roughly July 31.

Only Alphabet (parent of Google) is eeking out a positive performance since that time. And some of the biggest and best are even underperforming the index they once led.

That is a worrying sign for the overall market at a time when these 7 companies are nearly 30% of the S&P 500 index.

That means that the rest of the entire index, 493 companies (!) is only 70% of the S&P 500.

It isn't just that the market retreating though. It is also turning cautious. Other sectors and companies are now leading the way.

See here how Energy has outperformed the Super 7:

This matters. Previous standout companies and industries are now struggling and new sectors are now leaping ahead and leading the way as investors rotate from one sector to another under the surface of a rising (or declining) market.

The S&P 500 might be falling but some sectors are doing well, just other sectors are doing worse!

One of the reasons some investors are likely doing this is because the Big Tech companies are also incredibly richly valued.

See here:

P/E ratio stands for price/earnings ratio and is a technical term to help investors evaluate how expensive (or cheap) a company is. Don't worry if that doesn't mean much to you. This graph is simply showing you that this group of stocks have gotten far more expensive by this widely used metric of comparing a price per share to how much a company is earning.

So, the share price has risen very high compared to how much these select few technology companies are earning. The reason? Expectations of greater profits from artificial intelligence down the road.

Meanwhile, the share price per earnings entire rest of the index - once again, 493 companies! - has stayed steady.

A P/E ratio of 45 isn't just very expensive either. It is extraordinarily so.

So, if you are looking forward and wondering how to protect against both volatility and overly expensive companies, one option could be removing the Big 7 Tech companies from your portfolio.

It might help you sleep better at night or it might simply line up with how you want your portfolio to reflect your values.

Or it might be because these stocks are incredibly expensive right now. They could go higher but it is difficult to envision in this time of inflation, geopolitical tension and big government.

There are also a number of individual reasons that these companies' shares could struggle beyond "they are expensive" or "other stuff is doing better."

Let us explore a few.....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.