US Housing Is Now Officially Unaffordable - Here Is What That Means.

Related to really all the above, we are past time for a US housing update.

Previously we have outlined the surprising fact that, though mortgage rates were rising quickly, housing prices were also rising as well.

This is pretty strange!

Rising house prices at a time of higher interest rates isn't just unusual, it is also an outlier. Single family homes are actually the only category of real estate that have increased in value since interest rates began rising in March of 2022.

As you can see here, they dipped a bit after the start of the interest rate rises but have now returned to steadily rising.

Add it all up and US house prices have risen by 9% over the last 3 months even as US interest rates rise ever higher.

This is pretty striking since the quickly rising rates have damaged a lot of other sectors of the economy.

Interesting to also note that, while the US is also an outlier in terms of just how much houses have appreciated, it also isn't alone.

So, what is going on?

There is still not enough housing supply. This is leading to a deeply frozen housing market.

We have spoken about this state of affairs before but it is both important to point out that it hasn't changed and in fact has worsened considerably.

For one thing, mortgages rates are reaching levels not seen in decades.

Here are current 30 Year fixed mortgage rates in the US:

They have now reached 7.7% and are likely going to surpass 8% sometime this month.

This is having a predictable impact on home sales which have also reached a new nadir. No one wants to sell their home when any new purchase will mean taking on an 8% mortgage. The pain of those monthly payments at these house prices is simply too great.

The latest estimates are that over 60% of outstanding US mortgages have a rate under 4%.

Unsurprisingly, this is having some very perverse effects on the housing market.

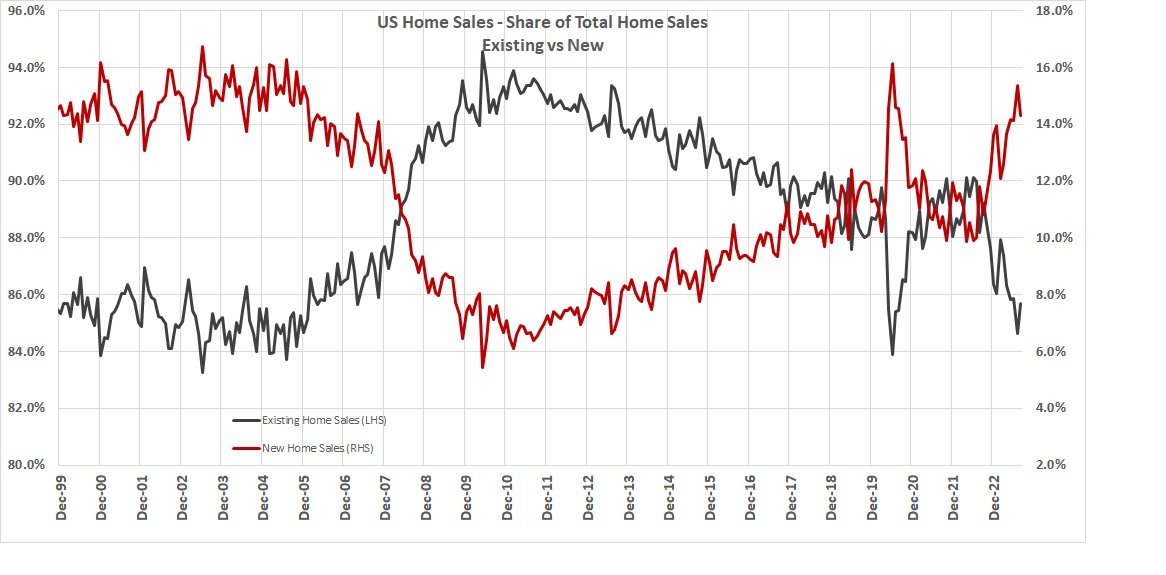

The best way to see this is by comparing and contrasting between existing and new home sales. Existing home sales are reaching new, new lows while new home sales are rocketing higher:

This divergence is showing up in pricing as well. The median new house is selling for $430,000 while the median existing house is selling for $396,000. That is very weird! New homes typically sell for far more than existing, all else being equal.

More importantly still, we are selling well over 600,000 new homes per month this year. The Commerce Department data also demonstrates that this $430K and change is significantly more than the $321,500 new homes sold for in 2019.

There are two important consequences here:

An economic one.

And a political one.

The first is one we have spoken about before:

Millions and potentially tens of millions of Americans (and their employers!) are impacted by being unable to find a home.

There is one silver lining here. The demand for new homes is leading to lots of new construction. Builders are working around the clock to try and take advantage of these wonderfully high prices. That is good for employment and good for US economic growth, of course. Many of those newly hired people in September will be employed in the building trade, no doubt.

It is less good if you want lower interest rates or a cooler economy. Ironically, this hot housing market is helping, not hurting the fact that Americans can't afford to buy houses.

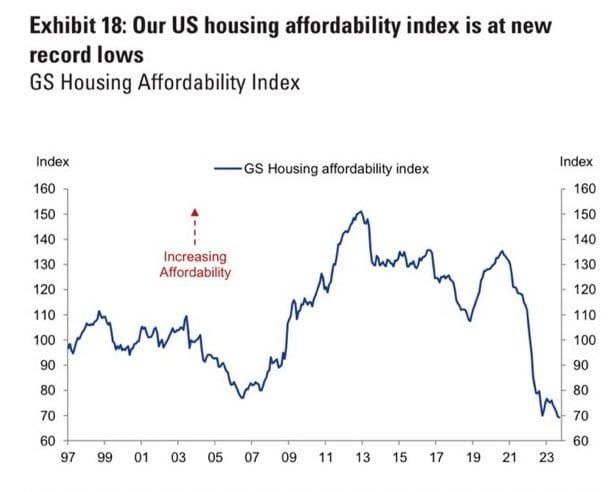

This isn't an exaggeration. Home affordability is historically brutal at the moment. Here is Goldman Sachs's Home Affordability index right now:

This lack of affordability hurts a lot of historic American strengths: family formation, geographic mobility, building wealth, etc etc.

People in our country can't have kids or move to find work or accept a new job because we don't build houses is quite a problem to have for the richest, most powerful, technologically advanced country on earth.

This situation obviously screams out for solutions.

This is where the second impact comes into play - the political one.

We are staring at another election year here in the US and it is very likely that housing will play a role. That isn't on the radar yet but the fact that millions of voters are shut out of a key American right will likely be a part of it.

There is a huge and often unspoken generational component here. Baby boomers and Gen Xers are often comfortably housed with a very low fixed interest rate. Meanwhile younger millennials and Gen Zers are stuck outside.

This makes us nervous.

It is unlikely that either the US President or any other elected official in 2024 will be able to swiftly solve the housing crisis. There are simply too many layers of reform needed in a federal system where state and local governments must also make major reforms.

It will also take time. The problem with houses is they take time to construct.

But that is precisely what makes us anxious.

Because the levers that can be pulled are clumsy and won't provide the targeted micro reforms to quickly boost housing any time soon the pressure will be to find other solutions.

Going into 2024 the political pressure will be to help people get into houses.

Here are two outcomes:

The danger is that this will involve making it easier by lowering loan conditions for first time or buyers below a certain threshold.

Or subsidizing house building via tax cuts or mortgage guarantees from federally controlled mortgage

These solutions will likely have their own perverse effects. They will add further wrinkles to an already very complex housing market and likely just send high prices higher still.

Unreasonably low interest rates from 2008-2021 stoked incredibly expensive housing. Now we risk piling new subsidies, incentives and loopholes to an already cumbersome process.

The Federal Reserve will be watching all of this with serious alarm. In the near future, the central bank could be more hesitant to cut interest rates if they fear that it could make housing even pricier and stoke a housing bubble.

So, we may find ourselves trapped between an even more subsidized housing market on the one hand and a central bank trying to bring house prices on the other.

There is another word for this: a mess.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.