US Housing And Homebuilders Update: Is This Just The Beginning?

It is time we (re)turn to one of the strongest parts of the US economy that does not involve either "artificial intelligence" or US government green subsidies.

It is time to talk about the housing market and especially the business of building the selling new homes.

We have two long running themes when it comes to the US housing market:

First off, we like US homebuilder stocks.

Second, we have argued that large portions of the US housing market is pretty "frozen" and will remain so as long as interest rates stay elevated.

If you have an interest you can read some of our earlier work on homebuilder stocks here and here and the icy US housing market here and here.

Further, we have built a theme on the homebuilders which you can find right here.

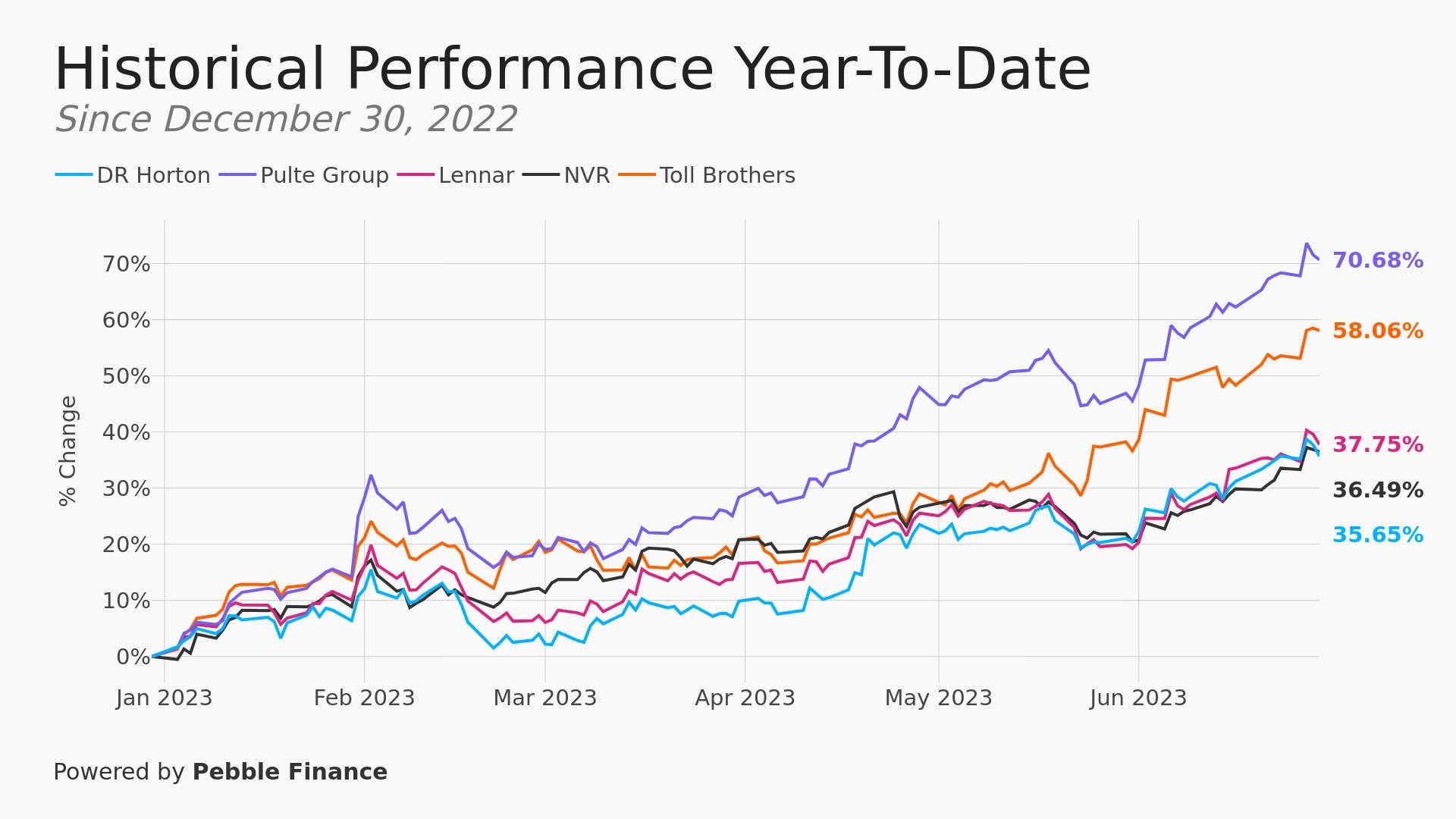

Here are the year-to-date performance of the Big 5 publicly traded US homebuilders:

Obviously, they have done really well! These are tech-like performance numbers.

Both of these trends and this related strong stock market performance emanate from the same structural condition affecting the US housing market:

A fundamental shortage of available US housing supply.

This isn't a new development, of course. Rather it has been an issue for well over a decade, stretching all the way back to the years immediately after the financial crisis.

But what was a long running problem only reached truly crisis proportions in the last few years.

Unfortunately and sort of incredibly, just about every single pandemic-related problem negatively impacted our ability to build more houses:

The pandemic itself shut down building for months if not quarters across the country.

Then a lack of labor severely harmed the ability of the industry to get back up and running. During the lockdowns many roofers became delivery drivers etc.

Further, the supply chain crisis meant that even if labor was around there were delays and problems actually completing homes in a timely manner and on schedule.

A simultaneous boom home renovation also competed for labor, building supplies and fixtures.

Lastly, high inflation has played havoc with costs and added difficulty to the business of building and selling homes.

The subsequent exceptionally rapid interest rate increases made homes less affordable for many Americans nearly overnight.

Even worse, as we have detailed before, today, many Americans are reluctant to sell homes and trade up (or simply move) because they have a fixed AND very low mortgage rate on their current residence. This is what contributes to the "frozen" nature of the market. It isn't that prices are rising or falling but simply that no one wants to transact and have to pay such an elevated interest rate,

Unsurprisingly, all of this has left the country with a real and almost universal shortage of available housing.

Advantage people building new houses from scratch. i.e.: homebuilders.

It is deceptively simple: People need housing they can afford to live and work and start families. If that doesn't happen then all three of those conditions (living, working, starting families) get either put on hold or permanently disrupted. Either way, that is no bueno.

Unsurprisingly, a lack of available housing that gets noticed by just about everyone: politicians, policymakers, investors, economists and, most crucially, regular people.

It is very possible that people at your holiday BBQ this week will be discussing house prices, lack of housing supply, rents or some other aspect of the housing aspect thereof.

When you add up all these facts it is, come to think of it, pretty surprising that we have stayed so positive on homebuilder stocks.

And we would be lying if we said we did not have some nervous moments on the way! But we felt confident simply because:

As we detailed above, there are very few new homes to buy. That puts pressure on prices.

We expected that the US economy would stay strong enough to keep people employed and houses from being dumped on the market.

Of the two points, we felt very confident in #1 with #2 being far more risky. After all, half the world was calling for a US recession "next quarter" for the better part of the last year.

So long as the US economy stayed resilient we felt it would be good-to-great for homebuilder profits.

The reason for that was also simple: if existing homes are not coming to market because of the "frozen" market that would mean many desperate house hunters would turn to the most obvious alternative - a new build.

That appears to be happening.

A healthy housing market should have four to six months of inventory, and in May we just learned that there were 2.2 months.

Further, the % of houses sold that are brand new are rising strongly:

Finally all 5 major US homebuilders have had bumper years individually. They are completing and selling more homes and doing so at record high prices which is, of course, flowing through to their profits.

For example, Lennar, a major US homebuilder, ended its fiscal second quarter with 17,885 new orders. This was a 1% rise on the same period in 2022. The company also reported that it expected to deliver 68,000-70,000 homes in 2023. That is up about a solid 8% from its previous forecast.

All of this is to the good but the question now, however, is far more important and uncertain:

What next?

Sadly, we think the good times for house building businesses and homebuilder stocks will be coming to an end sooner rather than later.

Why? The economy is still growing, after all and America still needs millions and millions of new homes.

Both true and valid points.

The problem is that there are real limits to both the speed and ability of homebuilders to start, complete and sell homes. You can ramp up production but only in a linear fashion, not exponentially. It will just be very hard for them to make dramatically higher profits from here.

Furthermore, inflation stays in the 3-5% range and interest rates keep rising - as they legally must - to deal with that fact then at some point both homebuilder profits and prospects will be challenged once again.

We have been in a sweet spot for these companies. Falling inflation and improving supply chains and labor markets have been great but looking forward it is difficult to see them repeating the trick.

Either inflation will continue to rise which will hurt housing affordability and eventually their profits OR the economy will cool and so will house prices.

There is also the fact that this weakening could suddenly leave the market oversupplied. Building housing of any type is very different from building semiconductor chips or software programs but eventually this great conditions will drag in a lot of competition and against the odds of the modern American housing market, a large number of houses could hit the market at just the wrong time.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.