The Terribleness Of Shrinkflation: What Is It? And How Is It Creating Problems?

Some of the challenges facing consumers, investors, voters and citizens are either far out in the future (climate change), tough to forecast (fiscal sustainability) or simply very complex and politically thorny (entitlement spending, aging populations).

Some, however, are dead easy and wildly understood even if they are more felt than precisely nailed.

One contemporary issue that is easily understood by just about every American is shrinkflation.

We covered this topic back in the heydays of inflation in 2021 and 2022. At the time we made the case that, regardless of what happened in Washington, consumers everywhere should prepare for the rise of shrinkflation as high and sustained inflation began to bite.

We also argued that one of the many reasons inflation is to be feared is the steady creep of this price rising strategy. We were trying to push back against the rise of the intellectually flawed and very lazy "sure, inflation is here, but here is why it is good!" type of politicized argument.

This type of garbage was later eclipsed by The Atlantic's incredible and infamous: "Inflation is Your Fault" article that will long live in infamy.

Shrinkflation is a pretty straightforward but one with all sorts of hidden twists and turns when it comes to implementation.

The idea is deceptively easy: one way to account for inflation is to raise prices. The other way is to lower the amount of goods you sell for the same price.

You make the same revenue but for less goods or services provided.

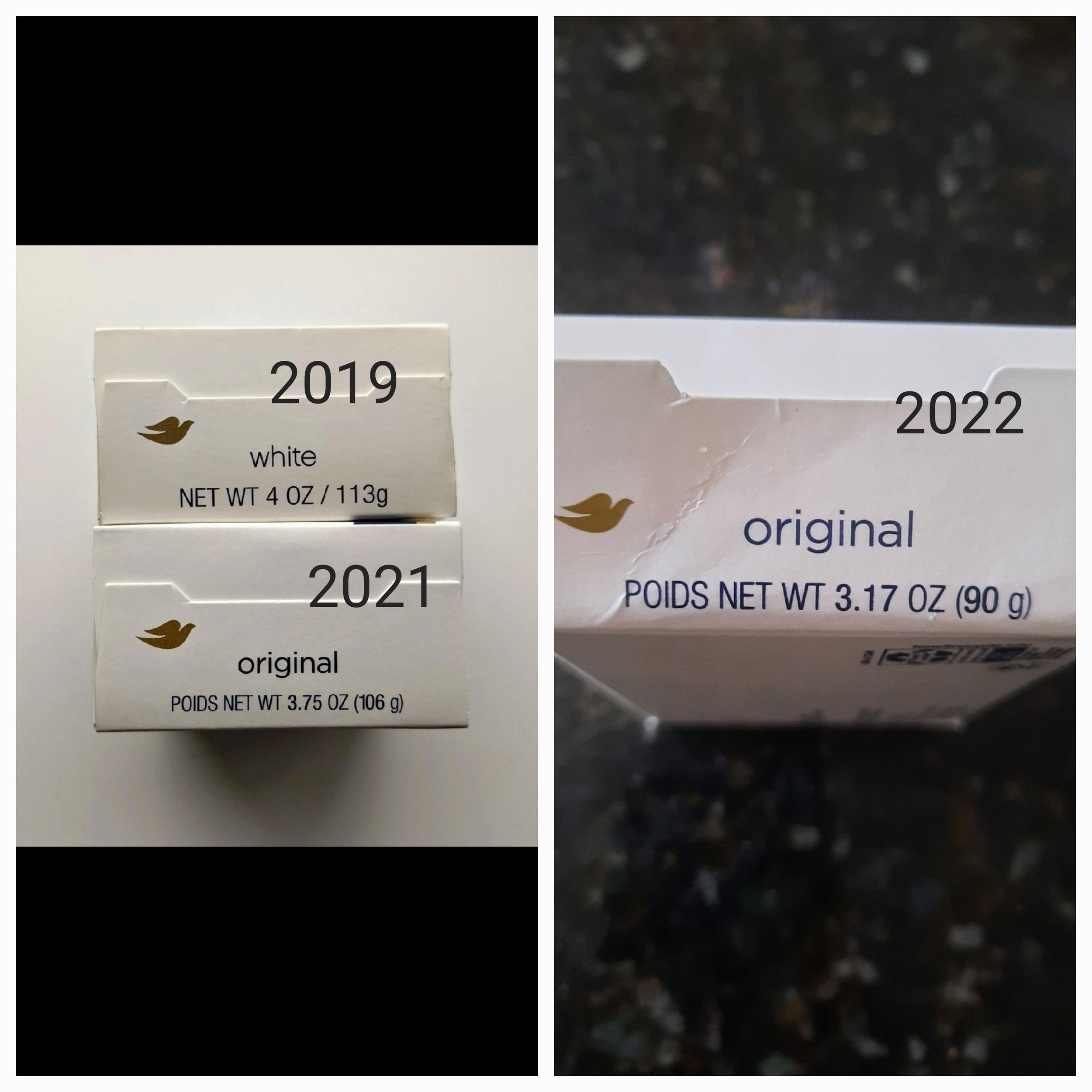

Here is a classic and contemporary example from Dove Soap:

There are plenty of others if you want more examples they are easy enough to find. There are whole message boards and online tags to keep track of the creep of inflation's costs.

The concept is also, of course, creating a considerable backlash around the world. South Korea is even forcing companies to come clean with a raft of new laws on the subject. Similar political campaigns are occurring elsewhere, though with very mixed results.

Inflation and shrinkflation are easy to attack and demonize but they are very hard to eradicate or remove. As we have argued for almost three years, this is why you should be very careful about letting the inflation genie out of the lamp.....

All of this is as unsurprising as it is sad. What is new though is that we can now see the corroding effect of inflation all around us. This is especially the case for shrinkflation.

It has been, after all, a few years since then and inflation has done its nasty work and, just as importantly, companies have had time to strategize and find just how they can chip away at their customers' wallets without necessarily paying the price.

On an individual basis a company might be able to get away with this but in aggregate, across the whole economy, people are not fooled. You don't need an economics degree or even a college degree period to realize that all over the place you are getting less for more.

Once you begin to look for shrinkflation, you find it everywhere. It also isn't just happening with basic consumer goods either. Some of its most notorious impacts occur elsewhere, in fact. For instance:

The changes to airline tickets where you have to pay for more and more adds ons. It used to be luggage, then luggage and picking your seats

The fact that streaming services are both raising prices and adding tiers with advertisements.

All those hidden fees at service establishments like restaurants or bars or salons. The 1% "solidarity fee," the 3% "kitchen fee," the 0.7% "fee-fee" etc.

Even companies are getting in on the act. We thought this AT&T ad did a great job of nailing the general vibe:

Even if you don't know all of these examples or have others in mind, we all "feel" this to be the case.

What is important about the above isn't just that they are examples of inflation per se but also that they are not captured by the official inflation statistics.

How? And why?!

Well, the likes of the US CPI simply do not capture "kitchen fees" or the fact that you are paying for streaming+ads now, not just streaming. The surveys capture what the cheapest possible flight is from A to B not whether the people buying that ticket can take a bag or a carry-on or get water or breathe.

The official statistics capture the price of the chicken sandwich, not the taxes, or tips, or fees or the fact that you have to pay for extra mayo now.

This is not just important for your pocketbook but has wider implications as well.

For instance, this largely account for some of why the economy is doing so well and inflation is down and yet consumers - and voters - are still feeling pretty down in the dumps.

This isn't some large conspiracy theory, to be very clear. Inflation IS down. Furthermore, it may continue to fall. We hope it will though we are less sure that base effects won't start to cause it to stay stubbornly above the 2% target.

Nor are companies working with government to rip off hard working folks. It doesn't have to be so fantastic. Rather both the government's approach and companies' interest in obscuring their maneuvers to raise prices are regrettably combining to create an odd and perverse situation:

costs are continuing to rise but they aren't all being captured by the hard working folks trying to track these things.

Unfortunately, the fact that this state of affairs is happening by accident isn't keeping it from creating disillusionment and, also, anger. The only thing worse than struggling might be struggling and being told how good you have it.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.