2022 Theme: The Thud Of US Inflation

If Chair Jay Powell's Jackson Hole speech in late August was a brutal dose of reality for financial markets then this week's US inflation data was hard proof that his concern was warranted.

Tuesday's CPI release will only have reinforced the US central bank's belief that the battle against inflation is very far from over.

It certainly convinced investors. As we demonstrate below, the market's narrative about the single most important data point has shifted once again.

The basics:

The consumer price index increased 0.1% in the month of August. More disturbingly, core inflation, excluding energy and food, rose 0.6%. Both these numbers were higher than expected.

On a yearly basis this puts inflation at 8.3% rather than the 8.0% as economists had projected but the problem is really the core number above.

The price rises were driven largely by increases in food, shelter and medical care services arenas. These more than offset a sharp decline in gasoline prices.

The core inflation problem is particularly striking. Here is Bloomberg pointing out that by nearly every possible way to slice and dice, core inflation is high and staying high.

Ouch.

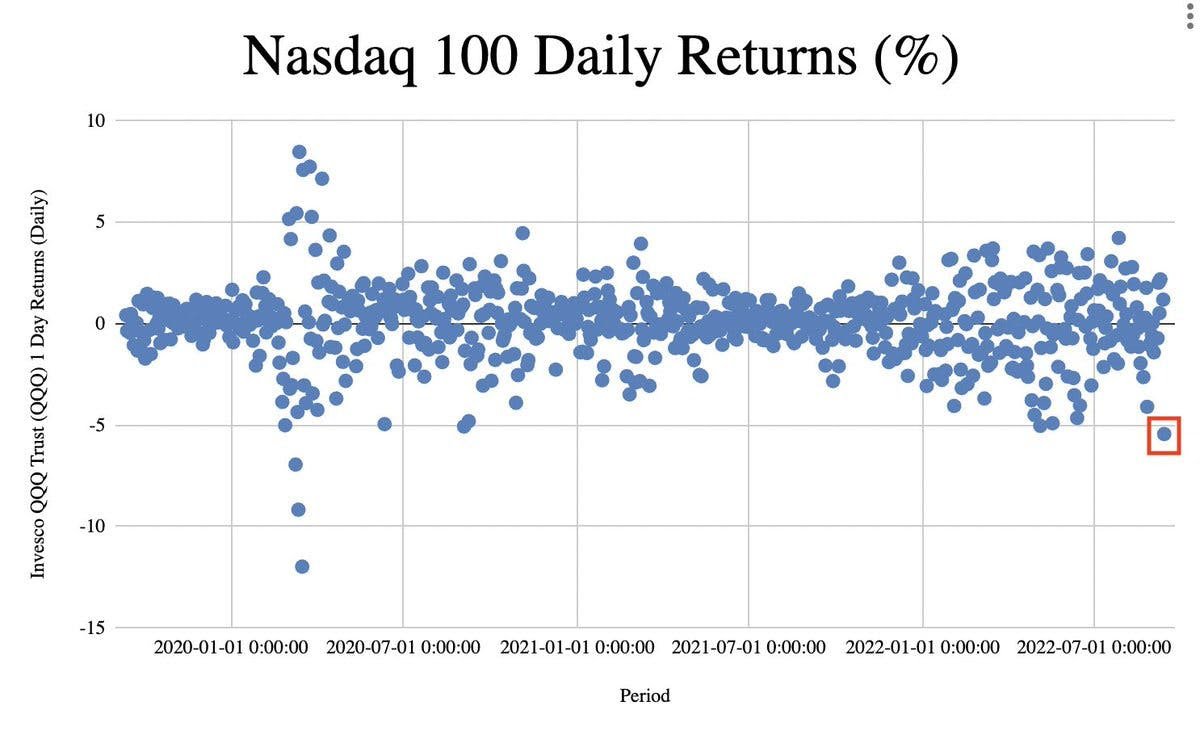

This caused the markets to have their worse day since the early months of the pandemic (March 2020 to be precise) with the NASDAQ falling over 5.2% and the S&P 500 falling over 4%.

We have mapped out the NASDAQ returns over time below to help put it in context.

The day was indeed dramatic but keep in mind that all it really did was erase the recent run up in the same asset prices as investors bought in to the expectation (hope?) that US inflation would register another fall.

Oops.

Nothing might be more dangerous than front running "obvious" market events. They disappoint depressingly frequently.

That is exactly what happened this time as well. And there is a bigger message here as well. This month's CPI release did a very good job of popping the overconfident belief that our inflationary problem could be easily and decisively dealt with.

We just aren't that lucky.

What to say about all this?

There isn't much that we haven't covered before. We tried to warn our readers to be very skeptical about either:

The Federal Reserve considering a pause in hiking interest rates.

Or the fact that inflation would continue fall precipitously let alone steadily.

The end of the "inflation was last quarter's problem" has generally brought the narrative back to what we have argued previously.

What did we see that others missed?

As regular readers know we were impressed by the state of the rally in June and July and August especially as it really gathered steam towards the end of that period against the grain of the available data and common sense.

The best way to build the bull case about declining inflation was likely that commodity prices and especially energy prices had been falling steadily and so this should feed through to a lower CPI.

Indeed it did. As you can see here the energy component of CPI (orange at the top) continued to decline over the last month.

But as this chart reveals, the abatement of rising energy costs is very far from the entire story.

For instance, while the orange slice may have come down, the blue slice continues to rise. This is services based inflation from a sector of the economy distinctly unrelated to either pandemic supply chain issues or, cough, cough, Vladimir Putin's horrific invasion of Ukraine.

We have talked a lot about this in the past as well. As far back as Jackson Hole 2021 the inhabitants at Pebble HQ were deeply concerned that not only was inflation not so transitory but it was also becoming very broad based and self-reinforcing.

And now those signs are, as we are finding out, sort of everywhere. They are also particular painful in one essential part of the economy.

Many people can (and perhaps should) change how they shop for food or clothing. Very few can do much about the cost of keeping a roof over their head.....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.