How Is Apple Doing & Why?

We covered Apple a few times in the second half of 2023.

We approached it from a couple different angles but it was all part of our: "be cautious about expecting greater gains from the Super 7 Big Tech companies" theme.

Our argument on Apple had two prongs:

Apple was struggling to sell more of its famous hardware, this was especially the case in its most vital growth markets like China.

Apple' non-hardware services business was actually still growing very strongly but was under serious threat from a legal/regulatory angle.

Put them both together and it seems clear that the iPhone maker is struggling to innovate and find more people to buy their incredibly expensive gadgets while at the same time having their greatest area of growth - services - under serious threat.

The conclusion from all this was a bit scary: one of the best companies and stocks the world has ever seen might be worth excluding from your portfolio.

Here is what that looked like before this week's new data:

What used to grow is now shrinking and what is still growing could quickly reverse due to a court ruling or a new law specifically crafted in Washington or Brussels to limit Apple's profitability.

This is a tough spot to be in, if you are Apple's leadership. It also is a tough place to be as an investor when thinking about buying or holding Apple as an investment.

Recommending excluding a company like Apple is quite nerve wracking because it is obviously a phenomenal company with a long track record of great products and huge profits.

Now, if that was the situation towards the end of 2023, it is likely well past time for an update: How are things? How is Apple doing?

Should you still have a negative view on the world's most valuable company?

Not great, would be the simplest answer.

The company just had its earnings for the most recent quarter which were, of course, very revealing on all of this.

Let us start with the positives:

The positive is that Apple ended its slump by seeing growth in sales last quarter.

The Cupertino-firm also released its first product in nearly a decade with its virtual-reality Vision Pro headset.

The negatives, however, were arguably more important:

Meanwhile, services revenue was up 11.3% to $23 billion but like the Chinese data, missed analyst estimates.

The new Vision Pro product has been launched to a typical slick amount of Apple fanfare but sales expectations are very low.

The symbolism of the low bar for the new virtual reality product is telling. The expensive headset will likely sell in the low hundreds of thousands to real aficionados not the tens of millions that Apple requires to actually make a difference to their business.

Whisper it quietly but most people aren't interested in wearing a heavy-but-cool-looking headset to experience a manufactured reality? Is it that obvious?

In any event, you don't become a three trillion dollar company selling niche products to nerds. You do it by selling an incredible brand with commoditized technology to everyone at a price they can barely afford.

The problem for Apple is that moving the needle for a $2.8 trillion stock is very, very hard. They need to sell a lot more hardware AND continue to improve their services business and neither of those things is happening anywhere close to enough.

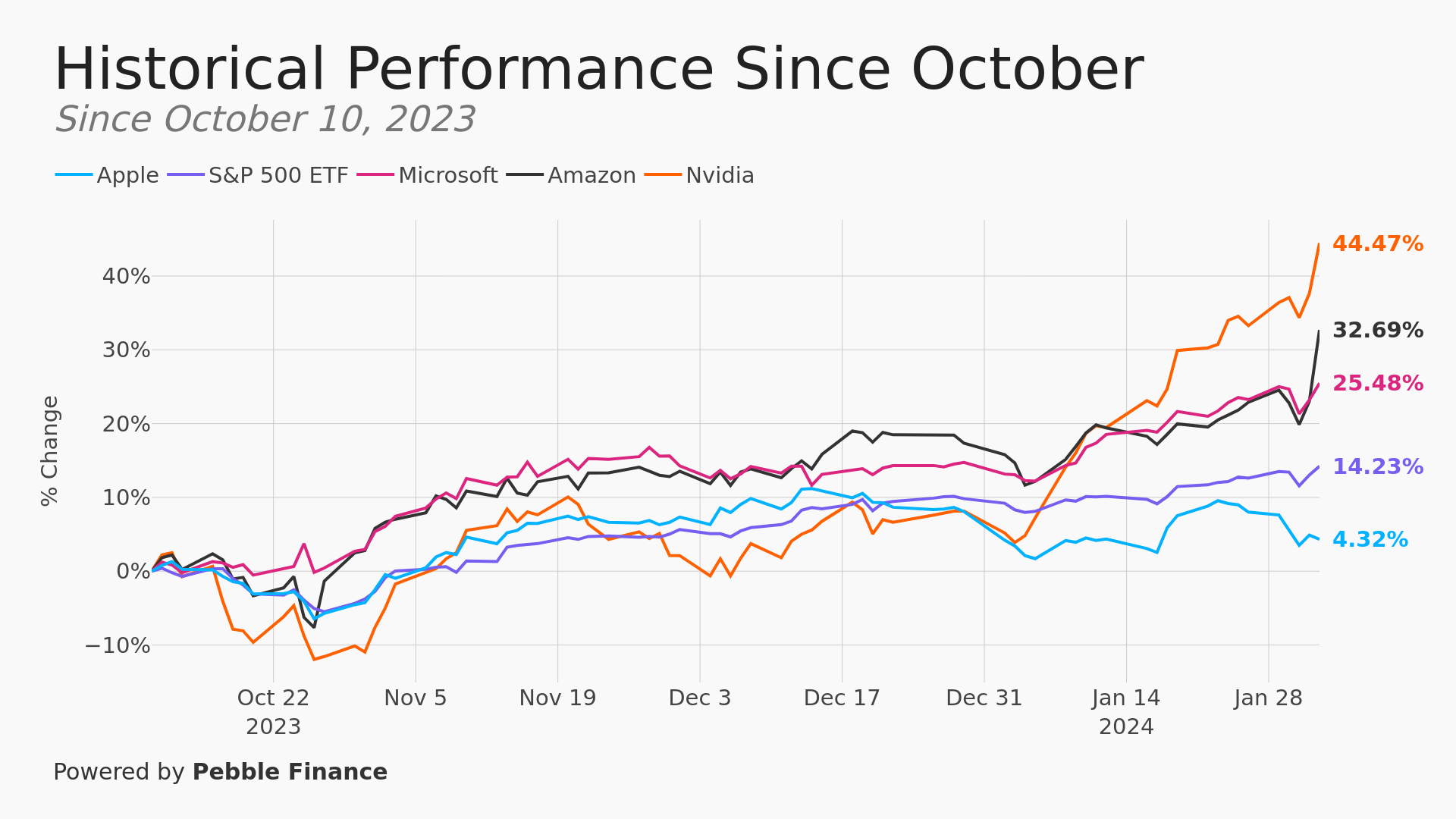

Here is the graph of their performance vs some of their peers and also the wider market since we first began flashing warnings about the stock this past autumn:

That is quite something. The market has risen, some of its peers have risen and yet Apple is basically treading water. That is a stunning reversal for a stock that defined the "only goes up" FANG stock mentality in the post 2008 world.

So, we reiterate our point that, as wonderful a company as they may be, it is time to exclude Apple from your portfolio. They are not "AI" enough to be gaining from the AI boom and their hardware is struggling to sell at the volume required to add the next trillion dollars of valuation to the stock.

And we are still waiting for rulings on their services business....

Apple remains a tough stock to own in 2024 and ripe to be excluded from any passive portfolio.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.