Silicon Valley Bank’s Collapse: An Old Time Bank Run Like You Read About

In truth, we had hoped to avoid writing about the (still strong) US labor market on Friday, we just didn't know how.

And then, like a tragic hero in a Greek myth, we got exactly what we wished for, just not in the way we had hoped.

We got an old fashioned bank run!

A bank run is when all the depositors at a bank want their money back immediately. The bank can't honor all those requests because, by definition, banks borrow short term deposits to make long term loans. That is the whole point behind the institution - borrow short to lend long and manage that tension effectively.

The trust involved is really around the management of the risk involved, not that your money will be stolen etc.

For a long time, these runs happened all the time and people were constantly on guard about the risk. Here is the classic version of a bank run from the famous Christmas movie, Its A Wonderful Life starring James Stewart as a small town bank manager trying to stop a run:

And here is a great piece on perhaps the most famous bank run in US history, the Panic of 1907. This was a seismic event that eventually led to the creation of the modern Federal Reserve system several years later.

In a lot of ways this past week was both nothing like the above and yet also driven by the exact same behavior. In the end a bank run is still a bank run. It is animated by the belief that you must save yourself even if it means the certain ruin for others.

That impulse is very hard to halt once it begins. You are fighting against the survival instinct of your average human and, in the moment, no one stops to think that it might be them crushed by the horde.

"Let the Devil Take the Hindmost" is a classic line from literature that has a modern variant in the idea that "when a group of people are being chased by a bear, you don't need to be faster than the bear, you need to be faster than the slowest person in the group".

The bear analogy is apt but it might require a bear with super powers.

That is because this time, however, the bank's collapse was done with modern technology and financial infrastructure' where everyone operates with the belief that their money is instantly accessible and fungible. There are also the incredible network effects of social media, as well.

In many respects this was the first bank run accomplished by the power of a mobile banking app and a smart phone. It was carried out from ski lifts and boardrooms and in traffic and from homes and offices all over the country as Silicon Valley depositors tried to withdraw $42 billion on Thursday.

All of these factors are causing panic and not for the first time. We have watched our institutions struggle to keep up with events on ground and on the major social media platforms.

This was, we will admit, very unexpected but it does further highlight a point we have made again and again:

The implications of strongly rising interest rates are underrated, not fully appreciated and, most especially, understood by even sophisticated financial participants like a large and important US bank.

They are also not fully appreciated by US financial regulators, including the US central bank - the US Federal Reserve. That should make you pause and think that regardless of the outcome here, major changes will once again be coming to the financial system.

A system that was perhaps overly reliant on low rates.

The era of low rates "forever" had a lot of perverse outcomes but perhaps above all it made it difficult for us to shift our mental model about what is possible. It has also apparently left our very large and very expensive banking regulatory system totally clueless....again.

That shouldn't happen but the ongoing paradigm shift from a low interest rate world to a high interest rate world is having a profound impact on our economy. We have written about a few of them often.

Here are some reminders:

It lay at the root of the bubble in software and other unprofitable stocks.

It likely still lies in our frozen and in many respects, broken US real estate market.

Essentially what we have suddenly discovered is something we should never have forgotten:

A lot of people, institutions and companies have what financial professionals call "duration risk." They own assets highly sensitive to interest rate changes and can be very volatile.

This is true for lots of people, companies, institutions and even governments. For instance, owning lots of long duration bonds in your retirement account exposes you to duration risk. It is also true for a government borrowing at far higher rates and it was apparently very true for Silicon Valley Bank.

The precise details of the SVB collapse are still a little murky because, well, the vagaries of mass human behavior are tough to pin down and we are still very much in the fog of war on some stuff.

What we do know is as follows:

Recently, a slow moving crisis has occurred as another bank, Silvergate Capital, that primarily served the crypto currency market declared bankruptcy. The reason for that: the crypto meltdown meant that many deposits fled forcing them to sell long term assets at a significant loss.

This caused people to begin wondering what other financial institutions might have similar problems. It didn't take long for them to land on the Bay Area's Silicon Valley Bank, the preferred bank for the country's venture capital, venture-backed companies, crypto industry and apparently the California wine industry as well.

That was Wednesday. On Thursday, very unhelpfully, the bank surprised investors by declaring a $1.8 billion write down on a $21 billion sale of almost its entire available-for-sale fixed income portfolio. It also announced it would be raising $2.25 billion in new equity and debt. Both of these developments were sudden and very unwelcome.

On Thursday, the echo chamber in the Bay Area tech ecosystem ramped up with speculation that the problems could be just beginning. Some VC funds recommended companies pull their cash from the bank. This effectively kicked off an old fashioned bank run but in a modern world.

Also on Thursday, the SVB CEO, Greg Becker, came out and told customers to "stay calm" and not to "panic" thereby likely ensuring that they will do exactly that. He was in a tough position but this was not a great strategy because, of course, people panicked...

And on Friday, as we write this, Silicon Valley Bank tried to raise capital to shore up its balance sheet and signal that other credit worthy institutions were still willing to lend the lending institution money.

This immediately failed for the obvious reason that no one was willing to step in front of a runaway train and by midday Friday the stock was halted (again) and everyone began asking who would buy the now distressed bank.

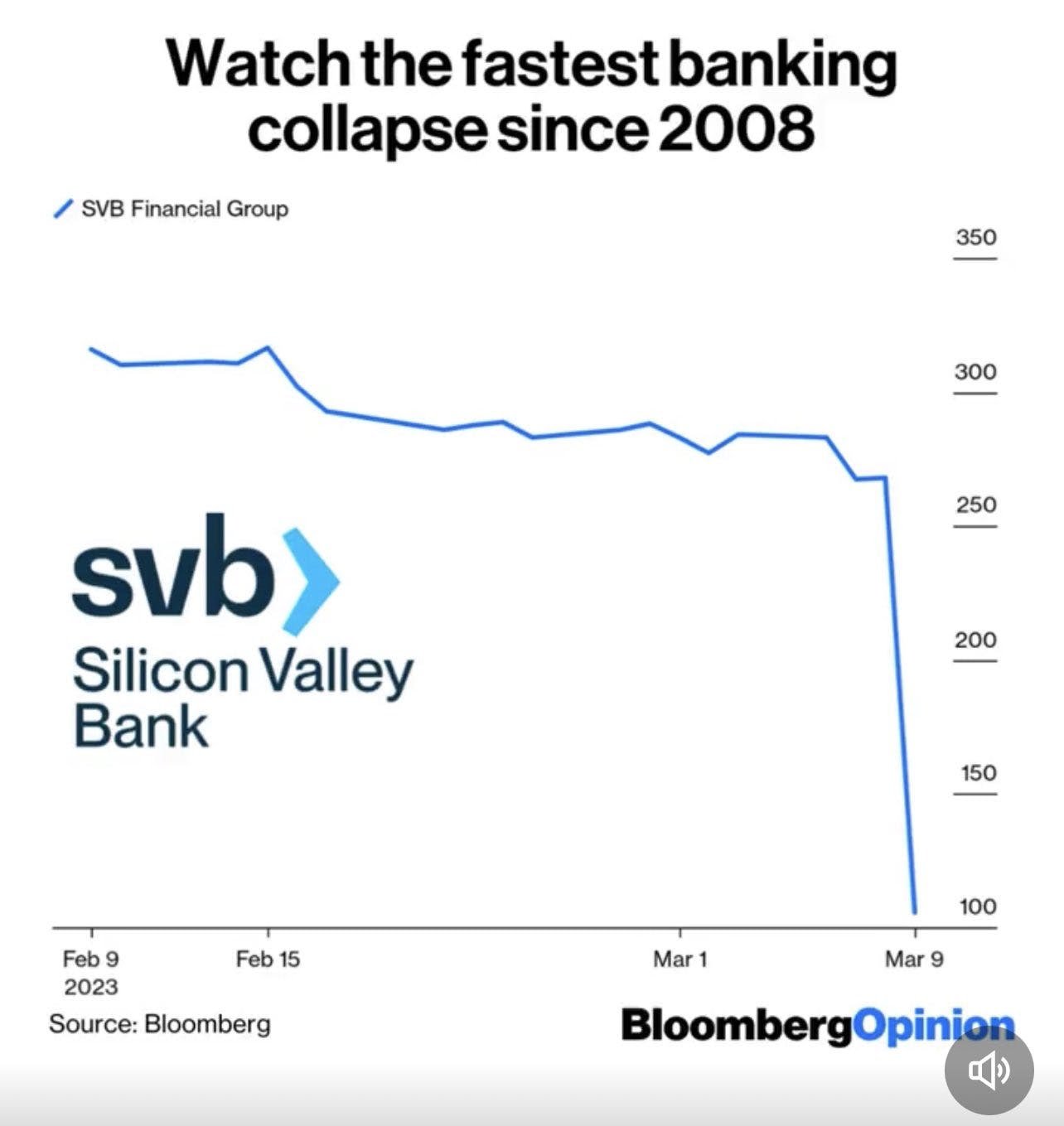

Here is the share price chart:

US regulators stepped in before it hit zero and halted trading but it likely would have and it's now a moot point.

SVB is likely a great asset for the right buyer but right now there is simply very little time and even less insight into the scale of its problems. That makes it tough to even arrange a shotgun marriage let alone proper due diligence that another bank would need to carry out to avoid getting sued by just about everybody.

Regardless of what happens Silicon Valley Bank is toast and that is stunning.

(update early on Friday afternoon: the bank has been taken over by the FDIC and will be shut down)

(update to the above update later on Friday afternoon: the call for bailouts have begun in earnest as apparently well over ~97% of SVB's deposits are above the FDIC's 250K threshold.)

(Sunday update: at the time of writing - 3pm Eastern - the government-run auction for SVB is live but there are not many other details especially around uninsured depositors)

(late Sunday update: The Federal Reserve has announced a formal facility that will backstop all deposits - including the uninsured - and let all the equity go to zero).

But regardless of what happens going forward, this was the second largest banking collapse in US history by assets and will go down in history as (another) black eye for the US banking regulators. It also reveals, very uncomfortably, an incredible weakness in how very large banks are able to legally operate.

That is important to realize here. This may have been incompetent and even reckless but there is no evidence of massive fraud and not much of hugely illegal behavior. That may change, of course.

Right now, the focus is on how to prevent contagion and figure out some sort of workable solution for the remaining depositors, if possible. But in the future other questions will be raised, less about what to do and more about how this was ever allowed to happen.

To understand that we have to go back to 2021 and the fact that, like a lot of Bay Area businesses at that time, Silicon Valley Bank had a huge surge of new business.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.