Why Did Silicon Valley Bank Collapse?

This entire sorry affair raises a critical question that gets to the heart of the whole problem:

How did Silicon Valley Bank find itself in this predicament?

After all, this was the 16th largest bank (by balance sheet) in the US. This is not a trivial institution and its collapse has already wiped out hundreds of billions of other bank equity value and destabilized not just the financial system but is now threatening the actual economy.

To understand all of this perhaps we should begin at the beginning.

The irony is all of this began because of the surge of new customers, new accounts and especially deposits in 2021. These went from around ~$62 billion at the end of 2019 to nearly ~$190 billion by the end of 2021.

You can see the asset inflow here courtesy of the Wall Street Journal:

As you may recall, the startup and crypto scene went totally bonkers that year. The Fed had cut rates to practically zero and many companies raised huge amounts of capital as people could borrow and lend very cheaply.

The combination of lower rates with a huge shift of consumer and corporate activity online created a vicious cycle whereby venture capital firms experienced serious fear of missing out or FOMO and engaged in a frenzy of deals expecting that the pandemic related shifts in technology adoption would be permanent. A lot of those deals and a lot of that cash ended up at SVB because it was the bank located in the heart of the Bay Area's tech hub and had long specialized in serving both venture capital firms and start ups.

This seems like a great problem to have but like a lot of companies during the pandemic Silicon Valley Bank discovered they were unprepared for the violent shift in their business model. Despite it being obviously in a positive direction, they had a thorny issue with this gigantic wave of new customers and deposits.

For one thing, they couldn't handle this volume of business. Remember banks don't just hold your money, they also make loans. At its core, that fundamental relationship at the heart of banking was central to SVB's eventual demise.

The reason was simply that the Bank couldn't possibly turn around and lend out a sufficient amount of money as loans quickly enough to match their new deposits. To do so would have risked simply spraying money around irresponsibly and created bigger problems down the road.

So, what to do?

Well, SVB did the obvious prudent thing - instead of making rash loans they instead bought supposedly safe securities. i.e.: mortgage bonds. Lots and lots of mortgage bonds, to the tune of over $80 billion apparently.

See here (the second pie chart) from the Bank's own presentation their latest 10K:

(the green and orange slices added together)

The challenge was they were buying when bond prices were excruciatingly expensive and yields were low. They then reached for yield and bought long dated mortgages to make a little more and also at least lock in some yield in a world where rates just seemed destined to stay low forever.

Uh oh.

Then as loyal readers know all too well, 2022 happened. In particular, the Federal Reserve decided to get very serious about the runaway inflation problem and start the fastest rate hiking cycle in history.

There is an inverse relationship between bond yields and prices. Rising interest rates cause bond prices to fall. This is of course what happened all across the board last year leading to one of the worst years ever for the 60/40 portfolio and its ilk.

So, SVB's portfolio of mortgage bonds and other government securities that they had bought at the top of the market, began to decline in price. And the thing about duration risk is the longer dated the bond (or mortgage in this case) the more sensitive it is to changes in interest rates.

So, the value of SVB's portfolio of bonds went down in value. In fact, when depositors in the Bay Area and elsewhere in the technology industry began to withdraw deposits for other reasons - crypto winter, falling profits, job layoffs etc etc - SVB had to sell some of their bonds and took a significant loss.

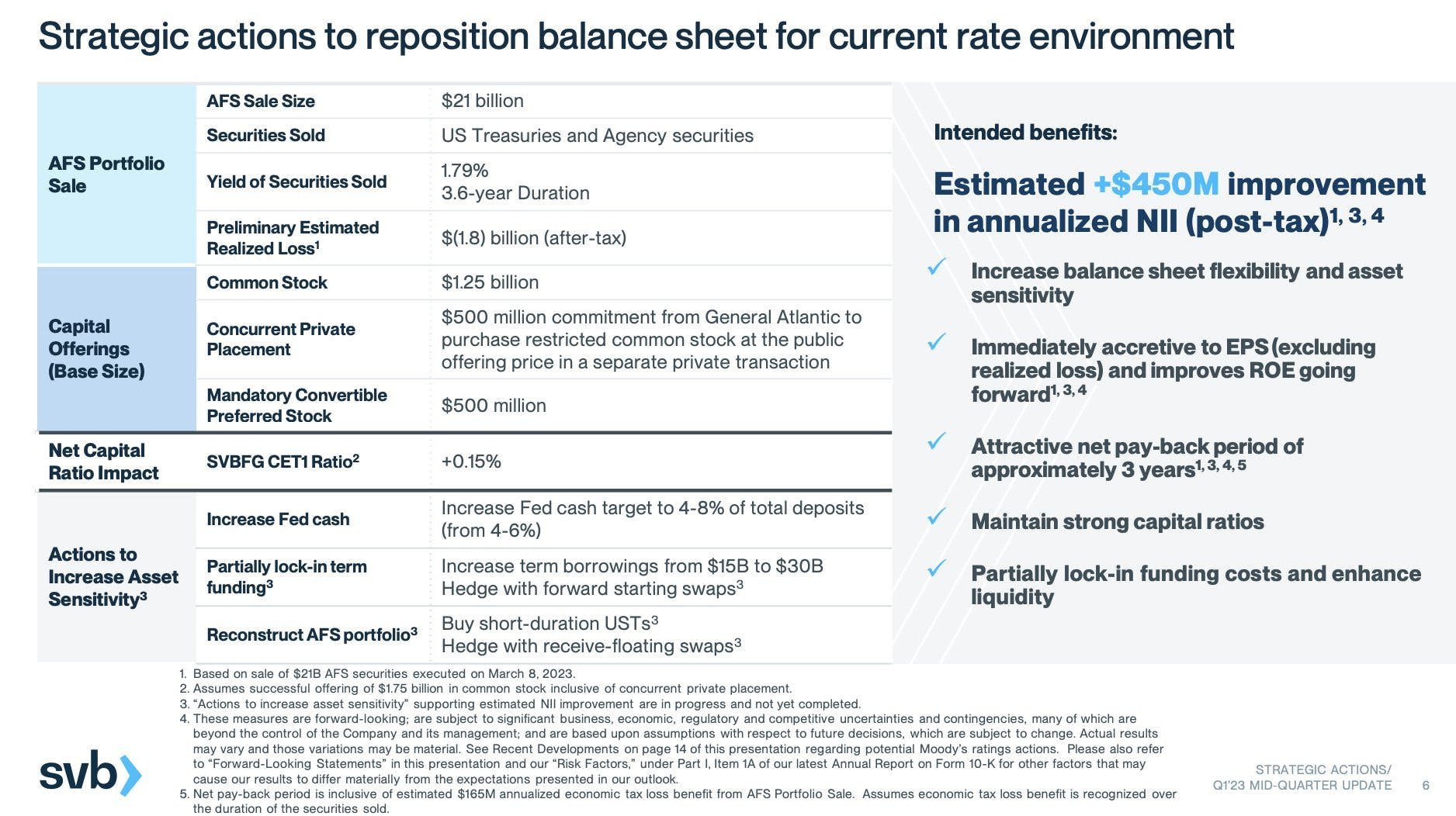

$1.8 billion loss on the $21 billion of fixed income assets sold. Not a great outcome but even worse was the fact that they announced that, to be prudent, they needed to raise MORE equity and debt from their investors.

See here outlining this plan from a presentation to investors just LAST WEEK:

This plan did two things. It surprised investors in a negative way and started them thinking, what if this isn't the end. What if this is just the beginning, not the end, of these redemptions, these sales, these losses and these capital Raises?

That feeling and the chatter in the tight knit networks in Silicon Valley and around the tech ecosystem proved fatal. The rest is now, well, history.

Ouch.

SVB is no more. The real question as we all now collectively watch and wait for what the plan is and whether there is risk going forward?

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.