Crypto Winter Sets In: No, There Will Be No Bailouts

There is only really one reason we were so hyper focused on the threat of inflation for so long: we were all too aware of the severe consequences that occur when it becomes entrenched.

At the time, as inflation slowly gathered pace last summer and autumn, it felt not unlike yelling with gradually more hysteria about an incoming runaway train that the various rail safety authorities are confidently ensuring you is well under control.

And now we are witnessing that train running amok live and glorious high definition as it smashes its way through all and sundry.

But of all the various industries, businesses and lives disrupted, perhaps none has been more affected than the cryptocurrency nexus and those who work in and on it.

The headlines come quick and fast: significant layoffs, crypto funds imploding, multiple so-called "stablecoins" pegged to the US Dollar in theory breaking the buck, defaulting on loans, entire companies shutting down or mysteriously going dark and being unable (or simply unwilling!) to return money owed to their investors/customers/counterparties.

The latest in this parade of unhappy news was the concerning announcement on Friday that the major crypto exchange and brokerage, Voyager, was suspending all transactions, withdrawals and other business activities.

They even closed down their debit cards and loyalty programs.

It is really bad, in other words.

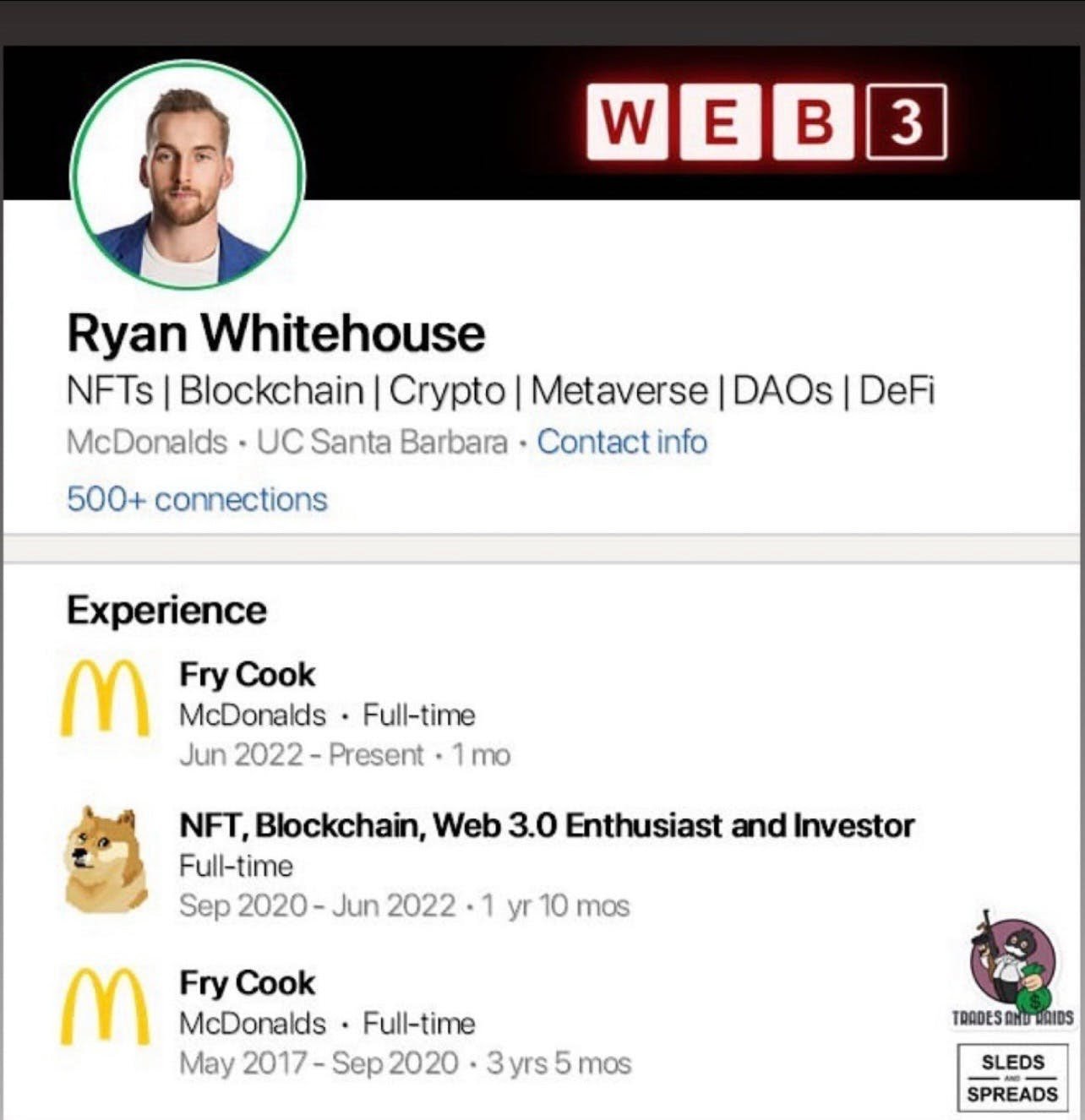

And the crypto bros, the people who used to chant "have fun being poor" at their detractors online are now mostly silent. Every once in awhile they post a satirical meme.

To wit:

Now all of this angst and misery has caused a lot of schadenfreude. Double, super emphasis on "a lot."

We hardly live in a polite age let alone a respectful one so this may be pointless to mention but a lot of the triumphalism around the implosion of various cryptocurrencies and the ecosystem of companies and investors around the space is sort of sickening.

Yes, it is likely a good thing that the massive bubble inflated by cheap money and the (largely false) promises of getting rich quick is rapidly deflating or perhaps, simply popping in spectacular fashion.

But for every charlatan or annoying crypto-pump artist getting his comeuppance there are hundreds if not thousands of regular people who have lost a lot of their hard earned savings. It isn't just very possible but likely that many of them couldn't afford to lose it in the first place.

It says something about a broader society that doesn't just celebrate but practically revels in the immiseration of a large and young or ignorant (or both) percentage of the population.

This will have an impact on many of them, not just now, but for the rest of their lives. You only need to read a few histories of the Great Depression or have had formative experiences during the Great Financial Crisis to realize that the impact in a formative financial experience can be permanent.

And it is beyond strange, as we have mentioned before this year, that the regulatory state - under multiple and very different political administrations - has been largely absent during this entire experience. What is the point of a state that tightly regulates its banks and its fiat financial system to the Nth degree but allows an entire new and unregulated financial system to grow largely unbidden for well over a decade and shrugs when the inevitable happens?

We here at Pebble HQ have been and remain deeply worried about this outcome since the faintest beginnings of our company in 2020. We were founded, in many ways, precisely to counteract the drift away from safe and stable investing and towards the allure of the financial casino and the hucksters and thieves who prowl its halls.

Digital native money is very cool and will hopefully continue to develop real products and help regular people do more for less and do it in a uniquely and powerful secure way.

And this isn’t all:

The implosion of the crypto complex bears all the hallmarks of an imploding financial bubble. It is very regrettable and likely didn't need to be this way (?) but it also underlines the real danger of this moment.

The complete evaporation of simply huge amounts of wealth (estimates are around $2 trillion (!) so far) in the cryptocurrency space, and the continued, seemingly endless issues allow us to take stock and make a single recommendation.

Get your money off the crypto exchanges. Do it now.

Additionally, are a couple points to keep in mind:

Bitcoin and many other aspects of the cryptocurrency complex are not going to disappear. Far from it. This current episode could be critical to getting the industry to grow up and become far more useful.

That being said, the pain is also likely not over. There are simply too many unresolved issues as well as outstanding and continuing crises to suggest we are near the end.

But the final point is the most important: the concepts and even some (most?) of the currencies may live on but you should be extremely careful about where your assets reside (ie.. which exchanges/institutions).

Only 15-16% of Americans own cryptocurrencies. Or that is the reported number.

We can only hope that this is the case because the combination of plummeting consumer incomes and falling crypto-currency prices raises the specter of, not just a crypto winter, but rather a crypto-extinction.

Which institutions stand to lose in this scenario? Let us take a look at only one very public and very popular company: Coinbase ($COIN).

Coinbase Global is a publicly traded company that operates a cryptocurrency trading platform. It is a major enterprise, the largest crypto exchange and gives every impression of running itself in a legal and responsible manner.

Unlike a lot of the crypto-universe there is neither the "air of the huckster" around the company nor any track record of irresponsibility. That is, in many ways, the reason for their success.

But here is the problem and, also, the little appreciated fact:

Coinbase loses money. Every month. Every quarter. Every minute. In fact, they lose quite a lot of it.

In the first quarter of 2022, the company lost a record $430 million dollars. That was nearly ten times its projected $47 million expected loss. "Yowza" is all we can say to that.

And here is the unpleasant and also under discussed fact: your valuable monies at Coinbase are NOT FDIC insured. In fact, as an account holder you are a junior creditor. You are the lowest rung on the bankruptcy totem pole.

In a bankruptcy liquidation you get paid out last, in other words.

Read that again.

Your capital would be seized and might be paid out to some other more senior creditor purely because it is an available asset. You think it belongs to you and it does. Sort of.

We wonder about how many people who have a likely significant amount of their savings in a Coinbase cryptocurrency account and are thinking that they will simply wait out the turmoil and perhaps dollar cost average their losses or add to their position at prices near where they made their initial purchases?

They may be pretty smart in a lot of ways. They may own strong and resilient currencies like Bitcoin or Ethereum or the like. Those currencies may see further depreciation but are both too popular and too properly built to really struggle.

But the key is the platform everything is built on.

And what if Coinbase goes bankrupt? Then no matter what currency you own or how stable or profitable your investments appear, you will immediately lose access to them and go to the very bottom of the liquidation ladder for payment.

We aren't suggesting that it will go bankrupt. We have no idea. The CEO, Brian Armstrong, claims that Coinbase Global Inc. is in good stead and won't go bankrupt.

That is great! And he is a serious figure who we believe is trying to build a serious business. But of course he would say that and furthermore, can he really predict the many repercussions and ripples of this popping financial bubble?

We wonder how much of the above is understood out there. Especially the killer point that the company itself isn't just unprofitable but massively so. To be clear it lost over $400 million in the FIRST quarter. That was long before the 2022 fun really started in earnest.

It is sort of hard to remember and funny (not funny haha) to say but there were actually very few uncomfortable Fed press conferences and panicky cryptocurrency headlines in Q1.

Relative to the second quarter, the first quarter was pretty good!

This makes us uncomfortable. And we aren't alone:

Goldman Sachs came out this week and made Coinbase a "sell" in their equity ratings ranking and also lowered their price target to a jaw dropping $45.

That was good enough to knock another 25% off the price and send the shares beneath $50 instantaneously. Once again, that doesn't necessarily mean they will go bankrupt but it does suggest that they will have a very, very hard time

In 2008, the Federal Reserve and the rest of the government (and across the world) coordinated rescues to protect the financial system and keep people protected from the vicissitudes of a vicious bubble that many people did nothing to inflate.

Will that happen today? We strongly doubt it and if you believe otherwise, well, we might just have some cryptocurrencies and crypto stock to sell you.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.