Is The AI Bubble Bursting? Is It Even A Bubble?

This is an important question and it is driving a lot of discussion and speculation at moment.

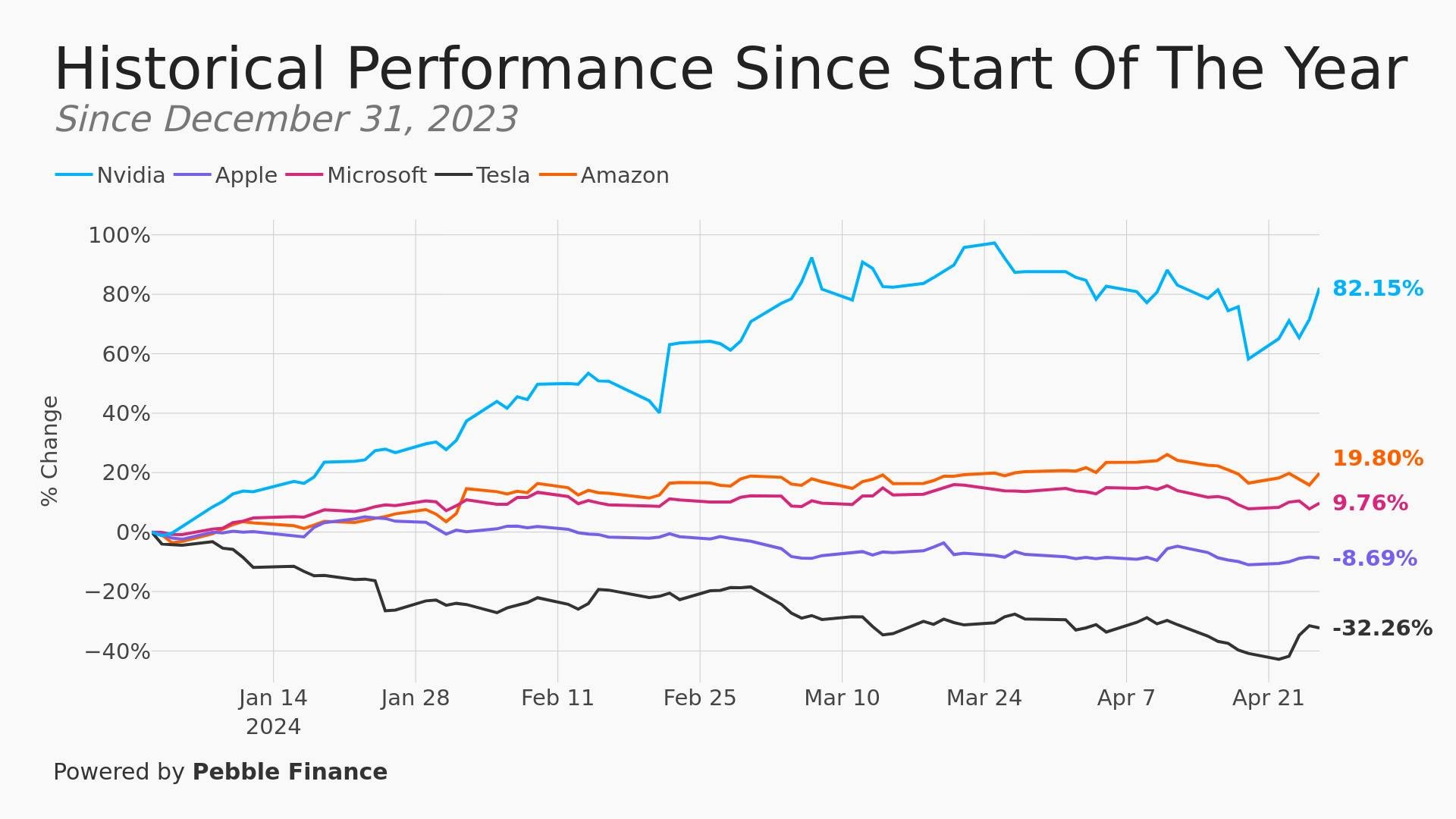

The reason isn't hard to divine. Many of the best and brightest "AI" flavored companies' stocks have hit the skids over the last 4-6 weeks. Others are trading sideways.

This change in relative fortunes is causing the usual divide to occur. Those who are owners (or long) are confidently asserting all is well while those who have largely missed out (or simply sold early) are predicting the end is night.

What is really going on?

A tough one!

The answer doesn't necessarily lie in between but rather about what is causing the divide.

There are two parts here:

Some high flying companies are struggling to match sky high expectations

And also other firms are changing their strategic plans to try and protect themselves and their profits.

Let us deal with each point in turn. The first in this section and the next below.

To begin with, for much of the last 7-8 months we have argued against owning several of the world's most profitable technology companies.

We have made this general point that the entire Super 7 big tech companies might worth avoiding going forward.

We have also made specific arguments about individual companies like Apple that, in our opinion, was facing increasing headwinds.

One of the key points to our argument was constructive, though self-serving. This situation was an ideal use-case for the Pebble Investing App.

Previously as an investor it was very, very hard to do anything about this state of affairs. You basically sat at home and looked at the over valued companies and unbalance market thought: "crap, this isn't going to end well (especially for me)."

It is what makes investing very difficult as just an ordinary person with some money in the market. Yes, you aren't as informed and sophisticated as the professionals but you also lack some of the most basic tools to be able to easily and safely protect yourself.

That is why partially why we founded this company, of course. We wanted to do better than the current financial products and try to ensure that regular investors didn't have to look around and think: "this sucks", quite so often.

However, another of the central points to the above concern - which is important to what follows below - is that these high flying companies could also find themselves in trouble in multiple market scenarios.

i.e.: if the overall stock market turned over they would obviously be very vulnerable as huge relative winners OR if the market kept rising then the rest of the index - whether in the NASDAQ or the S&P 500 - would likely do some catching up.

The latter is what has broadly happened so far this year.

Many - not all - of the Super 7 have struggled in 2024. We have covered that at length. Recently we have cautioned, however, that even some of the remaining giants were getting to price levels that are very unsustainable.

We most recently and clearly did that right here.

That has begun happening. Over the last month, even Nvidia's stock has been plummeting. In under a month it fell nearly 20%: from over $960 to nearly $750 a share.

Meanwhile, Microsoft, perhaps the most bulletproof tech giant of all has suddenly also stumbled. At the time of writing the company's stock is within spitting distance of the S&P 500's return in 2024. If that seems overly cherry picked then you might be surprised to find out the computing giant has actually underperformed the index over the last 6 months.

That was something that seemed impossible even a few months ago and still seems strange even now. We had to verify it twice.

So, even the best and brightest have struggled the last 6 weeks or so. Others have done more than struggle, they have flat out stumbled.

You can see it for yourself here:

From one perspective this seems completely unsurprising. Nvidia's valuation and expectations for future profits was becoming - still are! - more than simply absurd. Yes, the chip designer is making unreasonable amount of revenue and especially profit but the expectations are so high that everything must continue to go perfectly to be worth this stock price.

From another point it view, it is rather amazing to watch a stock that couldn't go down for an entire year, finally crack. It has this somewhat magical expected-yet-unexpected quality to it. It can be hard to accept what you had expected to happen is finally happening.

It is always a mug's game when stock valuations get out of control to try and predict where they are going. The important thing is to recognize they are no longer likely tethered to any sort of business-based reality and just be honest with yourself (underrated quality!) about what is going on here.

Before we get a flood of self-interested mail, yes, both companies have bounced more recently but the sudden selloff in these previously bullet proof companies and the underperformance of some of the market's highest flyers has raised the previously unthinkable.

Is the AI moment over?

And the follow up: Is it (was it?) a bubble?

Our answers: No. And not necessarily.

Why?

When it comes to the question of whether AI stocks are in a bubble and if this bubble is over, the simplest hallmark of a stock market mania might be that the market ignores bad news.

As the earlier chart and discussion of Nvidia's recent gyrations indicates, that isn't the case this time.

Another is that there is very little real, hard data to analyze, everything is rather on "vibes." That also isn't necessarily the case.

There is likely plenty of speculative fervor in stocks like Nvidia and Microsoft but there are also plenty of very healthy profits. That is a HUGE contrast from the infamous internet bubble of the late 1990s. Then there were near zero profits. In fact, there were barely any revenues! Just the hope and dreams of millions of investors buying into the hype for different webpages.

Now there are not just revenues, there are profits, Lots of them. So, we are instead we are debating just how unreasonably big the pile of cash these companies will accumulate.

Lastly, investors are trying to grapple with just how good the crazily good business is going for the likes of Nvidia and Microsoft. As always there are people on both sides and after a tremendous year there are legitimate questions about where these companies can go from here.

As a direct result, slight changes in sentiment can have wild swings in the stock price when a company has done as well as Nvidia.

Just this week, a sudden flip in expectations around those profits have lifted Nvidia over $100 a share. That may sound like a lot but it is actually considerably more than a lot. The $290 billion dollar swing in Nvidia's market cap was more than the entire valuation of most of the companies in the S&P 500.

So, as corny as it sounds, this time is different. You can see it in returns on investment and healthy company balance sheets as well. These companies have tens of billions of dollars and earn billions more in profit every quarter. The likes of Meta and Google and Amazon are not going anywhere, no matter what happens with the AI question. In this respect they are very, very different from, say, pets.com.

You can also see this in valuations. The valuations for Nvidia and Microsoft are very high but in aggregate the valuation for the broader tech index is far beneath other frothy periods.

For the answer to that question we turn to answering.....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.