China Targets Apple’s iPhone - Can Anything Be Done?

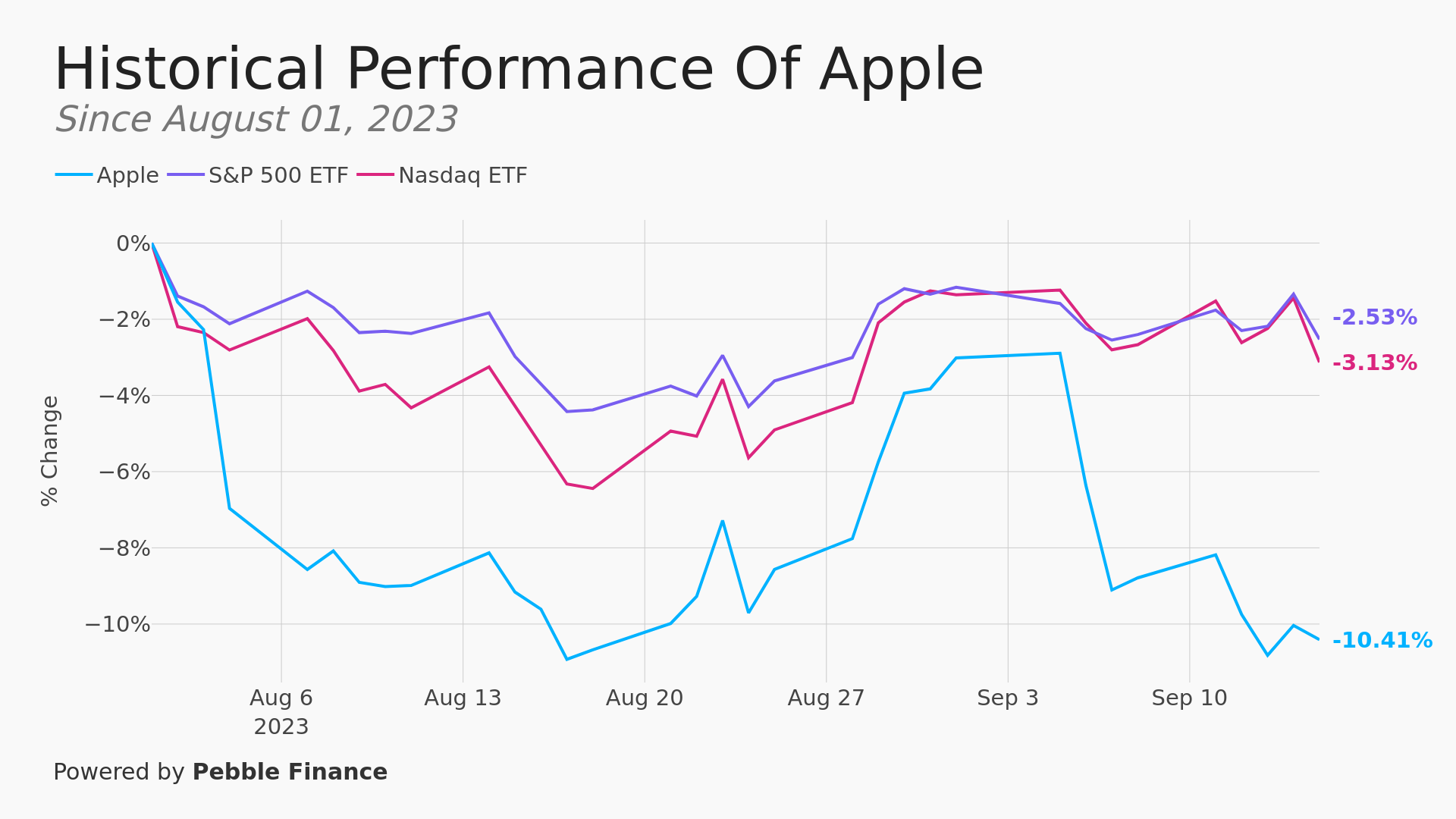

Disney wasn't the only major American company to get a comeuppance recently. Apple had a unspectacular but, for it, very rare experience over the last few weeks:

It discovered that share prices can go down as well as up.

Finding out how the rest of publicly traded companies live was no doubt a shock for a company that is typically just used to hitting home runs, collecting laurels and reaping otherworldly profits and prestige.

Apple hasn't just declined. It has even underperformed than the overall market of late:

That is very, very unusual.

The humbling of Apple raises an interesting question:

Is it time to exclude Apple from your portfolio?

Let us examine the case.

The first issue for the Cupertino giant is typically a major strength:

Apple is a huge global company with worldwide manufacturing and retail businesses.

Keep in mind throughout that Apple isn't just a normal big company. Even among large ventures, Apple is truly a giant.

The iPhone maker represents a full 7% of the S&P 500 and has a market cap, even today, of $2.7+ trillion.

Unfortunately what was normally a strength - it size and global reach - risks becoming a real weakness. Apple is also operating in a time of deglobalization and big power decoupling. Companies and especially technology companies are becoming synonymous with their home countries and having to choose sides in a geopolitical struggle for hegemony.

That is bad for many reasons but it is just particularly negative for global multinational companies that rely on maximizing profits on a global scale. The particular genius of Apple isn't that Americans love their products it is that everyone loves them.

Apple has, by dint of careful diplomacy, the tremendous popularity of its brand and slick marketing, neatly avoided most of the blowback of fraying US-China's relations thus far.

That has now changed. China has expanded and toughened its ban iPhones for central government workers. The employees were told not to use foreign devices or even bring them to the office.

This was clearly a step up in the campaign to move away from being reliant on foreign technology but it also signaled a direct attack on Apple. It may be yet another escalation in the tit-for-tat trade conflict between the US and China but it was the first time that Beijing went after a company that employs millions of Chinese citizens.

This isn't a symbolic gesture of a few small departments either. China is not small and it is also an authoritarian state. Central government workers number in the tens of millions and are full of the Chinese Communist Party's elite cadres.

The additional for Apple and its suppliers is that this won't just be central government workers either. This decision by the Xi Jinping regime will set the tone for what businessmen and other elites should use and those expectations will downwards in Chinese society.

The latest move in Beijing sent a chill through Apple's supply chain and caused hundreds of billions of dollars to be lost from the computer company's market cap. The expectation from investors was clearly: this is just the beginning.

The CCP has gone off Apple. That will quickly mean that China does so as well.

Or that is the fear now that even Apple is not immune from geopolitics.

It also wasn't the only recent disappointment for Apple investors either. The second problem is perhaps far more serious because it is far more global:

It is getting harder and harder for Apple to wow the world with their core products.

The whole point of Apple is that their products have serious wow factor. In that respect they are the envy of really every other product but a few truly exceptional marques. The same way that a Ferrari isn't really comparable to another car brand, an iPhone is similarly' unique.

That is how they can charge hundreds and hundreds more dollars per unit than phones from (non-Chinese) competitors like Samsung or Google that are for all intents and purposes, just as good if not better on paper.

That is the power of branding.

The China announcement was bad and knocked off hundreds of billions of dollars from Apple's share price but the bigger, more significant longer term deal might have been the Apple product launch this past week.

Under Steve Jobs' famous and his incredible, spell binding "reality distortion field" these new product launches every September became huge events that were keenly followed by the legions of fans around the globe.

It is not an exaggeration that they were a rock concert but where the star of the show were tech products, not a musician.

Here is Steve Jobs announcing the first iPhone:

The Macintosh, the iPod, the iPhone, these products could claim to have changed far more than just the narrow product categories they were in.

By comparison to those past releases, this week's big reveal was, to put it kindly, pretty disappointing. Bragging about how the phone weighs 1 gram less or that it has a new polish is just, well, hard to get all that jazzed up about.

The best part other than the new colors might have been the attempt to be carbon neutral.

The whole thing felt flat and out of ideas. That isn't great news when you are a $3 trillion dollar megafirm that needs to sell tens of millions of devices every year just to hold serve rather than grow.

One of the things that has consistently surprised even very sophisticated investors is Apple has been able to charge more and more for newer versions of their watches, earphones, computers and especially phones.

Many people who cover the phone market very closely have been surprised that Apple has been able to get away with these price increases even though the products themselves have had diminishing new capabilities over time.

You are getting roughly the same for quite a bit more is an incredible way to run a business, if you dare.

However, we may finally be getting to the end of this particular "suspension of reality" that has helped Apple avoid the rules of physics that typically constrain most companies.

If there is no real need to upgrade your iPhone then it is likely that more and more cost conscious consumers around the world will opt to at least delay their next purchase. We do live an age of declining standards of living and not just in America. Even a slight slowing in their sales volume will very quickly impact their bottom line.

The third problem might be the most interesting and least appreciated:

Other companies are catching up to Apple technically.

This was perhaps the really big news out of China two weeks ago. A lot of the attention was focused on the new sanctions and their impact on Apple but the real news might have occurred elsewhere in China proper.

This is because it isn't just Apple being hurt by China's actions but also about who benefits.

There are two overlapping trends here:

The first is that Chinese hardware and technology firm shares soared after the news.

The second is that a Chinese company, Huawei, released a new phone to directly compete with the iPhone in the Middle Kingdom.

More notably still, the Mate 60 was mostly made in China and either circumvented or replaced Western components and technology now barred.

This was both impressive and a wake up call about the limits of Western sanctions and the resourcefulness of Chinese tech firms. We have written about this a few times in the context of Russia but it is worth repointing that sanctions fall short or get circumvented more often than not.

In this case, it is still a bit unclear but it seems as if Huawei was able to repurpose old chips to achieve impressive new capabilities with their new phone. That will give a lot of policymakers and executives pause. The Chinese SMIC semiconductor firm and Huawei seemed to have accomplished what was previously thought of as impossible.

What to say about all this? How should we think about it?

There are three simple conclusions:

Apple will still move a lot of fabulous products in the next year but it is doubtful they will meet let alone exceed expectations.

This is only the start of China's anti-Apple campaign. Expecting anything less would be very foolish.

More importantly still, the US government will be watching all this very closely and will also get to respond as well.

It is almost a guarantee that Beijing will increasingly make it difficult for Apple to sell and profit from Chinese consumers as punishment for Western sanctions on Chinese firms and products.

But the US will also respond with likely even tougher sanctions of semiconductors and their related technology. This won't just affect American companies but will stretch from Dutch firms like ASML to Korean and Taiwanese chip makers and Japanese raw material suppliers.

Add it all up and perhaps the most basic conclusion is to expect further sanctions on China and especially and specifically in the area of high tech hardware.

Is the most basic takeaway here then not: Apple is in real trouble but that Nvidia (or TSMC or AMD etc) could be as well?

If you have been looking for what could harm Nvidia's sky high expectations around growth and profits then an ever worsening trade war and global decoupling could be it.

A further fractured global system of trade and free flow of goods has other implications besides being bad for individual companies' share prices.

It also isn't great for inflation either....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.