The Magnificent 7 Stocks Becomes A Fab 4: What Are The Implications For The Wider Market & The Future

Four there are here, yet seven there were, to paraphrase Tolkien's Lord of the Rings.

In 2023 we were optimistic about the stock market but had one big worry: it was heading up but only very narrowly. By "narrow" we meant that there were only a handful of names leading the market higher for much of the year.

All of them were mostly the same familiar Big Tech names from the go-go FANGAM days before the pandemic only with the addition of the newer AI darlings, Tesla and Nvidia.

As regular readers will recall, there were long stretches of 2023 where 9/10th of the stock market was actually underwater but the overall was up 5-7%ish.

One again: the power of indexing!

That wasn't all either. Building on this argument we typically argued that:

If the market stayed narrow, the rally was vulnerable.

If the rally broadened then the market should do well overall.

This was a quietly rather nerve wracking. As we have written about before, it was very unclear last summer and into the autumn that the rally could or would broaden. Most analysis saw the narrowness of the 2023 stock market as a sign of its vulnerability full stop.

The rally has broadened! Every single sector of the S&P 500 but real estate was positive in the first quarter of the year. It was nearly the inverse for much of 2023.

Regardless, what happened, happened but now the stock market has pulled a second magic trick out of its bag:

One by one the Super 7 stocks are slowly falling by the way side and the overall stock market seems just fine.

See here:

What was once 7 has become 4 and really sort of 3ish??

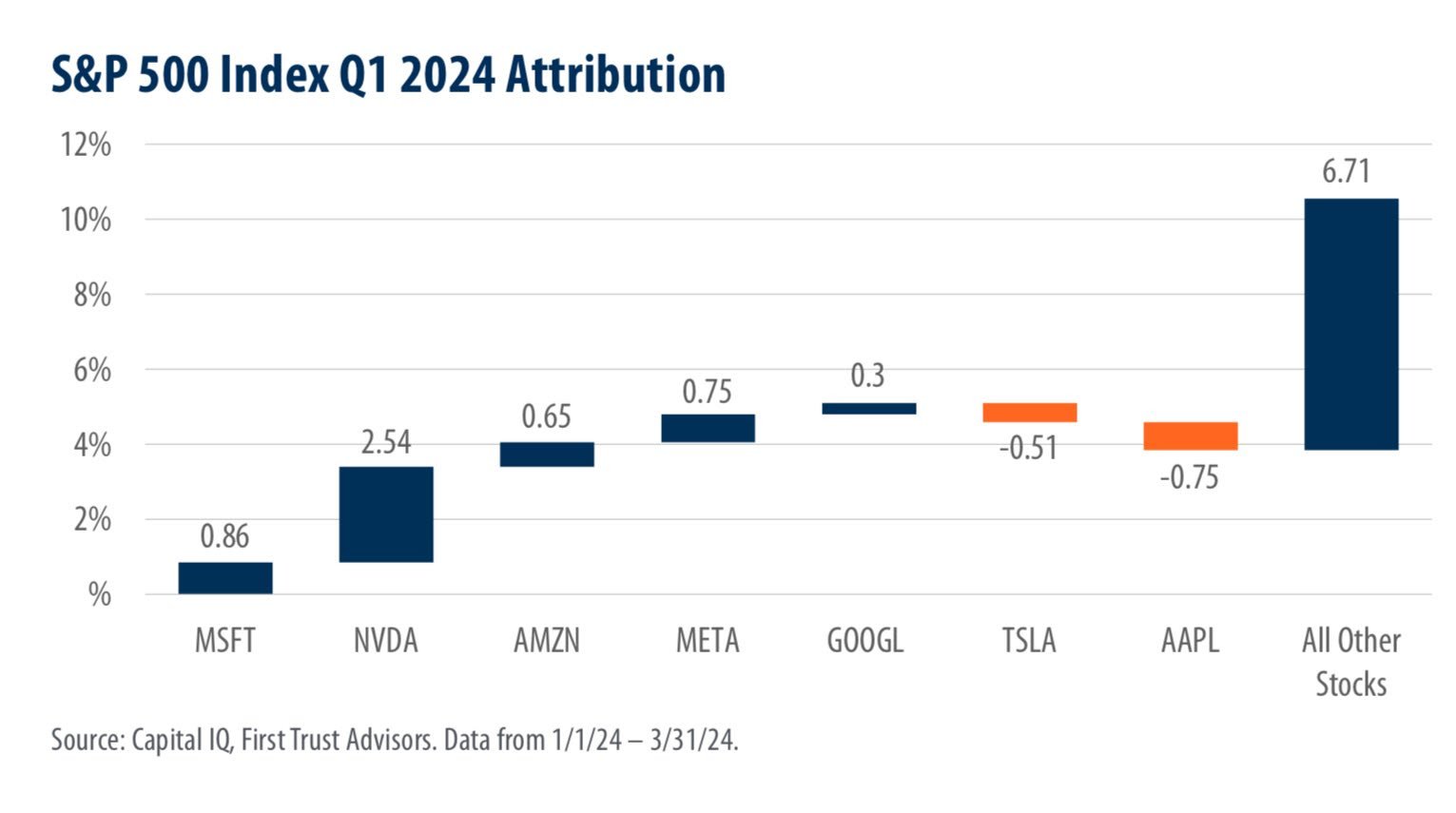

More importantly still, the market broadened. Here is the attribution for the first quarter of 2024 comparing the Super 7 to the rest of the index:

However you want to define it, it has been a significant shift and a tough development for those who think investing just means buying the biggest and shiniest of stocks.

Buyer beware if that is you. It could be some time before the market worm turns yet again.

For now, it is simply impressive to witness the steady disappointment of the near perennial market champions.

In this respect, the dramatic underperformance of Apple and Tesla and the like has been a real shock. Regardless of whether people thought the market would go up or down it would have been very difficult to see the types of troubles for Apple or Tesla or even Google and think: the S&P 500 will be just fine.

And it has!

Will it continue? Can it continue? For that we turn to the developing tension in the economy.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.