The FTX Melodrama & Scandal: What Hasn’t Been Said And What Do You Need To Know

A major "new" financial company valued at $32 billion two weeks ago went to zero this week. Furthermore, one of the new economy's hottest new entrepreneurs went too close to the sun and, like Icarus, flamed out spectacularly.

What happened?

Well, in a tale as old as time, some combination or either reckless or fraudulent financial practices came to light, caused unexpected sales of assets which got out of hand and swiftly caused billions of dollars of losses and, shortly thereafter, the bankruptcy of one of crypto's most powerful firms.

Big picture, this episode underlines some of the inherent problems and structural fragilities within this space as well as the hidden leverage in the financial system that keep causing things to go *boom.*

Some of these weaknesses of this industry we have covered before, some are new to this newsletter, though not new to either the crypto complex or financial history.

********

While regular financial markets may have been overjoyed by this week's US inflation number, the crypto economy and its attendant financial system were rocked to its core when FTX, a large crypto exchange that had previously been called the "central bank" of crypto, tried to hurriedly sell itself to a rival, Binance.

When this sale fell through, questions were suddenly raised about the long term viability of FTX and, perhaps more importantly, an entire ecosystem of crypto companies, coins and ventures that surrounded it.

When FTX couldn't find another buyer or raise new capital to plug a rumored $8-10 billion dollar hole that had magically appeared on their supposed "healthy" balance sheet, they declared bankruptcy.

Why should you care?

Well, for one thing, it should also be mentioned that FTX's problems have locked up millions of individuals' savings as FTX accounts and assets have been frozen from the Bahamas to Japan. It is becoming clear that perhaps billions in funds are also missing.

Many people will likely lose everything. Many of them will not be as wealthy or as fortunate as Tom Brady and Giselle Bundchen.

Perhaps more importantly for the non-crypto holders, it also underlines some of the points we have made before about finance, crypto and beyond.

The classic lesson is, as always, trust in a financial institution is actually very ephemeral and even the biggest, most impressive operations can be laid low very quickly if that trust evaporates.

What banks and other traditional financial institutions learned during the Great Financial Crisis, crypto firms are learning anew.

The precise breakdown is both very complex and been covered in depth elsewhere but the broad strokes are that, allegedly:

There were hidden loans and possibly illegal siphoning of customer cash between FTX and Alameda Research, a hedge fund and a web of other crypto companies and investments.

Once these hidden counter party risks and exposures were, well, exposed in a Coindesk report two weeks ago, people began withdrawing their money in a perfectly rational flight to safety to protect their investments and adjust for finding out about those risks.

That would be fine if it had happened in a limited way but when major investors began attempting to withdraw their capital, then FTX could no longer cover the cash and a run became a stampede that threatened not just the asset prices but the underlying institutions themselves.

When it could no longer afford to defend its assets or meet the calls for capital, FTX tried to hurriedly arrange a sale to a rival crypto exchange, Binance.

The sale was announced Tuesday when the very real collapse of Alameda and therefore FTX suddenly became possible. All of this caused trust in everybody associated with this (FTX, Alameda and Bankman-Fried) to implode.

The merger fell apart on Wednesday as due diligence - shocker! - uncovered quite a bit that gave Binance pause and they had second thoughts. These second thoughts seem to have focused around the fact that FTX has far less money than reported.

By Thursday the mess was real and problems became insurmountable. Assets were frozen, others may have been stolen, wealth was being destroyed.

On Friday, the inevitable finally happened. With regulators and financial sharks circling and no one willing to rescue FTX and the mysterious and gigantic hole in its balance sheet, all of these institutions filed for bankruptcy.

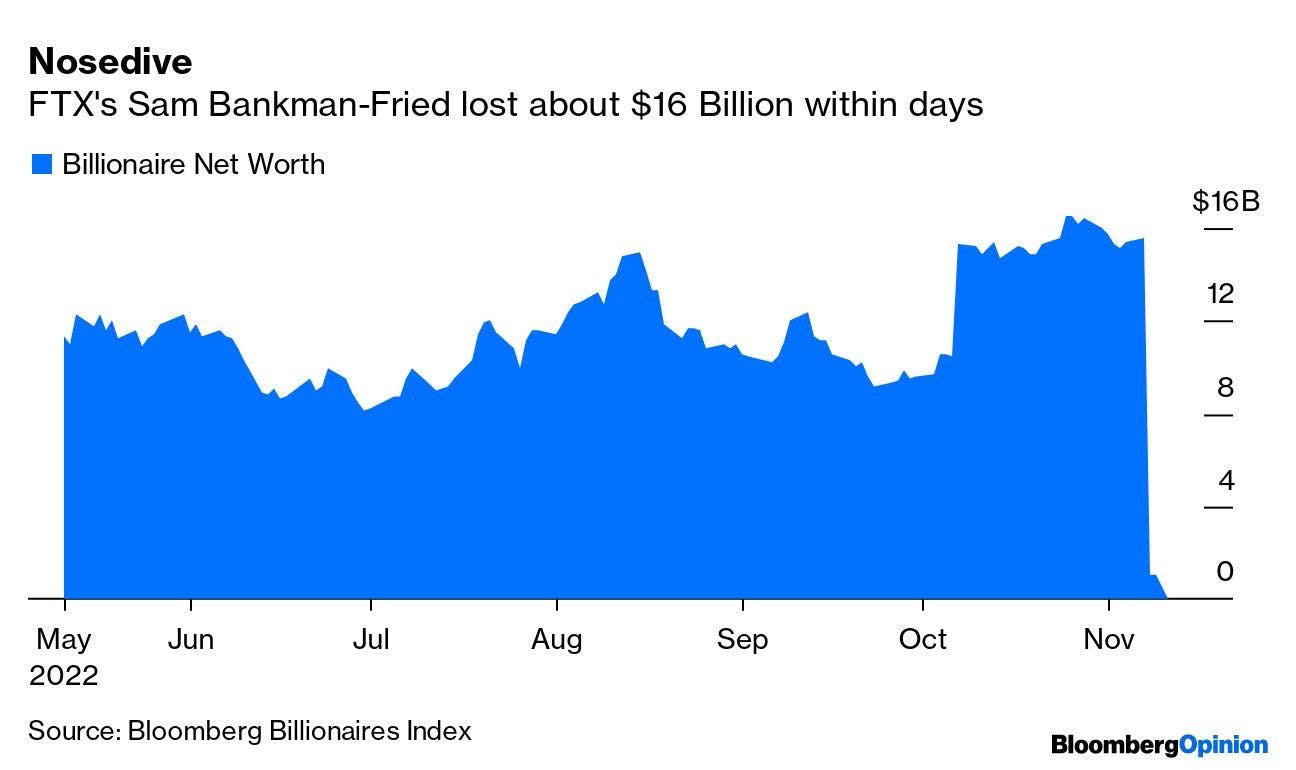

The best and simplest way to visualize all of the above is Sam Bankman-Fried's net worth:

Poof. And it's gone......

All in all, it was a stunning collapse.

The founder of FTX, known everywhere as "SBF," was as recently as a week ago, lauded as the heir to J.P. Morgan for his role as a "white knight" investor and savior of multiple important crypto companies that were struggling as coin values declined and liabilities mounted.

Besides the fact that SBF is now bankrupt and he is also facing near certain personal and professional ruination; he will likely now be pursued to the full extent of the law.

Tough week....

It doesn't come as a surprise that all of this had a profound impact on crypto assets, coins and otherwise.

After months of rocky traditional financial markets - gas prices! Big Tech revenues! interest rate hikes - and quiescent crypto markets all of that calm suddenly evaporated. Bitcoin plunged by over 20% in a few days and the rest of the crypto complex went with it.

The basic conclusion is clear: the "everything bubble" continues to deflate and the victims, most of them poor, young, ignorant, dumb or a combination thereof, continue to mount.

For anyone who cares about a well regulated and functional financial system this was both very sad and very frustrating.

This episode allows us to say two things:

The first is to remind you that crypto exchanges are not like other financial exchanges. They are nearly entirely unregulated and, as the FTX panic made clear, it can become a race to get your money out like an old fashioned bank run...only there is no physical bank to run to.

The second is to point out something that was obvious to many but ignored by a near equal number: there is no buyer of last resort in the crypto space. There is no central bank.

Both these points are both interlinked and have been obvious for months. We are not breaking any new ground here and we made the first one several months ago writing around crypto exchange Coinbase's terrible earnings.

But this is how financial crises work. You start on the periphery with the most vulnerable, over-levered and fraudulent schemes and then gradually work your way inside until you reach the core institutions.

We have reached that moment for crypto - the "Lehman Brothers" moment. The point in time where there is no (larger) buyer anymore and systemic institutions in the crypto world may be allowed to go bust.

It will take time to find out just how bad the losses (or fraud) of FTX and its sister trading house, Alameda Research, are but what is clear is that no one wants to catch the hot crypto potato anymore.

But here is the problem with all of this, this time:

At this stage, there are no government bailouts. For anyone.

Not for the billionaire owners like Sam Bankman-Fried and not for the far less owners of the coins in question.

FTX was registered in the Bahamas. There is no one to call. There is no way to get your money back or out or even find out whether it still exists. In that respect, this is very different from the Great Financial Crisis and the Lehman Brothers moment.

More importantly, whether or not FTX fails completely is sort of beside the point. The fact that it could fail is now abundantly clear and will throw a chill over the entire crypto sector possibly for some time.

Lessons:

Please be very careful where you keep your crypto assets.

Unlike regular financial exchanges, many crypto exchanges are both less regulated and also very opaque in terms of how they are structured.

Even for those that are more regulated such as Coinbase, you (and your coins) are a junior creditor.

For the final risk, one thing to note about this episode is you don't necessarily have to be a bad actor to cause mayhem or bad outcomes.

Sam Bankman-Fried may have done illegal things intentionally or by accident but that may not matter either way. The whole point of sensible regulation is not just to stop bad actors preying on innocent victims (the wolf vs sheep analogy) but also to provide guardrails to minimize the risk of accidents or unintended outcomes from people who, despite being intelligent and well intentioned, do not know what they are doing.

The story of FTX and its founder is not yet finished nor is it even ready to be written yet but one thing is clear, he has risked and likely lost billions of dollars through his own irresponsible behavior.

Regardless of his motives, that should matter.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.