China’s Techlash: The Case (and Consequences) of Censoring Didi Global

Is the "China trade" imploding? What does that even mean? And why does it matter? Most importantly, is this evidence of the Pebblization of global finance.....?!

Let's start at the beginning. Is there something wrong in the Chinese economy?

Last week, we mentioned almost in passing that there were growing concerns around China's economy and that the Chinese government stimulated the economy. They did so by cutting something called the reserve requirement ratio (RRR) for all Chinese banks.

Surprising fact: the Chinese authorities are now as lenient toward the banks as they have been since 2007....

This gets pretty technical but the key takeaways are that:

The government is allowing Chinese banks of all sizes to lend more money.

The banks will obviously comply because this is how they make money which injects more money into the economy and provides more liquidity for it to grow.

Big picture, China is starting an "easing cycle" in their monetary policy and making it easier for a sputtering economy to grow.

This surprised some observers and suggests that maybe all is not well in a country that supposedly beat Covid-19 handedly and has been relatively open all year.

Past history suggests that these cuts do not occur a) alone and b) if things are going well. They are often accompanied by other more serious measures as well which can stimulate the economy and lead to a bounce in asset prices.

We can cover this in greater detail in future weeks, if interested ->

Didi Global:

Meanwhile, the China story getting the lion share of headlines was the sudden and very serious government crackdown on the Chinese tech giant, Didi Chuxing (or Didi Global in the US). It is ongoing but so far:

The Chinese government has seriously sanctioned the ride-hailing giant over data protection and cyber security issues.

It went as far as to ban the company from acquiring new customers which meant it - and other companies - had to pull the app from app stores (welp).

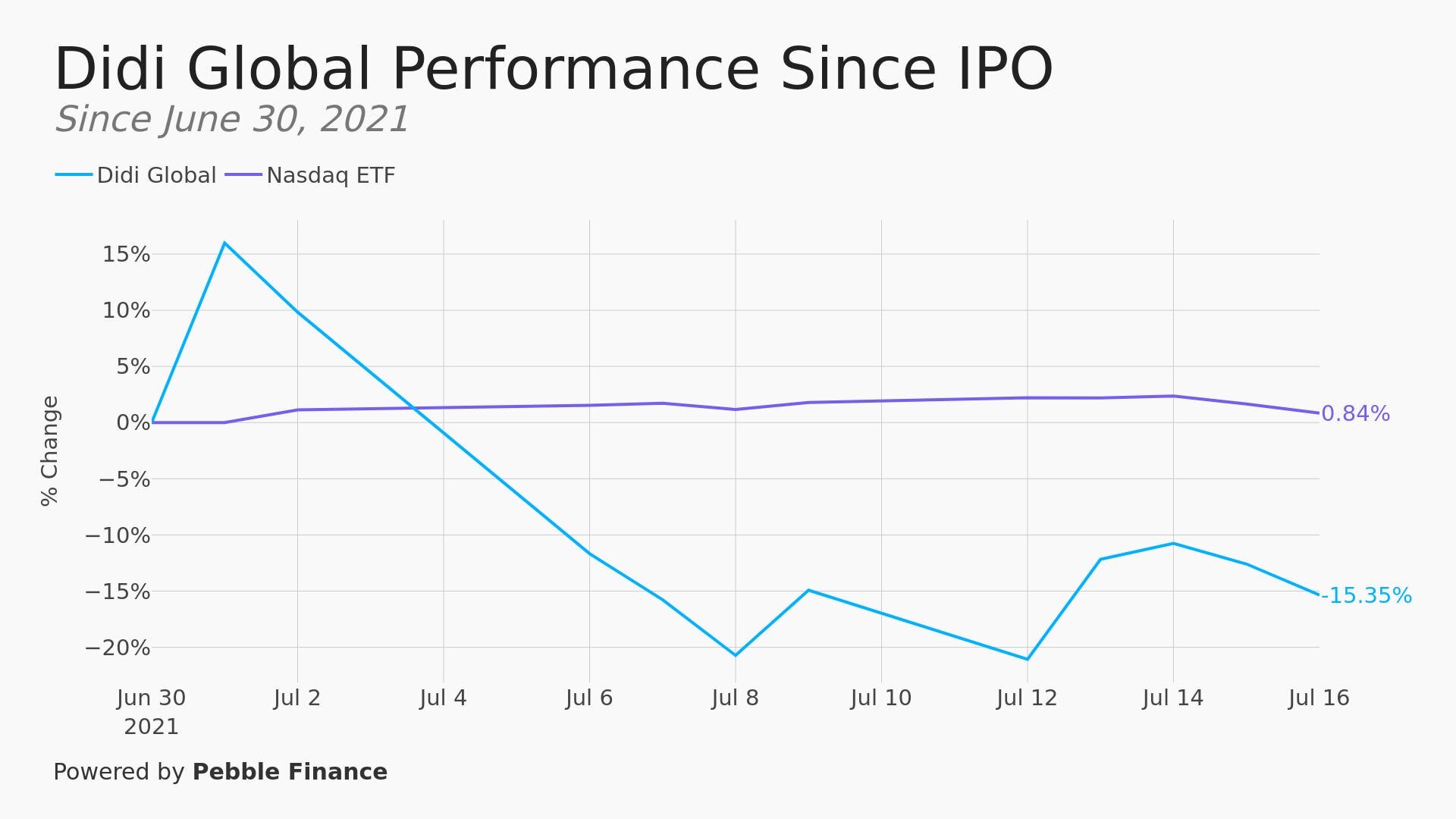

Not shockingly, this has hammered the newly IPO'ed Didi stock.

This episode now joins others in a serious trend: the canceled Ant IPO, the record antitrust action against Alibaba and plenty of smaller investigations including, most recently, a similar probe into the Didi Chuxing of trucking.

The obvious thought occurs: Who will be next?

There is a lot that can be said here but maybe the simplest is something some wise folks have talking about for years:

If forced to choose, the Chinese government will always choose political control over economic growth.

The Chinese regime's equilibrium about that tradeoff is clearly shifting rapidly in favor political control. What is often euphemistically termed a "corporate governance" campaign might be better termed a growing unwillingness to allow a corporation to grow to a certain degree of power (and therefore rival the state).

More slippery still, there might also be a prohibition on any company having data that is not also available to the Communist Party. If true, this would be a seismic change for many business models.

In conclusion:

This creates a nasty challenge for investors with a scary long term implication to reflect upon:

If China optimizes for political control rather than economic growth, especially around data security, then inevitably its tech champions will struggle to fulfill their potential.

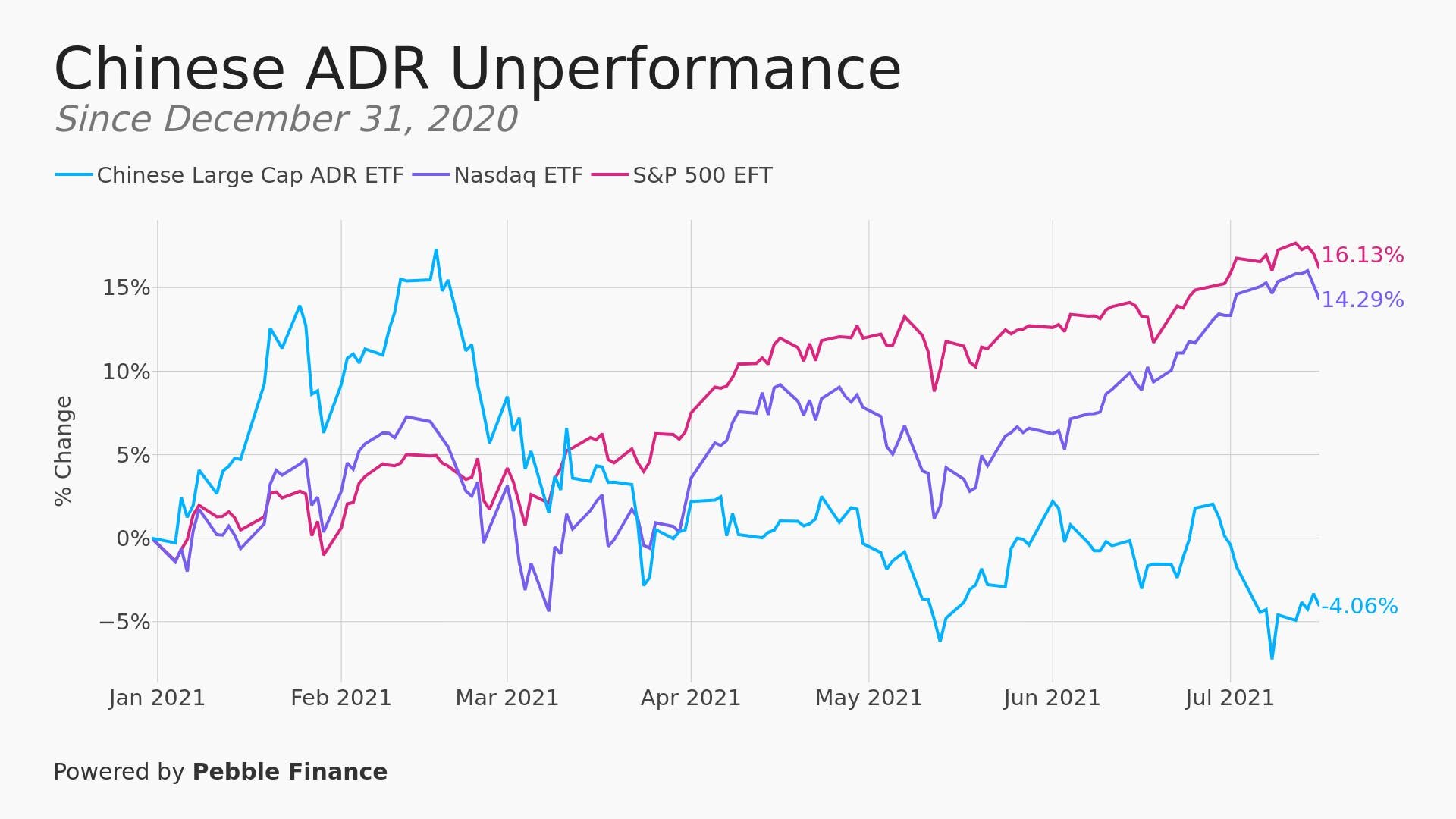

There has already been a serious underperformance from US-listed Chinese stocks (known as ADRs).

Furthermore, what if this is not just about asserting domestic political control but also about removing Chinese companies from relying on (or even being a part of) the (US-led) global financial system?

This is a chilling thought. There has long been a symbiotic relationship between the US (and the West) and China.

There have always been negative consequences of this relationship but increasingly it seems as if rather than trying to resolve those issues, we are instead simply opting for decoupling (or unstitching) a very valuable relationship. What if index providers start stripping out Chinese ADRs, Pebble style?!

It is extremely unclear that reversing economic integration will lead to greater political comity. In fact, the very opposite is likely true.

That means less economic growth for American capital markets, Chinese companies and, of course, those who invest in them. It might be even worse for those who want less great power competition.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.