What’s behind the ESG label?

Product Labels - A Consumer Problem

Every Saturday morning I step into my local Trader Joe’s and am immediately faced with the most important question of the weekend; organic bananas for 29¢… or regular bananas for 19¢. It wasn’t too long ago that farmers and grocery chains figured out that slapping the word “organic” on their products could command a premium price from the growing trend of choosy shoppers. It wasn’t until the 1990’s that a public outcry triggered the USDA to step in and set some clear rules (and penalties) for what farming practices are indeed considered organic and thus regulated the usage of that label. We as consumers are all better today because of this.

ESG investing is in a similar spot today as organic foods were during the late 80’s. Like “organic”... “ESG” is a label that you can slap on a product (like an exchange-traded fund). ESG-flavored products tend to command a premium price over their non-ESG counterparts from the growing trend of choosier investors. However, we are not at the point where there is a clear and/or agreed upon definition of what “ESG” actually means yet we see this label appearing everywhere!

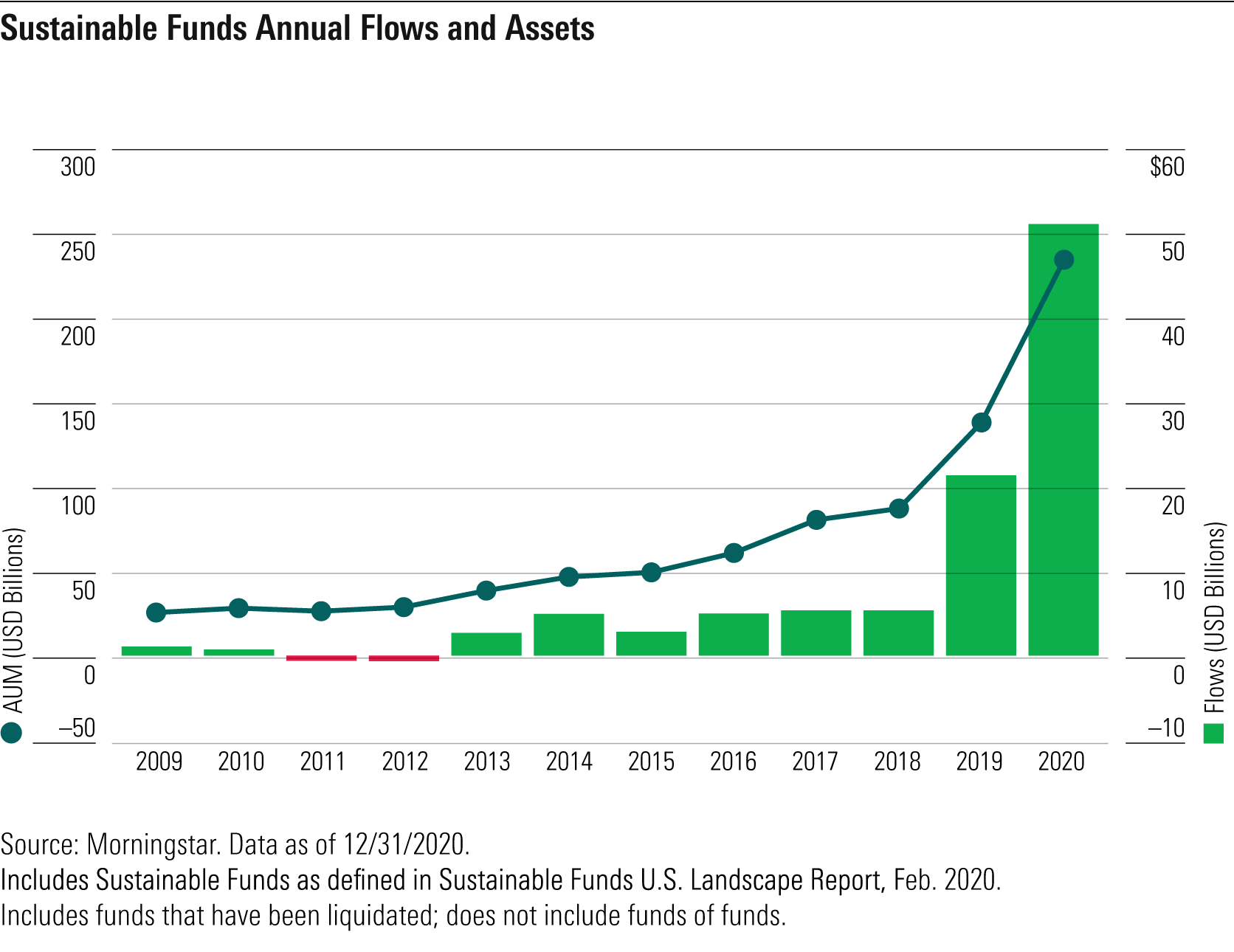

We aren’t talking 29¢ bananas here. In 2020 alone… over $50 billion (yes, with a “B”) flowed into ESG funds bringing the total to over $250 billion invested. Wall Street is doing what Wall Street does best. It sees a growing “values-driven” investing trend and responds by manufacturing new products attached with the ESG label to sell into that trend. Boom, that’s how you make money!

In 2020 alone… over $50 billion flowed into ESG funds bringing the total to over $250 billion invested.

Reading Through The Marketing Hype

This is not to say that ESG funds are bad and/or a complete marketing scam. For those that want to invest with a tilt towards “sustainability”... they are perfect. But… understand that it’s a “tilt” and even if you are an “ESG minded investor” those ESG investments probably aren’t doing what you think they are doing. So do some due diligence before shelling out a higher fee for an ESG product.

How? Almost every ETF will have a web page that lists its fees, the amount invested and the holdings within it. If there is no web page for it (well, that’s a warning sign) try to find your information on an aggregator site like ETFDB.com.

The fee’s are pretty self explanatory. It’s a % of your money that will get taken away behind the scenes each year and covers the operation of the ETF. Most of the ESG ETFs that exist today are a specific flavor of “passive index”. So the fees should be low (less than 0.25%) but you’ll see that most ESG ETFs are still at a premium compared to their non-ESG counterparts.

“Size of fund” (often listed as AUM) is important because small funds can go belly up. This doesn’t mean you will lose your money but you will be liquidated to cash and forced to pay taxes on any gains. If you are doing due diligence on an ETF fund and it’s smaller than $250 million in AUM… you might want to look elsewhere unless this fund is backed by a big fund manager like Blackrock, Invesco or Vanguard. This is a common thing to look at in ESG fund because they are so new and there are so many… most of them are fairly small.

Now, onto holdings. This is the most crucial part of ESG ETF research. ESG funds, especially ones that track stock market indices like the S&P 500 do this by filtering out companies that don’t pass an ESG threshold. The main problem with ESG investing is that the meaning “ESG threshold” is pretty darn subjective. Just like there are a growing number of ESG ETFs entering the market each day, there is also a growing number of data providers shilling “ESG scores” so that fund managers can draw that line in the sand. There is no such thing as a standard ESG score.

To show how I look at ESG ETF holdings… I’ll walk through the exercise going through two ETFs from Blackrock iShares; IVV and XVV. I’ll collated the holdings of IVV and XVV in this Google Spreadsheet so feel free to look at the raw data!

Let’s Dig In!

The most popular stock market index in the world is the S&P 500. This index tracks the 5 largest publicly traded US companies. Flip on CNBC, go to the WSJ… it’s hard to miss. Being the most popular index has also made it one of the most popular ETF (exchange-traded fund) investment choices.

One of the many ETFs that track the S&P 500 is a ticker called IVV. This ETF product was created by Blackrock iShares back at the turn of the century. When you, an investor, buy some IVV the fund in response will effectively purchase a little slice of 500 companies. The fee you pay Blackrock for this pleasure is 0.03%.

XVV is a relatively new kid on the block being less than a year old. It is very similar in construction to its big brother IVV… however XVV is the “ESG screened” version of it. This means that some of the 500 companies that are contained in IVV are eliminated from XVV because they didn’t pass an “ESG threshold” of some sort. What is the price of this premium product you ask? 0.08% for XVV vs. 0.03% for IVV.

So beyond fee, what do you expect to be different about XVV?

Many people, when they think of ESG investing, they think of climate change. The most vilified companies contributing to climate change are the fossil fuel companies. There are 22 fossil fuel companies in the S&P 500 (and thus IVV). While XVV has screened some of those companies out… it still contains 10 of those original 22! Big names like Exxon and Chevron are gone. However companies like Marathon, Phillips 66, Valero are all still in there. If your opinion is that an ESG ETF should not contain any fossil fuel companies… well you are going to be sorely disappointed.

A close cousin to fossil fuels are consumer companies that pump out a lot of plastics (which, well… it’s made from fossil fuels and ends up in landfills across the globe). As you might expect an ESG ETF such as XVV successfully targeted plastic producers like 3M and Dupont. However, those companies which are responsible for putting plastics into our hands (Pepsi, Coca-Cola, etc)... are all still part of XVV. So if a requirement for a sustainable portfolio to you is “no plastics” you are again falling a bit short.

Not all ESG investors weigh the environment so highly. Some are more concerned with society and social concerns. As an example, tobacco companies are generally not well regarded when it comes to being good for society. The two Big Tobacco companies in the S&P 500 are indeed stricken from XVV. While XVV is supporting healthy lungs… it is not really expressing much for the heart disease and obesity problem in the US. Again, just as an example… McDonalds and every other restaurant chain in IVV is also still a part of XVV. Why did they make the cut? Are you passionate about animal cruelty? Every single company embroiled in animal testing controversy (Estee Lauder, Walgreens, Proctor & Gamble, etc) passed the “ESG test” and sits firmly in both IVV and XVV.

To some, this ESG ETF might be far from perfect. But don’t blame Wall Street for trying to pull the wool over your eyes. ESG ETFs are a step in a positive direction. The problem is each and every person has a different definition of what “perfect” means. Wall Street simply doesn’t work like that because they only know how to make “one-size-fits-most” products for “one-size-fits-most” crowds.

What Can We Do?

When you dig on your own, how well does IVV or XVV fit your expectations? Pebble is changing the way Wall Street works for us. With Pebble we made it fast and easy to custom tailor any ETF into that perfect fit. Find us in the app store and create your perfect investment!

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.