Ben & Jerry's - Sticky Situation: Direct Indexing Use Case I

Ben & Jerry's Ice Cream created a classic social media firestorm this week when it announced on Monday that it was terminating the license of its Israeli affiliate.

In a single stroke, the beloved Vermont brand put its parent company, Unilever ($UL), in a serious jam and underlined a perfect Pebble direct indexing use case.

Details:

Ben & Jerry's was purchased by Unilever in 2000 and is a wholly owned subsidiary but with a formally independent board.

This unusual acquisition agreement was undertaken by the Dutch conglomerate with the hope of protecting the "soul," and integrity and the famously purpose-driven brand.

Now, however, after years of mounting social media pressure and a deteriorating situation in the Holy Land, the ice cream company has signaled it is ending its relationship with its current Israeli licensee.

This move was backed by the company's independent board effectively ensuring that Ben & Jerry's is boycotting Israel in all but name.

Their unilateral action has forced Unilever to a) try and muddy the waters be releasing its own statement b) declare unequivocally and very publicly that it is not boycotting Israel and c) attempt considerable fire fighting behind the scenes in both Israel and the US.

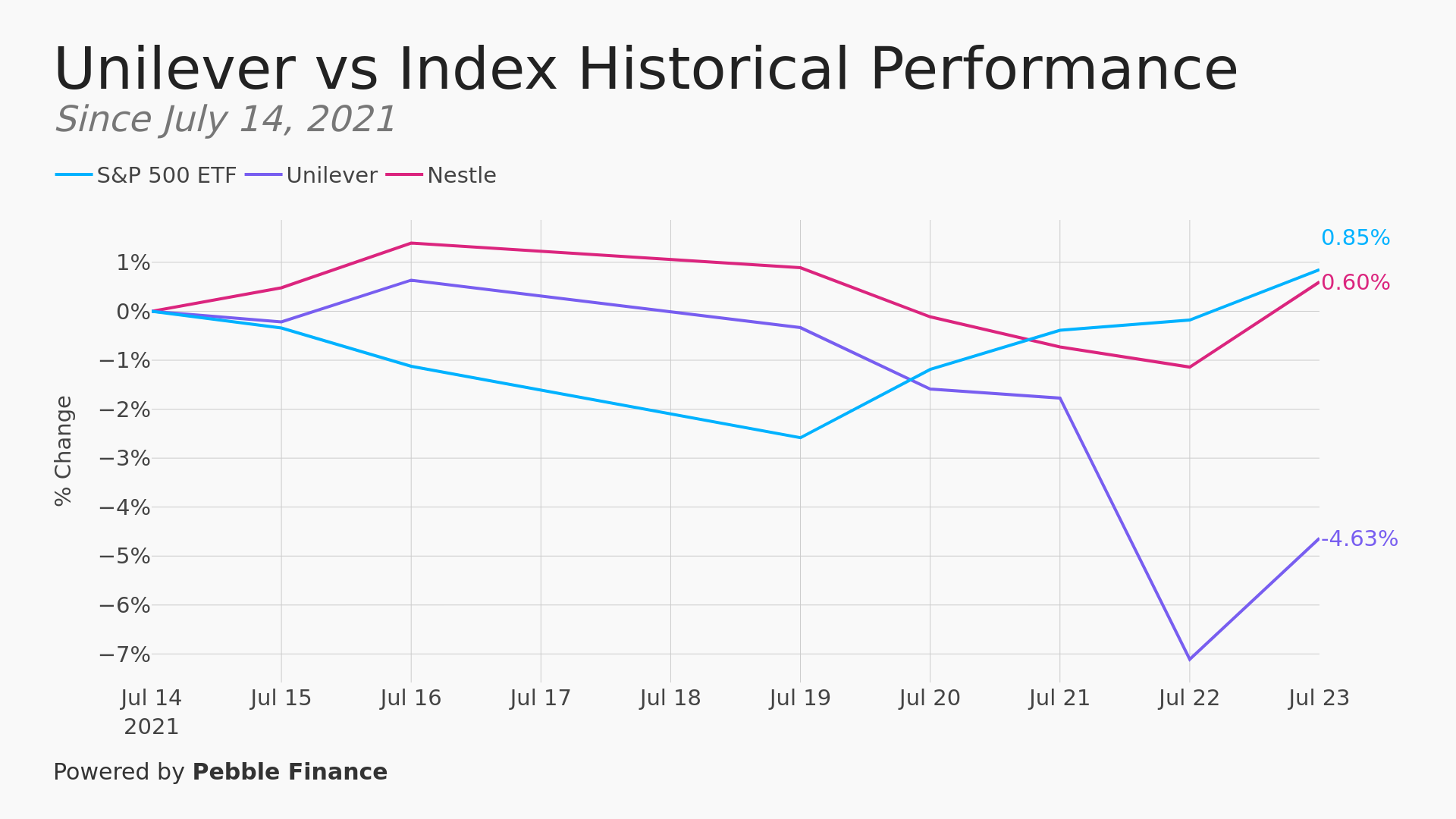

Unfortunately for its investors, it didn't help much: Unilever stock had a terrible week even as the market did rather well.

Unilever's Options:

The sticky situation for Unilever isn't just one of angering Israel or forcing it to make a choice it would rather not make by either endorsing a boycott or attacking its own brand's policies. That is actually the easy part.

The real issue are twofold:

It can't put the proverbial boycott toothpaste back in the tube nor can it easily overrule the Ben & Jerry's independent board. The Dutch consumer giant could easily set up a new arrangement in Israel but the independent board would need to vote on it. Tricky.

More importantly still, there are 33 US states that have passed legislation forbidding boycotts of Israel and some have forbid their pension funds from investing in companies that do.

Other states have laws on the books that say that no procurement can be done from companies that boycott Israel. That may not matter much for Ben & Jerry's but it would matter extremely for a mega-conglomerate like Unilever.

There is also the matter of a very angry US politicians in both major parties and Israel itself......

Pebble Use Case(s):

This Ben & Jerry's / Unilever thorny situation is exactly why we founded Pebble Finance.

It presents two possible responses from you, the investor:

An emotional one: You might deeply care about companies boycotting Israel - positively or negatively. Consumer goods companies leaving Israel might deeply anger or satisfy you and you might like to have those deeply held values reflected in your financial portfolio. Pebble makes that possible.

A practical one: Perhaps more significantly and certainly less appreciated is the fact you might be very uninterested in owning a stock impacted by an incipient and major, value destroying controversy.

Regardless of your own feelings or values about the situation, it is hardly rational to own the stock of a company so deliberately choosing to harm its business.

The fact of the matter is that thanks to Ben & Jerry's unilateral action Unilever now risks considerable:

Expensive and very public litigation both for the ice cream maker and its Dutch-based parent that may drag on for years.

US institutional investors pension funds possibly forced to sell Unilever stock and public and private boycotts of the company.

At a high level, the conglomerate is embarking on a major dispute with not one but two powerful states (Israel and the USA).

If this is the future for one of the most famously likable consumer goods brands then you might want to consider changing your financial relationship with Unilever the company.

You do not need to pick a side. You can simply not be involved.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.