2024 Theme: Utility Stocks Finally Have Their Moment

One of our earliest 2024 arguments was the new utility of the Utility sector.

It has been awhile so as a reminder, we made three inter-related arguments at the time.

In our estimation utility stocks were:

Boring but safer investments if economic growth reversed.

The companies were also great bond proxies if you wanted to protect yourself with bonds but not actually buy bonds.

The sector was also less expensive than the big and sexy "AI" tech names and yet, we argued, could benefit from the "AI" theme.

So the summary was that utilities are typically very boring, stable revenue generating investments. But right now, what made them dull could also make them attractive in 2024 for a few reasons. We were pretty proud of this pitch, if we are honest.

That pride was our first mistake!

We made this case in the very first week of the year (you can read that here) and then, in classic investing fashion, absolutely nothing happened.

Utilities underperformed the market in January and then, incredibly, did far worse. The sector began to sell off in February and most of March.....

It was a classic financial advice outcome: you suggest something could be a decent investment only for the exact opposite to happen. And then your patience is rewarded by even worse performance. That is financial markets for you. You may struggle to believe you are wrong but that doesn't make you right!

Or, to paraphrase President Harry S Truman: If you want a friend, get a dog!

What made us so incredulous was that our argument seemed to be coming true. Expectations around growth did moderate some. The AI theme kept going and utilities monopoly position certainly meant that many of them were well positioned to benefit massively from the increase in energy demand.

And then just as we were beginning to think we were going to have to pen a terrible mea culpa on this subject, the Utility sector suddenly took off like a rocket ship.

Just recently:

The sector as a whole is up over 12% in the last month.

After underperforming most of the year, the sector is now (slightly) outperforming the broader index in 2024.

Three of the best stocks this year thus far are super boring utility names: Vistra, Constellation Energy and NRG.

You can see the catch up (and the earlier suckage) right here:

A lot of the focus on these three companies and the broader sector has been on the AI theme that we and everybody else have covered in depth.

This is completely deserved. The AI boom is leading to a boom in demand for power generation to service the new (and existing data centers) that run on new processors and types of chip that need exponentially more than the more traditional cloud computing center.

We have written about that directly several times (here and here most recently). It would seem as if many investors have suddenly come alive to this theme. That is why you have Vistra Energy up over 146% this year!

140%+ is easily outpacing even the AI kingpin itself, Nvidia. That demonstrates the "catch up" factor going on here. Better late than never!

What is less appreciated however is that there is an overall boom in electricity demand across the country. There are multiple factors going on here.

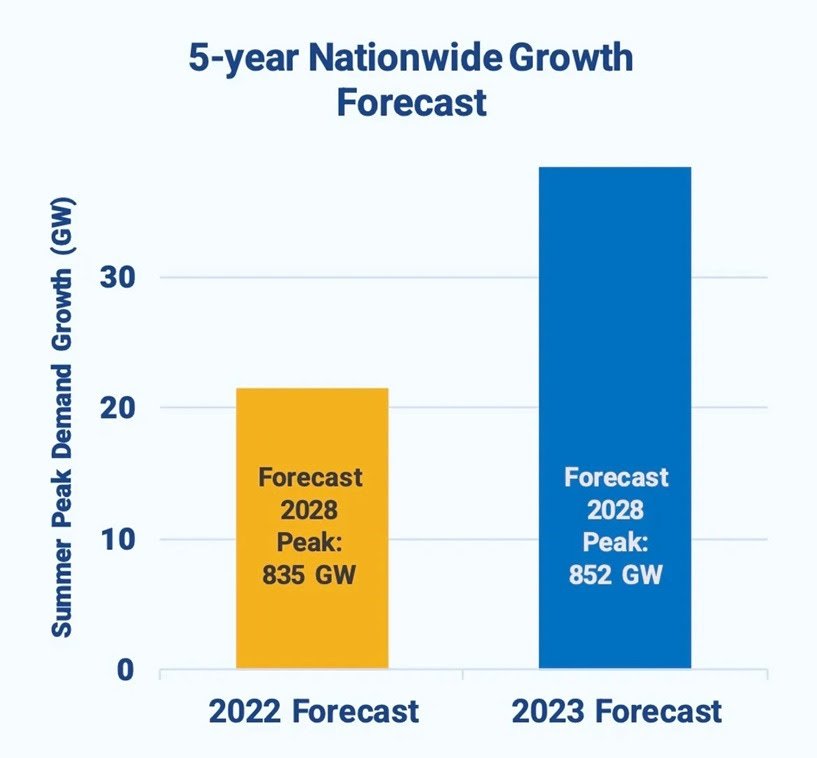

We have posted this chart before:

This shift isn't or even mostly anything to do with AI. Artificial intelligence is a very strategic but otherwise extremely niche portion of overall GDP.

The economy is still growing strongly for one. A robustly expanding economy is one of the best predictors of electricity demand.

We are also building many new facilities that are not data centers and yet require considerable power. These run the gamut from new manufacturing plants for electric vehicles to new domestically located semiconductor plants and other types of manufacturing facilities.

It is true that the US taxpayer is, in nearly all cases, paying for this to occur via subsidies, tax credits and the like. And yes, we think that will be a mistake over the long term but in the meantime, those new factories still need power. Not just that but factories are very intensive users. They require far more power than most service based industries.

"Build, baby, build" is the mantra for now and that has real world consequences for the US energy grid.

Lastly, we wonder if one the reasons utility stocks are doing so well is the fact that they are measurably cheaper relative to a lot of other sectors out there?

2023 was a great year for stocks. 2024 has already been another strong one (the market is up around 12% which is already a very healthy annual return). All of this means that many investors will be both looking for cheaper parts of the market and also, be wondering about downside protection if anything goes wrong.

The utilities sector is, at the time of writing, one of the only sectors that is considerably cheaper than the broader market.

So, utility companies simply tick a lot of these boxes. Two years ago we wrote that Nvidia was the answer to nearly every single question about the AI boom. Their monopoly position and ability to supply shovels to artificial intelligence gold mining technology companies meant they would win no matter what. This allowed them to print unholy profits and also attract massive investment inflows.

Today we look at Utilities and wonder if they could be in a similar type position going forward. Despite being boring, safe, dull, dividend paying slugs of companies they are also quasi-monopolists that are now being asked to rapidly ramp up their businesses and re-electrify broad swathes of the economy that have traditionally run on fossil fuels.

Their businesses are expanding and their profits are up from some very price insensitive buyers ("strategic" and subsidized factories and data centers).

The US state is even making it easier for them to build new capacity (see today's intro). That makes them nearly unique!

Even better yet, if economic growth does slow for some reason, then Utilities are also well positioned to outperform the market. The only risk scenario for the sector is the one we have written on to death: the threat of higher interest rates. THAT is what you want to keep foremost in your mind if you are buying this sector.

For a long time, everything was coming up Nvidia. Could everything now be switching to some of the most boring companies in America? Utilities?

Either way, they are not the only major energy provider looking to benefit from a switch. Utilities are also not the only thing coming up American.