Pebble Forever Theme: The Coming Electricity Crisis

Inflation isn't the only challenge staring the US in the face. In fact, the focus on inflation may be obscuring a deeper and more intractable problem for the American people and economy.

Slowly but surely the US is coming to terms with the fact that it is facing an energy crisis.

Not an energy crisis just in the sense that there will be higher prices with attendant economic (and political) consequences. We covered that possibility last week.

Rather, the US economy and society are increasingly caught in a vice between higher demand on the one side and underinvestment and poor policy decisions on the other.

This incipient crisis could hamper not only economic growth but also economic productivity.

This crunch creates something far worse and consequential than the threat of a simple spike in energy prices. It creates the potential to damage the economy and scramble our (already clumsy) attempt to save the climate. It is a two-for-one from our nightmares.

Bad energy policy and how to avoid its costs and take advantage of its opportunities has been a constant theme of this newsletter. The silver lining is this crisis is becoming mainstream. The bad news is that this is happening because things are becoming worse.

Two headlines caught our eye recently:

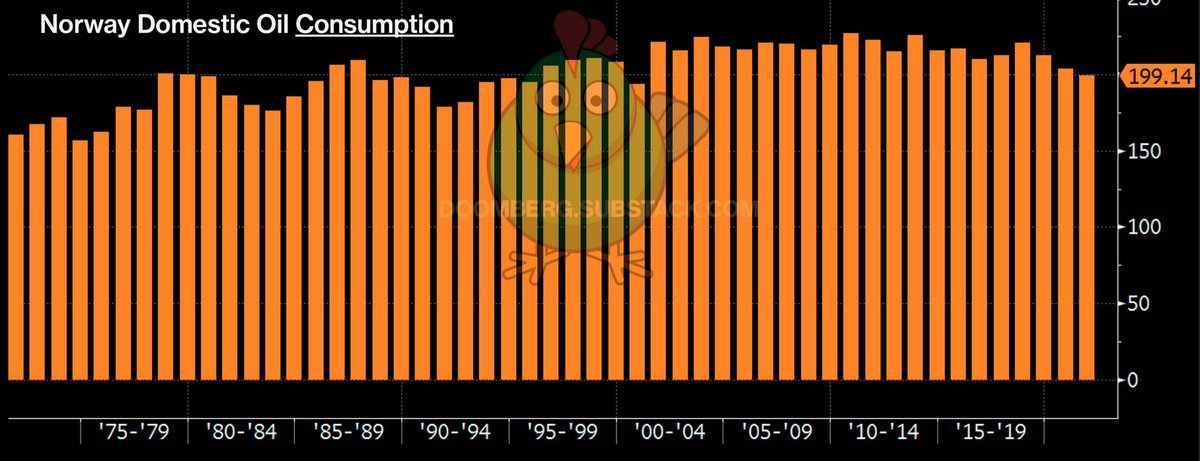

Norway's oil consumption continues to remain roughly flat despite the world's highest rate rate of EV adoption.

After years of stagnation, projections for U.S. electricity demand growth over the next five years has suddenly doubled from a year ago.

Important to note here that this is demand growth, not overall demand. What this means obviously is the pace or rate of change of demand for new electricity has suddenly leapt upwards.

Here is the sudden leap in peak US energy demand from the above report:

Here is a chart on the Norway problem:

The Scandinavian country's consumption is down but only very slightly.

Put these two together and they challenge some of the biggest assumptions about energy use in the 21st century. Namely that fossil fuels will be a thing of the past and also we will be able to supply

These are some big questions!

The answers as to why these two developments are occurring should be no surprise to regular readers of this newsletter:

We have already written about the (new) boom in data centers spurred by artificial intelligence and how suddenly a lot of places are finding it difficult to serve any new centers with enough energy.

But that isn't all of course. The large subsidies for both electric vehicles and also certain types of manufacturing facilities - including semiconductor chips and also electric vehicles - also require tons of (more) electricity.

This was unexpected and is leading to rapidly higher estimates for just how much the US energy grid will have to provide to the economy.

This is exciting, from one perspective:

More investment! More jobs and just as importantly, hopefully more productivity. The politicians brag about the jobs but it is the productivity that is the real prize. Do more with less.

As Paul Krugman famously said:

“Productivity isn’t everything, but in the long run, it’s almost everything.”

Productivity is how economies get richer over time. If you can sustainably boost your productivity then you can seriously change the trajectory of your country's growth. It is quite literally the holy grail.

The challenge, of course, is that you have to take advantage of of your opportunities. And ironically, right as this surge in energy demand is coming down the road we have suddenly made it nearly impossible for even hard working Americans to supply it.

According to an important new report this isn't going well. The evidence is overwhelming and very disappointing.

Only ~21% of power projects (14% of capacity) requesting connection to the grid from 2000-2017 reached commercial operations by the end of 2022 (!).

These numbers are actually helped by fossil fuel projects. Completion rates are even lower for wind (20%) and solar (14%).

Building transmission lines for new - often distant - solar or wind projects typically takes 10-12 years. That is four times the length of the Manhattan Project, for context.

The average time projects spent in queues has also increased markedly. The typical project built in 2022 took 5 years from the interconnection request to commercial operations, compared to 3 years in 2015 and <2 years in 2008.

This excellent if depressing report has plenty more detail, if you are brave enough to handle it.

The simplest conclusion is that the US economy is going to start running out of reliable energy to fund new growth, no matter how vital these projects may be. This is already occurring. One EV battery plant in Kentucky has already had to turn back on a coal station slated for closure because there is no other spare capacity.

More broadly, coal is having a wider renaissance.

The larger picture is similarly tough: the U.S. power market has been tightening for seven straight years.

CBRE, a commercial real estate firm, has a new report out on data power demand and constraints. There is all time demand for new capacity but the wait time for power is leading to delays of between 2 to 6 years for most projects for one reason or another.

Part of the issue is how many reasons are delaying things. Environmental reviews here, state regulations there, federal permitting all over, you get the picture.

Here is a quote from the summary of that report that brings together two of our themes. It is by Gordon Dolven, director of Americas Data Center Research at CBRE:

“Reliable power is a top priority for many data center operators and technology advances will increase this need going forward....New development is occurring across all regions despite limited power availability, yet large occupiers are finding it difficult to find enough data center capacity, giving impetus to emerging markets that have robust power supplies.”

So, we have a classic issue whereby demand is suddenly leaping ahead of expectations while we are hitting issues with supply and challenges from our creaky grid. Some of the latter in particular are avoidable and therefore "own goals" which is particularly egregious since the US is the richest and most technologically sophisticated country on the planet.

Only time will tell there but we are almost certainly going to hit a serious issue somewhere because this might be manageable in a flat economy but it simply unworkable in a world where demand leaps forward by

What to do about all this?

The first is to be frustrated. We should be able to do much better.

The second is to hope for sanity on the permitting front and overall energy grid improvement after this election year. We won't hold our breathe. Does either major party or nominated candidate care about this? Or even understand it?

The third might be reluctant acceptance. This is simply unlikely to change any time soon.

That is the true crisis here. We are capping what is possible for the US economy and harming our ability to make productivity enhancing investments to reach our maximum potential.

In that respect it will be a mostly quiet crisis. There won't necessarily be dramatic events or headlines. We will just grow less, be less productive and, overall, do less.

So, the sad summary is that the scope and reach of a 21st century technology and the productivity advancements will be curtailed by a poorly functioning 19th century technology.

Sad!

It may be more than just sad but it shouldn't be a surprise....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome. You can also get our newsletter as an RSS feed.