2022 Theme: What To Own? - Rare Earths

Keeping with our theme about what to buy in an era of high inflation, rising interest rates, and falling growth, we would like to turn your attention to rare earth minerals.

What the heck are rare earth minerals?

They are a group of 17 distinct elements and minerals that are widely prevalent around the world but also essential for many highly sophisticated technology products and related industries.

They may not have the cachet of gold, the strategic value of oil or the economic symbolism of iron ore or copper but rare earths are important nonetheless. They are a very small but essential ingredient in everything from military hardware to sophisticated semiconductors to fuel cell batteries, wind turbines, lasers, and beyond.

A good and brief list can be found here.

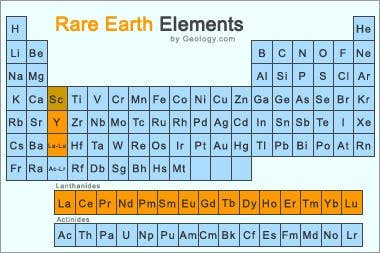

And here they are in the table of elements if you care to think back to high school chemistry:

They do exist!

It is quite an impressive feat to be both everywhere and yet almost totally invisible and unknown.

Why own them?

After decades of not realizing how essential rare earths are for our modern and highly technological economy and economic security we have suddenly recognized their significance and our economic dependence on them.

Critically, our realization is centered around both our economic vulnerability and their strategic importance.

If it wasn't both of these factors intertwined then what follows wouldn't be the case.

This double insight is causing countries around the world to make commitments in both rare earth mining and refining. In the same way that military budgets are rising around the world, so are strategic investments in rare earth and mineral projects.

The thesis around all of this is pretty simple: invest where the government is spending money because, increasingly, it is the only game in town.

When it comes to how they will practically accomplish a better rare earth supply chain, ideally, countries want multiple sources of supply.

The reasoning is pretty simple: ensure a steady supply and add resilience to your economy's supply chain without having to worry about a single point of production.

The secondary aims are to reduce worrying about international trade flows, strategic rivalries or shifting alliances.

Background:

Now, it is true that this isn't exactly new. In fact, we are old enough to remember when this first became "a thing" back in 2010-11 when China suddenly began restricting exports to Japan.

This raised Japanese fears to a degree where they have been investing in a distinctly Japanese rare earth supply chain for years now. Nothing like being an island nation heavily dependent on imports of raw materials to properly "get" what is at stake.

Why does this matter?

Well, as with other quietly key industries (prescription drugs, PPE, steel, recycling etc) China has quietly come to dominate the rare earths industry over the last few decades. The cause is generally the same: a combination of cheap labor and relaxed regulatory oversight means that the country has been able to gradually gain a stranglehold over something that has significant strategic significance.

As every single piece of analysis will remind you, the issue isn't that rare earths are actually rare. Rather, they are widely available but difficult to mine and even harder to refine.

Perhaps the best way to frame the current predicament is the US has very few mines and zero refining facilities at present.

This isn't too surprising on some levels. It is a nasty, polluting, difficult business and, as was common with many other such jobs, the West has preferred to let China handle it and, over time, forget they are even happening.

It was greenwashing long before there was greenwashing! Impressive.

All of this is now changing.

And it is leading to a verifiable bonanza. The broader West is getting back into the rare earths game in a major way. The US - and more specifically the Pentagon - has just made its second major investment with an Australian group to build the second American refining facility.

This follows a February announcement of a similar, smaller facility to be built by MP Materials in Mountain Pass to mine and refine the especially critical heavy rare earths. This deposit is supposed to the among the world's best and it will now become the center of a new mining AND refining complex in America - and in California no less!

That Chinese dry run versus the Japanese was actually quite helpful because it highlighted the real risk involved and also, of course, it has provided a playbook to follow.

The challenge, as with many of these things, what to actually buy. MP Materials and Lynas, the Australian firm, are publicly traded but are obviously just single companies and we are loath to advise them.

But the key is less about the individual companies involved and more about the government support.

And that support gets to the heart of the matter. Over time more and more rare earth mineral ETFs, funds and other - hopefully low fee! - products will come into existence. Some already do though we would be very careful about what is in them and how they are structured.

But the mining industry in general is already very deep and newly very popular, not just with investors but also governments. Whether it be the need for titanium for space, copper for EVs or rare earths for, apparently, everything, owning some of the general low fee mining industry ETFs might be very wise.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.