Why Company Earnings Is More Important Than Inflation At The Moment

On Thursday January the 12th we had another occurrence of what we have repeatedly referred to as the most important data point out there right now:

US inflation.

But rather than cover with both great fervor and serious focus as we normally do, we would instead like to actually shift our attention to a different topic entirely:

US corporate earnings season.

Why?

Two reasons:

Inflation has been covered in depth in these pages and elsewhere.

The data this past week was both bang on expectations and also continued the trend of slow moderation.

You can see both trends right here:

Big picture inflation continues to recede quickly. In fact, annual inflation has slowed for 6 straight months.

Additionally, we got a new low in jobless claims (people filling for unemployment insurance) which further underlines that the labor market remains strong.

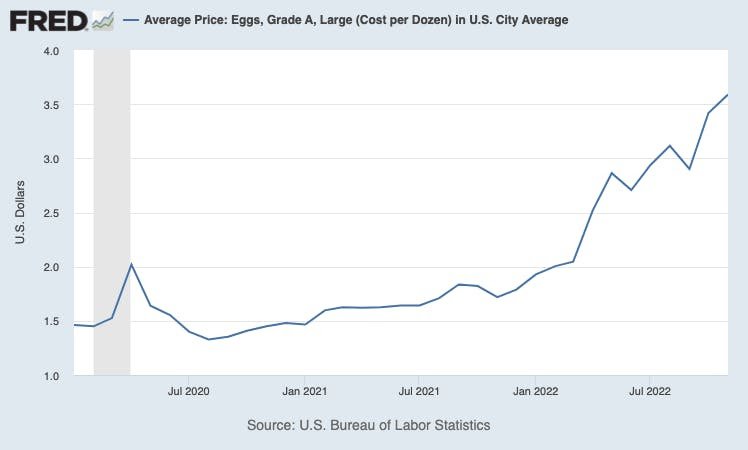

There are exceptions to this trend, like the ridiculous inflation in the price of eggs (reason: bird flu) at the moment:

And while we we could always get another jump in prices - Putin! Covid! Supply Chain! Alien Invasion! - all of this means that inflation is rapidly becoming yesterday's problem. Financial markets are the ultimate in fickleness. Everything is inflation, inflation, inflation one minute and then its suddenly like it was never "a thing" in the first place.

But overall, while there is stuff you can say that is both a) interesting and b) arguably important we:

Have sort of said it before

And it is (finally) declining in importance.

If interested, you can find our recent work here, here and here. None of those arguments have really lost importance, especially those surrounding the big risk in the months ahead:

This is simply that we need inflation to come down without harming economic growth overly and while the probability for this "soft landing" has been steadily rising there are still plenty of arguments that a recession could be incoming.

On the latter, this declining significance is obviously wonderful but it is dragging speculative attention elsewhere and creating interest in other questions.

One area that is rising in importance is what will happen to corporate earnings?

Why are earnings important?

Well, first of all, it is timely. Earnings season began in earnest on Friday with the first of the major banks reporting their fourth quarter numbers.

The means that the vast majority of big company's fourth quarter's numbers will come out in the next few weeks. They are also the full year results, of course. As such, these earnings reports will be both highly audited, heavily reported and also give a full accounting of the real damage done in 2022.

Second, there is the fact that company are a great insight into the growth part of the 2 part equation listed above. We are becoming more confident about the direction of inflation but the big remaining questions continues to be about whether economic growth can stay robust.

So, all in all, over the next few weeks we are going to receive a pretty good snapshot of both how many of the largest companies did in 2021 and how they are thinking about their 2022.

Understood. What is likely?

It is a bit hard to answer with confidence because inevitably this will be somewhat subjective. It won't matter so much whether earnings are judged "bad" or "good" but whether they are good vs expectations or not.

It is also across myriad industries, sectors, companies and even global vs national numbers. It can be tough to get your arms around all of this.

However, one possibly digestible and useful way to look at earnings is whether the damage from the Federal Reserve interest rate hikes was limited or not.

Why?

Well, long story short, when you have a period of high inflation and then to get to see:

-> interest rate hikes by the central bank which leads to -> financial conditions tightening then -> more expensive credit for companies and individuals (think higher mortgage rates) and then -> that tighter monetary policy flows through on asset prices.

But that knock on effect does so through a few vectors. There are two big ones:

The first vector that monetary policy works on is changing the relative attractiveness of certain assets.

For instance, when rates were effectively zero then there was not much point in holding cash. You got effectively zero return for holding cash. Therefore, there was a huge incentives to invest your money because "cash was trash" basically.

This made stocks very attractive and certain stocks exceptionally attractive. We have spoken about this theme a lot, especially as it relates to technology stocks. These are often termed "growth" stocks because while, generally speaking, they grow quickly but yield little to nothing in the present. In other words, they have very little profits today but they do grow very quickly and so they are ideal for an era where you can borrow cheaply in the present day and receive a payoff at some distant future.

As we covered last week, when you get 3-4%+ buying short term Treasuries, then suddenly high growth, low profitability stocks look much less attractive.

Throughout 2022 we watched the re-pricing of the value of the present value of the future cash flows or the ability of a stock to yield some value for investors (or not) today.

As a result, the FANG stocks, companies like Google and Apple and Netflix that were supposed to never lose money have suddenly become much less enticing when cash is no longer trash.

The second vector is where all the speculation is congregating right now:

2. The monetary policy tightening hurts the real economy via a general business cycle slowdown.

We don't just see the repricing of what is attractive because the relative shift in interest rates and cash flows. Rather, thanks to the change in credit conditions and the price of money we see real damage in terms of the actual economy.

The argument is that higher cost of credit and tougher financing will eventually lead to real businesses losing first their profits and later even, some revenue. Their businesses will stop growing or even possibly shrink. As a result of this businesses will understandably cut back. Some will even begin letting go of employees to keep their labor costs down. It is true that we have already seen a lot of this in housing, in technology and now, even, in financial companies like Goldman Sachs.

These newly let go employees will obviously change their own consumption patterns and the ripples will continue outwards throughout the economy and the country. One useful analogy might be to think of the US as a small town that loses a key factory that employs a lot of people when the cost of capital gets too expensive. Soon, regardless of whether they supply the factory or not, every business in starts to feel the repercussions from that decision.

So, this is the other shoe that has (yet) to drop. The relative attractiveness of certain asset classes changed in 2022. The big question for 2023 is: will the damage to the real economy be contained or will it create a real economic downturn.

This questions centers much more on Main Street than on Wall Street and for that reason will be keenly watched not just by investors but also by central bankers at the Federal Reserve.

And for good reason.

All of this is both very real and very serious. Tens of thousands of Americans have already been let go since the Federal Reserve lost control of inflation and had to start the fastest interest rate hiking cycle in history.

So far, as we have covered a few times, the broader economy has stayed robust. Businesses have kept hiring, losses have stayed manageable, job openings are still high etc.

But there is a lot of speculation that, essentially, at some point it won't. The argument is that the Fed will keep hiking because they are afraid of letting inflation rise again and the economy will crater.

We are very alive to this possibility but we aren't sure it is as guaranteed as some market commentators are arguing.

Why?

As we have stated before, the real fear around the job market hasn't yet materialized. All the evidence we have is that the economy isn't falling off the cliff.

It could in the months ahead but right now we have lower inflation and a strong labor market. That combo

We here at Pebble HQ are therefore watching all of this very keenly and are trying to stay very open minded about it. We could easily be wrong but as we pointed out last week, while there are lots of people arguing for negative outcomes, there is just precious little evidence of it....yet.

In conclusion, this earnings season is therefore a big one to watch. Yes, it is backward looking but it is also very detailed. Hundreds of companies will report in a very granular way about what they are seeing and also what they are planning on doing.

Stay tuned!

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.