Why Are US Houses Prices So Unaffordable Right Now?

You have to feel for the young, aspirational American house hunter.

Almost regardless of which type of home they are looking for or which region they are searching in or what their financial situation is, they will be having a very difficult time buying a home.

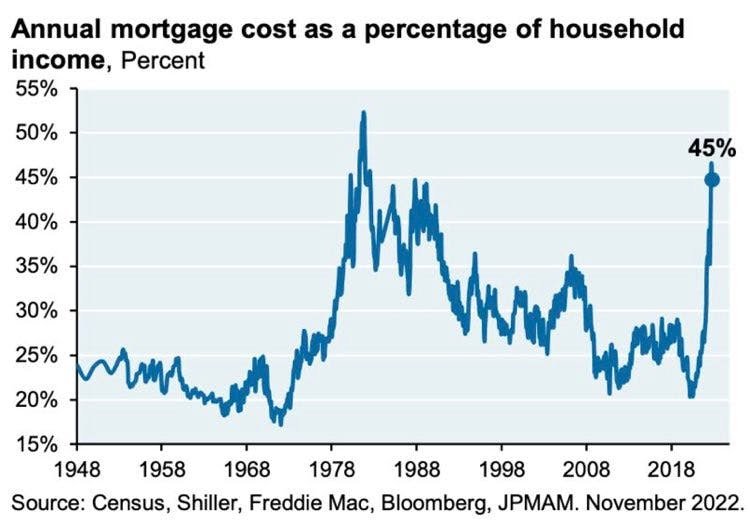

The issue isn't purely affordability though, make no mistake about it, that is a real problem:

This chart is pretty stupendous in the classical use of the word.

Now it is true that mortgage rates have come down somewhat (a 30 year fixed is now at ~6% rather than the 7%+ from the autumn peak) but as the chart reveals, the cost of your average mortgage is still prohibitive.

This newsletter has covered this phenomenon before: if the cost of a monthly mortgage payment has gone up by 2 times or more while wages have increased only 4-5% then something has to give - either house prices have to come down or far fewer houses will be sold.

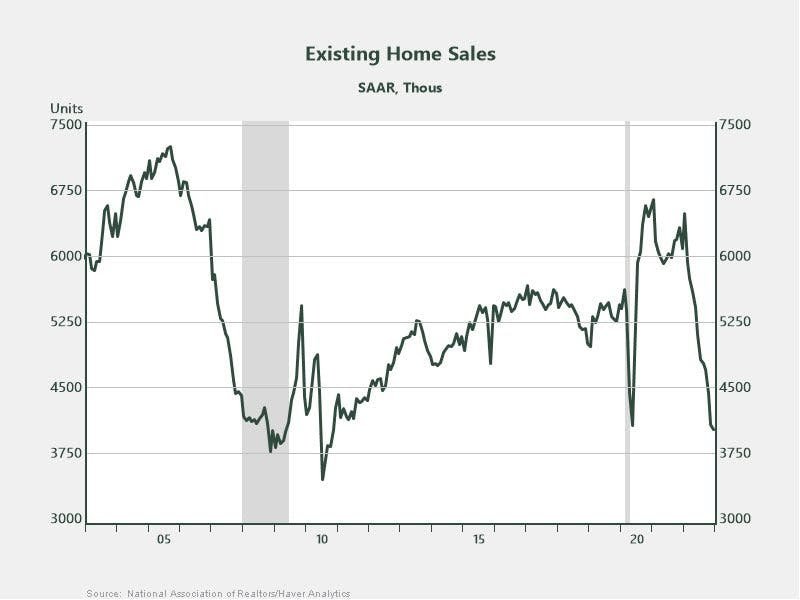

We got some timely data on exactly this phenomenon with the release of US Existing Homes Sales Data for December on Friday morning.

The data was not good and is in-line with the first point above. Houses continue to be unaffordable and so, are not being sold.

As you can see here, existing home sales have fallen for 11 straight months and are now back to levels last seen in 2010:

Can you see where the Federal Reserve began to raise rates last year? At the fastest pace possible ever? I bet you can.

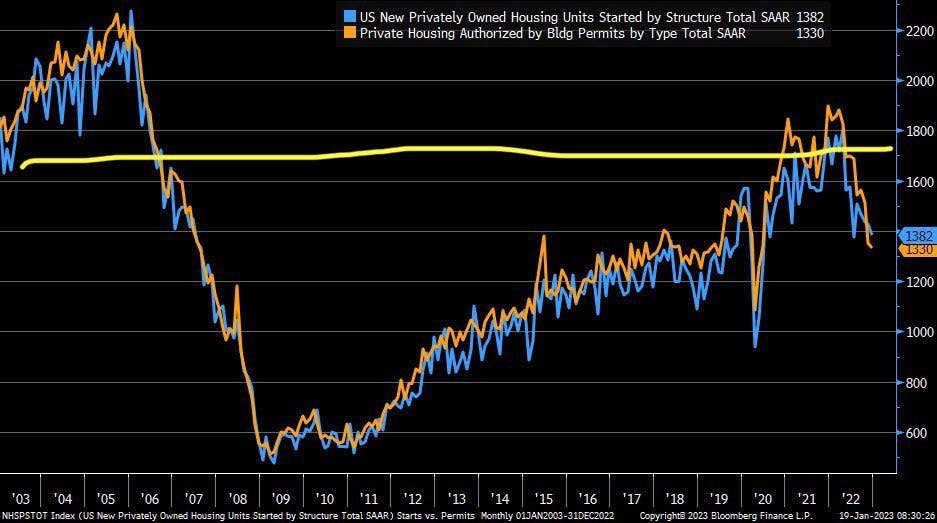

But that isn't all that is going on here. Because, as rates rise and make affordability more difficult, very few houses are being sold it is also true that very few houses are also being built:

This is pretty strange!

Why?

Well. because we have a huge housing shortage.

That yellow line above is the ~1.7 million new homes that America needs, on average, per year to supply the new homeowners coming into the market.

As you can clearly see not only are we not coming close but we are also heading in the wrong direction. This isn't a new problem but it is worth pointing out that the lack of available supply we wrote about in 2021 and that has been ongoing since 2008 is only getting worse.

You can read about some of our old work about the lack of housing supply here and here.

In fact, the problem described years ago has far outstretched even our darkest fears to become the current Franken-market desperate home buyers confront today.

The US had a "missing" 3.84 million homes in 2021 when this newsletter began. That number is now over 5 million according to some sources. Either way, it is high and heading higher.

Therefore, while there really isn't much of a question, both a cost factor AND a supply factor is acting as a serious brake on the housing market from coast to coast.

Very few homes are being sold.

Very few homes are being built.

Either would be really bad. In combination these two realities spell a slow-moving but real disaster and we should stress, not just for those looking to get on the housing ladder.

Why?

Well because prices of existing homes are high and we have a historic lack of housing and yet our market is reacting by....not building any homes.

That suggests that the real estate market is broken in some fundamental way.

And so it is to this subject that we turn to our next story.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.