What If Inflation Hasn’t Peaked After All?

There is really no way to sugar coat it. Or coat it with anything else either. Disguise is futile.

Wednesday's US inflation data, the monthly CPI print, was not good news. The headline number was high (9.1%) and the details were, in some ways worse.

Here you go:

The reason the details are worse? Because inflation is getting profoundly more broad.

By that we mean more and more of the CPI components are now elevated. 42% of the basket has an inflation rate over 6% over the last 12 months. Almost 75% of these items are over 4%. That alone is double the Federal Reserve's inflation target (2%).

A year ago, many commentators, "experts" and investors tut-tutted our inflation concerns by saying that there were only a few elevated categories. We agreed but worried that isolated one-offs would become broader based as government largesse, intractable Covid snarls and shifting structural drivers combined in a perfect storm of price pressures.

A year later and those isolated one offs have spread, combined and accelerated to create a broad based inflationary impulse.

And make no mistake about it, the continuing high inflation only raises the amount of pain on Wall Street and Main Street alike.

In short and as a reminder:

high US inflation = more US interest rates hikes = lower US economic growth

This is broadly true elsewhere in the developed world as well, of course.

As we have highlighted before, this is the terror zone for financial markets - the very opposite of a "sweet spot."

Because typically when growth is slowing, especially if it is doing so sharply, investors begin to believe that interest rates will begin to fall.

But that won't happen this time. In fact, it can't. Because the central bank is taking interest rates in exactly the other direction. They may be doing so belatedly but what they are missing in terms of being early they are making up for with great enthusiasm.

As long as inflation stays high then growth will continue to fall without any rescue coming from central banks. And it will be very hard for governments to find other ways to prop up their economies with other measures. There are no more Covid-19-type rescue packages coming around the corner. In fact, the very opposite is likely.

Namely, tax increases. The government's debt is becoming more expensive to service, after all, but that depressing reality is a topic for another newsletter.

Now, we have discussed all of this before. But we repeat it here for two reasons:

It is important!

We have also suggested that inflation would begin to fall and that we might have peaked already.

It obviously hasn't. Which isn't great.

Now we may just be early. In the intervening two weeks since we last wrote to you about plummeting commodity prices, they have only plummeted further.

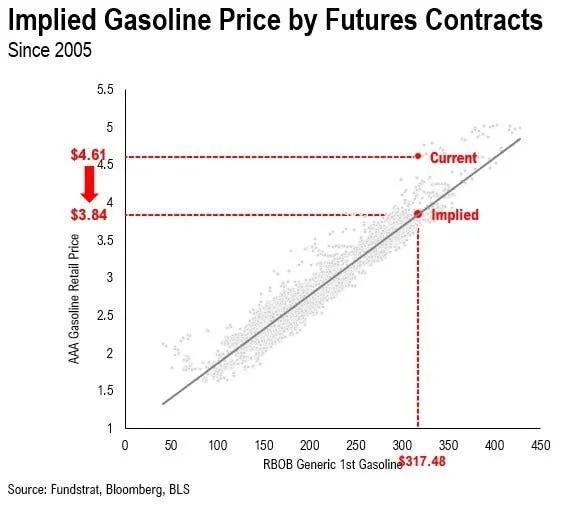

To take the totemic gasoline price as only one - though a very important example - the national average was $4.87 per gallon two Fridays ago and is $4.58 at the time of writing this week. That may seem like small beer but progress is progress!

And more will probably be on the way. Here is what is implied between present prices and gasoline future contracts:

Long story short, industry experts are expecting that prices will continue to fall to below $4 a gallon over the next few months. They could always be wrong but this is the present assembled wisdom of the gasoline crowd.

And it isn't some wild theory that declining commodity prices will quickly flow through to inflation.

It will.

And remember commodity prices - higher or lower - flows through via two channels.

Commodity prices don't just matter because we eat wheat and meat and drive vehicles that rely on oil.

They also matter because they are inputs for nearly every product we buy.

We are sticking to that expectation. In fact, we even think that there is a rising risk that the Federal Reserve finds itself behind the other way as inflation falls and it hikes.

But, equally important, perhaps we will be wrong.

It is not as if there are no reasons for commodity prices to jump back again. China is opening back up from its umpteenth Covid-19 lockdowns (maybe????) and is even stimulating its economy which will be supportive of the commodity complex more broadly.

And it is not as if the war in Ukraine is over either. That tragically drags on and Putin's Russia is only getting more brazen in both its ability to inflict terror and barbarisms on Ukraine while also punishing Europe economically for its reliance on Russian energy and any significant effort to help Ukraine.

Regardless of whether we are right about inflation beginning to ebb - and we maintain that the chances are still good - we have been more correct about the danger of buying any dips. We are at real risk of being tiresomely repetitive here but we are staying consistent.

Don't do it.

As long as we remain in the "terror zone" for financial markets then please be extremely reluctant about buying in Western financial markets. This is even and especially the case for "great" companies that appear cheap.

As we will cover below, yesterday's great company could very easily be tomorrow's corpse. Beware.

Another aspect of the above - one we have not made much mention until now - is the subject of our next topic.

What do you want to own in our most likely future?

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.