US Stock Market In 2022: Watch Out Below?

As we near the end of the year, we should take a look back to how the stock market has fared and look forward to what could drive it higher (or lower) in 2022.

As we detailed elsewhere on this blog:

It is entirely possible that strong economic growth is a necessary but not sufficient condition for American economic prosperity and political peace.

It is, however, proving good enough for the stock market, which has been reaching record highs on a near daily pace.

********

We seem to be moving from a period of rational exuberance to potentially irrational financial mania - if we are not already there - and doing so at a record clip.

Whether we get and stay there does depend on a host of factors - will growth accelerate higher? - and explicit decisions from policymakers - will the Fed withdraw stimulus and raise rates more quickly?

For now, despite our political divisions and economic stresses, we march upwards at an ever more incredible pace.

As blogger/author Matt Taibbi put it this week:

As America Falls Apart, Profits Soar.

Taibbi and the investors are also not alone.

Financial analysis and data firm, FactSet, published a report this week that noted that company profits are also at record levels.

The firm recorded that companies in the S&P 500 are on track to post net 12.9% profit in the third quarter of 2021.

They pointed out this was the second-highest result since the firm began tracking the number in 2008.

The actual highest? Q2 2021.

These record profits have, impressively, allowed investors to look beyond the supply chain issues and threats to margins:

In the last two weeks, the S&P has:

Reached new highs eight straight trading days, tying the longest streak since 1964;

Risen 19 of the last 23 trading days, a feat surpassed only once in 90-plus years, and

for only the second time since 1950, taken less than a month to rebound completely from twin fragility shocks (these are sharp selloffs).

So, the front page of the newspaper may not be reflecting it, but these are boom times for investors and financial speculators.

So what next? Or, better put, how long can this go on for?

Tough to say, of course.

But the "Fear Of Missing Out" type markets we have written about before (see here) are still very clearly with us.

So are the familiar themes:

Options volumes, trading volumes, retail trading flows, easy financial conditions, all suggest people are piling in more capital into publicly traded equities now matter the problems, threats or, most importantly, expensive fundamentals valuations.

Here is a chart from the FT on option volumes.

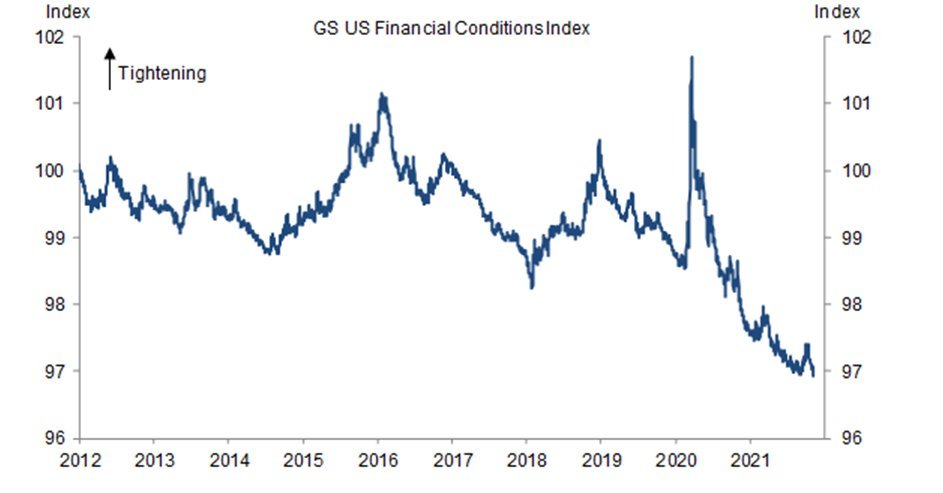

Here is an update we have shown before, the Goldman Sachs Financial Conditions index:

And seasonality suggests it could continue through the end of the year. This is often one of the best times of the year as investors hold on trying to either catch up to their index or segment greater gains into end year.

See here:

The one significant fact to keep in mind is markets can stay irrationally exuberant for quite a while certainly longer .

For context, in the last 5 months of the 2000 stock market dotcom bubble, the NASDAQ was up 110 percent.

So, buckle up and stay very alert. Our present frenzied and seemingly endless rip could actually go on for quite some time.

The present day challenge is markets are now seriously expensive and the labor market is tight and inflation, as we have covered in depth, is high.

This gives the Fed a reason to advance their plans to withdraw stimulus and raise rates. If not, they risk allowing inflation - self sustaining or not - to keep rising and hurt the poor.

Can Jay Powell and the FOMC risk the political backlash? Can President Biden and his party allow people to "feel" that their lives are getting harder every month? Heading into midterm elections?

Will the US elites start to understand that if the stock market and the economy are distinct, that the former may have to profit at the expense of the latter?

Either way, it suggests 2022 will not - can not - look very much like 2021.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.