US Equities - A Rising Tide Lifts All Boats?

What is Next for the US Stock Market? Below is our expectation.

An interesting question came up on the Pebble Slack this week. It was pretty simple:

Why are US stocks still rising?

On the face of it there seems to lots of reasons for concern. For one thing, as we have covered before:

US stock markets have risen very steadily and very significantly this year. The S&P 500 has returned 19.88% year-to-date.

US equities have yet to experience a 5%+ decline this year.

Valuations are very expensive. In other words stocks are expensive per dollar they earn in revenue and especially profit.

Neither of those are reasons they should necessarily fall per se but that brings us to the negative catalysts:

Rising Delta variant Covid-19 cases, globally and in the US,

China cracking down on its tech industry and shutting down its large and increasingly important economy,

Skyrocketing base metal and raw material prices that adds to costs and acts as a drag on profits,

And a Fed that has now heeded these inflation prints and agreed to bring forward the date of its (still very distant) interest rate hikes.

Add all of these together and it is sort of puzzling that markets still continue to grind higher. Any on these headwinds could, on their day, signal a reason for equities to cool down and possibly even experience a correction (defined as 10%+)!

We seem to be a long way from such an occurrence. So, what's up?!

Three Reasons & Three Charts:

1) Financial Conditions.

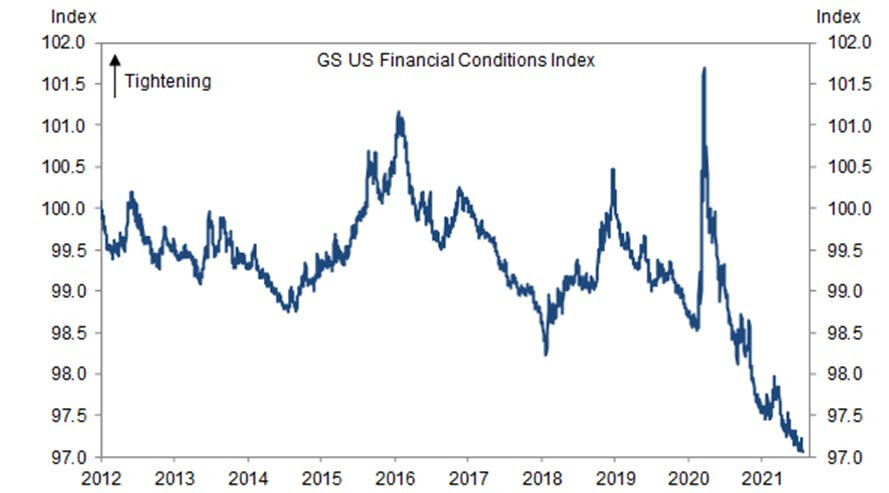

The first reason trend supporting US equities is that US financial conditions are at an all-time low level which means they are "easy." Financial conditions are an amalgamation of measures that influence the ability of the economy to grow.

Easier financial conditions are good for economic growth because they encourage borrowing and spending by companies and consumers.

Furthermore, as we have covered before here, despite these loose conditions and abundant liquidity the Federal Reserve is maintaining its "emergency" liquidity measures which does two things.

It assures investors that these easy conditions should continue in the future because the central bank has promised as much and

It injects large amount of capital directly into the financial system.

This creates a positive feedback loop whereby the Fed's verbal "forward guidance" not only gives banks the confidence to lend and businesses the conviction to spend but it directly incentivizes them to do so by creating a financial system awash with too much cash chasing too little reward.

Here is a representative example, the Goldman Sachs US Financial Conditions Index which is about to drop off the chart.

2) Company Profits.

Companies are making a lot of money. We know that because their second quarter earnings season results are outrageously strong.

How good?

So far, over 70% of the companies in the S&P 500 have reported actual results for Q2 2021.

Of these companies, 88% have reported actual earnings per share above estimates, which is above the five-year average of 75%.

This is the highest since 2009 and are also dramatically better than people expected even a few months ago.

For some context, six weeks ago, analysts were predicting Q2 S&P 500 earnings of $44.59 per share, but they are now up to $50 and on track to hit $51, according to DataTrek Research.

These are backwards looking numbers but they reinforce the idea that economic growth is strong and profits will continue.

It is all fine and well to dismiss the current performance as simply a result of a reopening surge and claim valuations are expensive but when nearly all American companies are making a lot of money it is very hard to walk away and sit on the sidelines.

See below for how outrageously good this quarter is proving to be for the US S&P 500 equity index vs expectations and broken down into individual sectors.

Green means above expectations!

3) T.I.N.A. (There Is No Alternative).

Super accomodative monetary policy (low rates and liquidity measures and quantitative easing) combining with strong economic growth ensures that equities and especially US equities are relatively a very attractive asset for the discerning global investor.

Relativity matters! As the proverb says, "in the land of the blind, the one eyed man is king."

This has been true often over the years but is doubly the case now.

Why?

Well, as we have covered somewhat exhaustively, US interest rates have been steadily declining since early spring.

This makes US interest rates - or US Treasury bonds - much less attractive because they offer so little yield.

Moreover, because inflation is rising, this doesn't just mean that interest rates are falling but also that real interest rates are falling. The real interest rate is simply the (nominal) interest rates minus the rate of inflation. So, in practical terms this would be the yield of a US 10 year bond minus the expected rate of US inflation over 10 years.

(We have written on interest rates and inflation in some depth and you can check out our blog here or here if you would like to find out more.)

As this newsletter has covered somewhat exhaustively, US inflation is super high at present. Therefore US real interest rates are not just very low, they are often negative.

So, as a discerning investor, if you want to earn a rate of return above inflation (i.e.: a real one) then government bonds are really not a viable solution. Rather you have to look elsewhere - and possibly accept a higher level of risk - to find the same amount of yield.

This naturally draws the investor to the most obvious and liquid easy-to-buy asset: US publicly traded equities.

Furthermore, US equities have gotten MORE attractive as bond yields have fallen because their own yields - what they pay in dividends and what they earn is staying very high (see the earlier point about company profits).

Don't believe me? Well here is a graph of the relationship and you can see, just over the last couple of months, the ratio has started to shift (notice the helpful little red arrow) as inflation has headed UP and US nominal yields have headed down.

So, in conclusion,

A. a continuing and strong economic recovery,

B. historically strong earnings,

C. super-easy monetary policy and

D. a lot of money on the sidelines from excess savings and cheap borrowing,

Has meant that there are a number of rather hefty tailwinds pushing up US stock markets and overcoming the not inconsiderable tailwinds.

This doesn't mean it is destined to continue let alone continue forever. As ever with the global economy and financial markets things are shifting all the time.

What can change this state of affairs?

As we have discussed before:

Growth meaningfully faltering. Especially in the US but also abroad. Watching China is important here as is Covid-19.

The US central bank having to meaningfully change policies vs expectations. If the Fed brings forward when they hike and surprises market observers with how rapidly they will do so, then watch out.

Cash Inflows to US Markets:

A final thought on what is supporting US equities in the face of rising negative news:

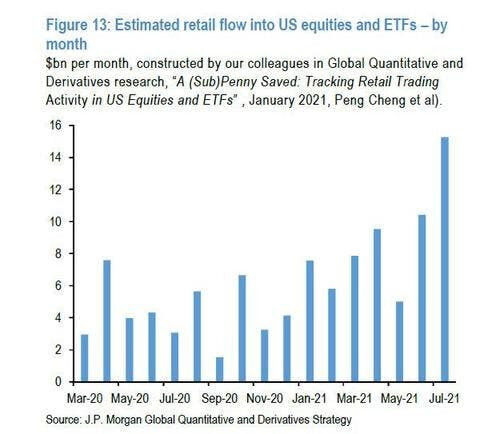

The pandemic and especially the US government's and central bank's responses to it have created unprecedented savings for rich and poor alike.

Many people (and corporations) are sitting on piles of cash and a lot of this money is slowly flowing into the US stock market. Why? Well, here is another acronym: F.O.M.O. (Fear Of Missing Out).

These steady inflows is further accelerating the theme detailed above: T.I.N.A.

For context, the July inflows were some 50% above that of June. Not small.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.