Update: The 60/40 Portfolio & Why The Pain May Continue

One of this newsletter's longest running themes has been the vulnerability of the classic 60/40 portfolio.

A "60/40 portfolio" is shorthand for a mix of stocks and bonds that is supposed to provide a natural hedge (or protection) to investors. The idea being that when stock markets do well - which is the majority of the time - the portfolio will grow but when stocks sell off the bond portion will offset the losses and counterattack that decline.

The name comes from the (rough) ideal mixture of this portfolio: 60% stocks, 40% bonds but these days a lot of these strategies slowly rotate people's holdings from heavily-favored to stocks when they are young to a larger (and safer) bond allocation when they approach retirement.

These strategies are also known as "Target Date" funds because they target a specific date of retirement with this evolving mix determined by that date.

Now, we have written about our concerns with this particular financial product last spring and summer but in truth, it has been one of the driving influences of this entire company since its founding.

So, in truth, our fears long predate the ramblings that occur in this newsletter.....

The reason that is important is not just that it has informed our incredible product but also because it led to a central animating question we began asking ourselves about personal finance in the 2020s:

What if the whole 60/40 construct is really just an animal suited for a low inflation environment?

Not just in the sense that this product is optimized for those conditions but rather that its entire raison d'etre has been low and ever lower of inflation that the Western world inhabited for nearly 40 years.

The world (say 1980-2020 roughly speaking) was also unusually financially stable by historical standards. And part of that stability, perhaps the most important part, was also predictable. Stuff generally did what it was supposed to do. When stocks struggled, bonds did well etc.

In the end, our animating impulse wasn't so much: what if these products won't work optimally anymore but rather, what if they won't work, period.

What if we need a new brand of financial product for a brand new investing environment?

Well here we are:

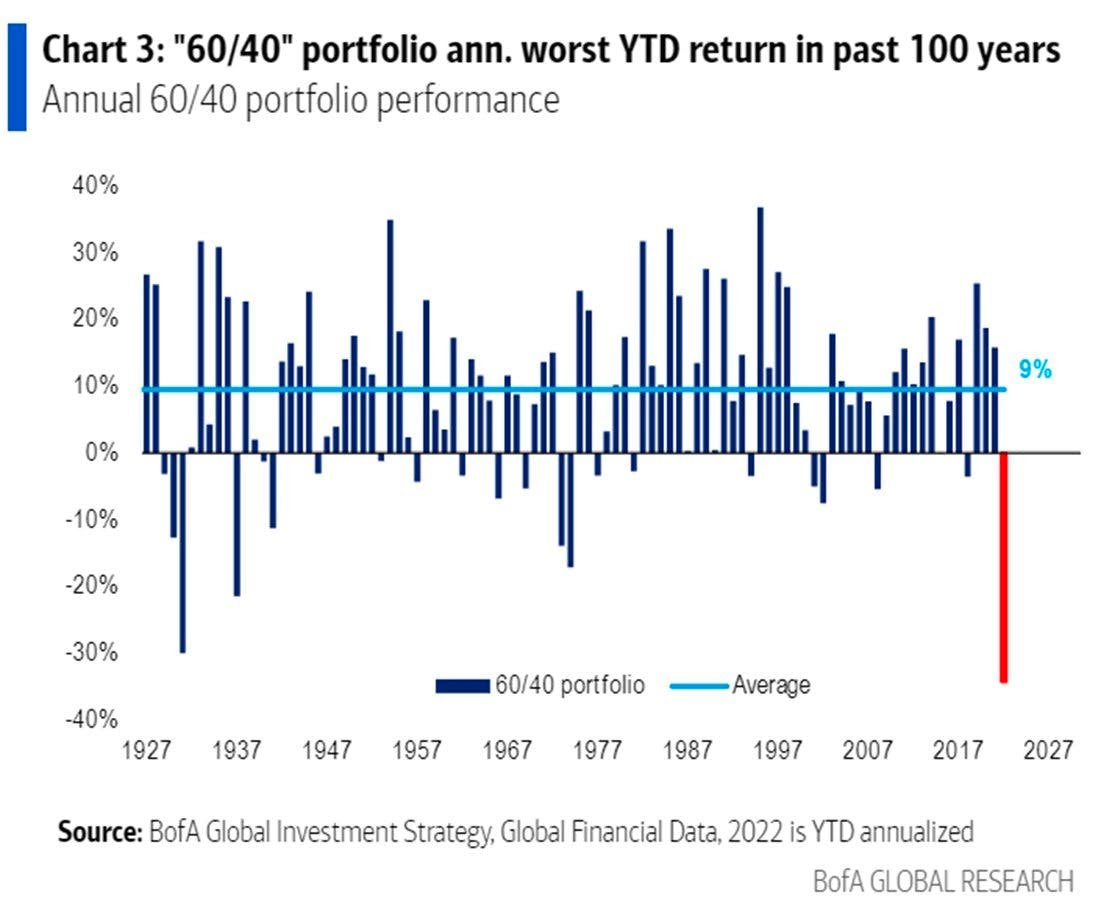

The data is both stark and, for a lot of regular savers and investors, scary:

US treasury bonds are on track to record possibly their worst year in over a century, some data argues for two!

Meanwhile, of course, major stock indices have also struggled. The S&P 500 has been down for much of the year and

Add it all up and you get a terrible return for the typical 60/40 portfolio or, really, any "Target Date Fund" centered around a mix of bonds and stocks.

Stocks have had a tough year and bonds have - unlike earlier crises - been unable to deliver a counterweight. In fact, as we have argued for the last year, they have accelerated the negative performance.

This has led to an unprecedented decline, the worst return in, well, quite some time.

Not great:

So, in short, a very bad year. Possibly historically so, but what does this mean going forward?

In a way, there is a case to be made that 2022 could be a one off. Bond yields have risen a lot and now, for the first in years, have the cushion from where they could fall and counteract further stock market weakness.

There is only one problem and it is a familiar one:

Inflation.

Now, this newsletter has argued carefully and consistently that we could see inflation fall pretty steadily in the months to come.

And we aren't changing that view. We still expect the coming months to show declining inflation. But we have also argued that inflation will stay elevated compared to recent history for quite some time and so will interest rates.

Both these things can be true at the same time. We can have falling inflation and high rates.

And the biggest risk to our argument is, also as we have noted, a spike in inflation. We have worried about another energy spike but there are also possibilities around housing, rents and wages as well.

Our core view is that this will challenge the 60/40 financial product complex.

This isn't unprecedented either. At the start of this century the 60/40 portfolio had a terrible decade. It returned a very slim 2.3% between the year 2000 and the end of 2009. That was well below inflation and represented in many ways a "lost decade" for careful investors.

That sucks.

And we think we could be in another challenging period now. It doesn't necessarily have to last a decade but next year could be another "lost year" for those who invest in Target Date funds.

Stay alive to that possibility and think carefully about how to structure your portfolio and hard earned invested dollars as a result.

Setting and forgetting it may sound snappy but if you set your portfolio to what worked over the last ten years and a different market regime, you may regret it extremely.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.