Update On The European Energy Crisis: Higher And Still Higher

'Tis the season for chestnuts roasting on an open fire and the energy bills to go along with that seasonal vignette......

There are two reasons we are returning to the topic of European energy crisis:

As we cover below, what is happening in Europe right now is historic. There is no other word for it.

We continue to think that energy and especially European energy companies are well placed to gain from what is becoming a global trend.

The combination of poor planning and policymaking with Europe's fractured market and the strategic vulnerability being mid energy transition suggests that this is likely to be a key theme for us in 2022.

In terms of the specifics, here is an update:

On Monday of this past week European natural gas benchmark prices closed today at a new, new, new record high settlement price.

The Dutch TTF benchmark closed at at €116.084 per MWh and UK NBP benchmark closed at 294.54pence per therm. That is roughly ~$220 per barrel of oil equivalent.

For context, in 2019-2020 these prices at this time of year were typically in the €25-50 range,

This is pretty wild.

Be glad that you are not facing a European energy bill for the holidays - just about every price chart, meanwhile, looks like this UK one:

This was only the start. Price have risen since.

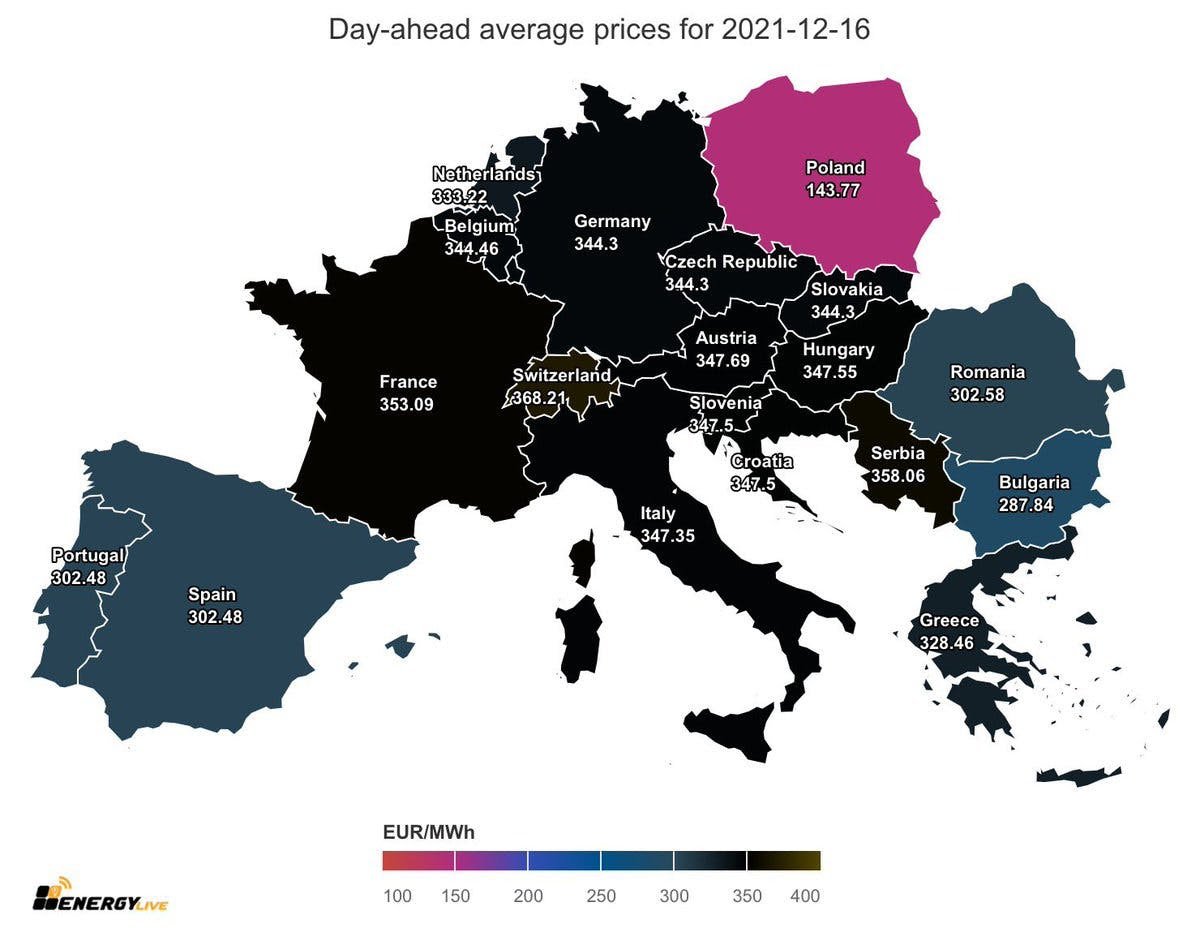

Wednesday brought even worse news with day ahead electricity rates rising above €300 MWh for most of the continent. At the time of publication (Sunday) prices were still higher.

Every black country below has prices well above that figure.

You get the picture.

There are two interesting points to make here besides the obvious fact that the European consumer and economy is experiencing serious pain.

The first is that this "temporary shortage" is starting to proving not so temporary. A different "transitory" phenomenon is transitioning into something else entirely.

And second, this lengthening time horizon is deepening the impact of what was supposed to be a minor hiccup. This will have profound consequences.

One point number one above, perhaps the most interesting change since we last covered this issue is the change in the contracts rising in price.

This is no longer just a surge in short-term day-ahead or week-ahead prices prices (i.e.: what is available for purchase today by companies and utilities) but has spilled over into long-term prices. Now, January 2022 electricity contracts for large swathes of Europe are changing hands at elevated prices.

It is even starting to creep into the prices for NEXT year's winter (2022-23).

This suggests two important developments:

That traders believe the crunch will only deepen in the weeks and months ahead.

Small businesses and individual consumers are going to start feeling these elevated prices more consistently and, critically, not just in Europe.

This development will likely be an unpleasant experience for all.

On the longer time horizon, it is remarkable just how serious this is and also how European tightness is rapidly influencing other global markets.

Most of our readers are, we believe, sitting snug in North America and they should all be glad about that fact.

Here is a helpful chart from the BBC this past week:

It isn't solely that Europe is not alone. It is now also a global problem. Japan and China are already feeling the pinch. It could be only a matter of time before this "temporary" energy crunch shows up in gas rich North America.

This is a global market, at least somewhat. There are limits that any politician or policy can do to keep this type of demand spike from impacting everywhere.

This somber point brings us to the second point made above. As the time horizon lengthens, so do the real consequences.

One of the biggest outcomes that is becoming increasingly clear is that not everyone is necessarily suffering.

For instance, Trafigura, one of the world's largest oil and metals traders, just reported record net profit for its fiscal 2021 year of almost $3.1 billion. The company paid its partners-traders $1.1 billion in dividends, an all time record.

And, in an interesting note from Trafigura's annual report they underline that this trend could continue. The company sees a "persistent mismatch between growing demand for energy and industrial raw materials on the one hand, and supply constraints including due to chronic under-investment on the other."

Read that again.

This crisis is a result of years and years of underinvestment and misguided policies. Now Europe is in trouble. They do not have either the local supply or the ability to diversify their suppliers.

What was a crunch has become a vice, tightening its grip with every week. This continues to reward certain parties who are either well placed or strategically powerful. Trafigura is one.

Coal companies are another. We have covered this topic before.

And Vladimir Putin continues to be perhaps the biggest winner of all. Europe becomes more vulnerable to manipulation if not outright coercion every week. They may not want to open the Nordstream II pipeline but they may also find they have little choice.

Putin has the whole continent just where he wants them and it is hard to see why he will not make it far, far worse for European democratically elected politicians and policymakers.

It seems likely that he is already ratcheting up the pressure.

This chart tracks Russian natural gas flows via the critical Yamal-Europe pipeline which crosses from Russia to Poland to Germany. This is from the crossing point at the Polish-German border which might be less easy to manipulate.

Today, Sunday, the flows have dropped even further to just a trickle. It also reflects a dramatic drop to this time last year (December 2020):

This chart represents even higher prices for Christmas and lower European natural gas inventories.

Europe may have to start ration demand shortly.

If this continues, this crisis could influence everything from the French election to the future of Ukraine and the global economy's ability to grow sustainably and successfully in 2022.

Meanwhile, America's next hot import could be record energy prices.

Not exactly what European politicians and activists had in mind when they made those solemn climate pledges and began to formally and recklessly rule out fossil fuel investment.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.