The “Big” Fed Meeting:

You can be forgiven for perhaps missing the "big" Fed meeting but it did happen on Tuesday and Wednesday of this past week.

The Fed achieved two notable success:

It met investor expectations. There were few surprises.

And it signaled it was taking a slow but significant change towards tighter monetary policy now and into the new year.

In doing so the head of the US central bank managed quite a smooth pivot in US monetary policy. You may not have felt but the US has transitioned to an interest rate hiking cycle - even in the middle of yet another Covid wave.

This marks a big shift. After reassuring investors for months that inflation was purely “transitory” and would go away by itself Jay Powell, the Fed Chair, abandoned this argument at the end of November and instead warned of tighter policy ahead.

Now he has followed that up with an acceleration in the Fed stance and expectations of more still if inflation continues to be far stronger than the Fed's mandate allows.

This impressive achievement led to a - temporary - relief rally because much of the above changes to the Fed outlook were already "priced in" by the market and the fear for investors was largely of the threat of the new and the unknown rather than the actual tightening of policy.

Lastly, nothing suggests that - while always cautious and open minded - the Fed is not overly concerned with Omicron. At least not yet. Their staff must have furiously studied the new variant before making this week's decision.

******

More prosaically, what the Fed actually announced was:

A doubling of the tapering of asset purchases. This means they have been slowing their "quantitative easing policies" and will accelerate that slow down.

And it confirmed investor expectations that at least 3 interest rate hikes are projected to happen next year.

More importantly, two things have occurred since:

Longer term US inflation expectations began to drop and

We are now formally on the glide path towards an rising interest rate cycle.

Both of these are important as they reveal some of the key shifts that are occuring underneath the surface of the US economy.

Further, both of these points were also met with calm by financial markets though this new framework does raise questions for the new year.

On the first point above, here is a graph of what investors expect US inflation will be in 5 years from the St Louis Fed database.

After rising nearly all year, investor expectations for longer term US inflation have broken meaningfully lower since the meeting.

This could always reverse, of course, but as investors have begun to feel more confident (relieved?) that the Federal Reserve will credibly deal with the inflation problem it has immediately become less of a problem.

Or, put another way, the fact that the central bank is no longer saying that inflation is temporary is the best actual evidence it will prove to be, in fact, transitory.

Acknowledging the gravity of the inflation risk to their mandate has, almost inherently, made investors feel more positive about the risk of the Fed lurching to a rapid tightening of monetary policy.

That was always the greatest fear of market participants. By wilfully ignoring inflation today, you increased the risk of a sudden and wrenching shift in monetary policy later.

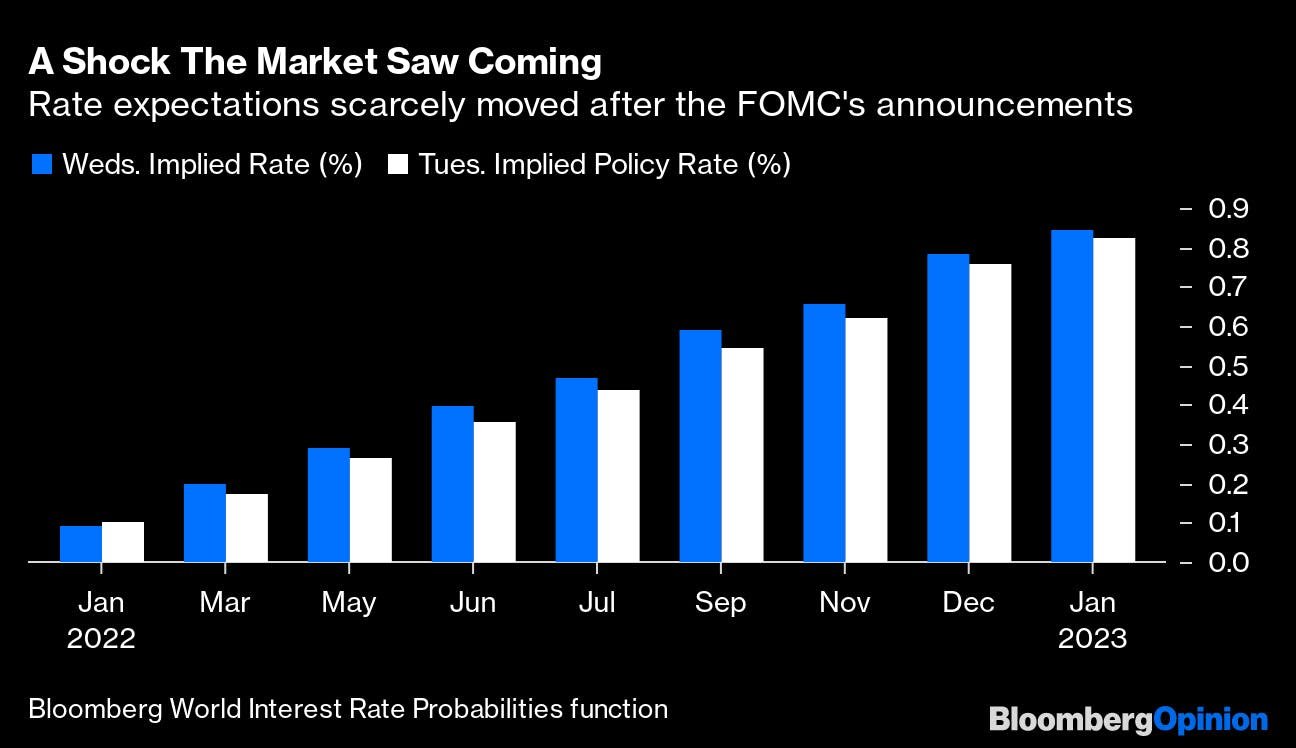

Here is further evidence. When it comes to next year's interest rate hikes, investors expectations before (white bar) (blue bar) and after the Fed meeting barely budged.

The two bars are nearly identical and show just over three 0.25% hikes next year:

And, as a result of the central bank's pivot, it is not too surprising to find that investors anxieties about the central bank's inaction are starting to alleviate.

Just like we did during the period of 2015-2020, we can raise interest rates and markets can head higher. Raising rates is, after all, a sign of a strong economy and growth.

So, action! And positive market responses! What a cheery outcome for the season.

********

But this leaves us with a final tension to keep in mind as we move forward into the New Year:

The Fed is (still) caught between two very different poles at present.

One the one hand:

If US inflation is already high and has proven stubbornly resistant to moderating then it is entirely possible that the Fed may have to hike earlier and faster than the market expects or the economy can handle.

In other words, there is very little wiggle room.

The good news is the Fed has responded to the data, The bad news is the data suggests tighter monetary policy is coming!

And on the other:

As we have covered extensively, the US job market is doing wonderfully well at present. There are plenty of job openings but many people (and especially men, ahem) are not yet participating in the workforce as they were before the onset of the pandemic.

So, there is plenty of labor demand but not yet the (willing) supply.

See here:

The central bank will want to close this gap. There are still far too many Americans who are unwilling (or unable, thank to Covid?) to search for meaningful work.

Thus, Jay Powell and his fellow policymakers on the FOMC will hope and aim to keep policy as accommodative (that means loose and easy) as possible, for as long as possible. They will want to support and encourage the economy to get as many people working productively as possible.

Put slightly differently, they will want to fulfill the "maximum employment" side of the Federal Reserve Bank's mandate without losing any more credibility on the "price stability" (inflation) side of their mandate.

For more on the dual mandate of the Fed see here.

The risk is that if they are not very careful and also perhaps very lucky then inflation expectations will become unanchored as the perception of inflation outpaces their ability to hammer it down and things get truly messy.

Because of the last 7 month dalliance with "transitory" the risks moving from perception to reality.

And when it comes to perceptions diverging starkly from reality allow us to introduce you to the continuing.....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.