Uber Finally Makes A Profit, What Now? Will The Stock Head Higher? Or Is It A One Off?

For long suffering Uber investors, the day many thought might never come has finally arrived:

In its second quarter earnings, Uber finally made an operating profit for the first time.

Even better, it did so on widely accepted accounting principles not the rather manipulated and overly kind "adjusted" EBITDA that is favored by many high growth, low profit technology companies. This metric was tolerated in the "low inflation, low interest rate" world of 2009-2020 but has fallen decidedly out of favor today.

(we won't get into the details but you are "adjusting" the numbers to obviously look better than they are. Read more about Uber specifically here.)

So, clearly a momentous day for a company that has long struggled with profitability. What do you think happened next?

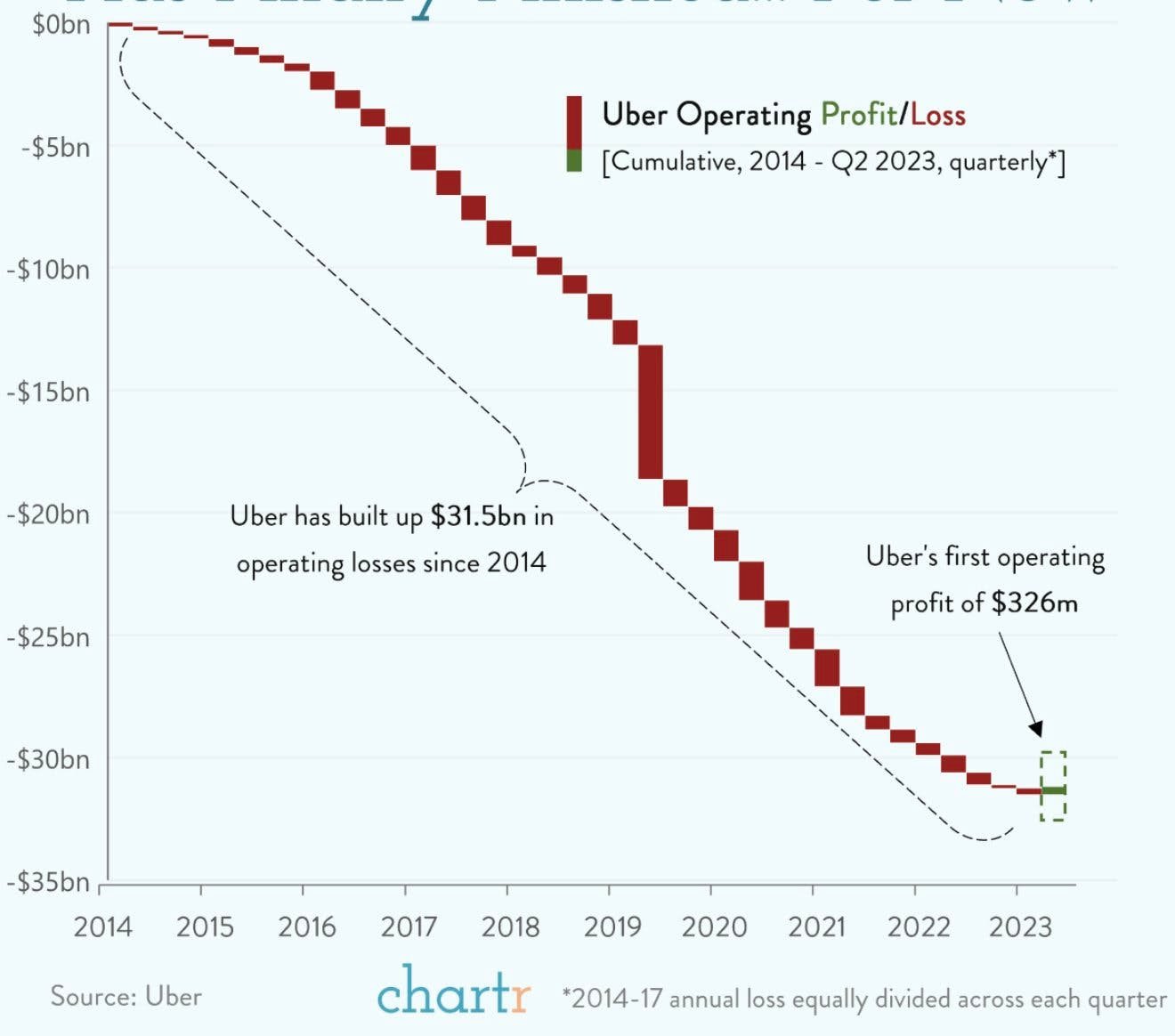

The stock plummeted of course! The near 6% fall in Uber's shares was a bit of a surprise though perhaps it shouldn't be when you reflect on this graph:

Its a wonderfully awful chart and really puts into context that, while the current quarter's profit may be understandably a source of real pride for the company, investors require quite a bit more from an enterprise that has burned through $31+ billion before getting into the black.

Initially, we scanned the numbers and were a bit surprised at the negative reaction and then moved on. Then, after reflecting a bit, we came back and took a second look to see whether our surprise was justified.

First things first, some of the numbers were pretty good!

Revenue rose 14% year-on-year though fell just short of expectations.

Gross booking rose 16% though, far more than expected and reached over $33 billion for the quarter which is very impressive.

The big number was, of course, the fact that Uber posted a profit of $394 million during the second quarter, compared with a loss of $2.60 billion a year earlier. That was obviously far more preferable than the $18 million loss that analysts had predicted.

Earnings before interest, taxes, depreciation and amortization came in at $916 million.

Most impressive still has been the change in business approach. Dara Khosrowshahi has delivered on his promise to prioritize cash flow, not high spending.

One of the biggest questions going forward is what Uber will do with these profits. As the CEO himself stated on the earnings call:

"Profitability is a means and not merely an end."

The good news is that this profit is unlikely to be a one off as long as the economy doesn't crater and Uber stays disciplined. 137 million people use the App at least once a month which is pretty staggering. As a company in the "please visit and use our App" business that is both impressive and intimidating in equal measure.

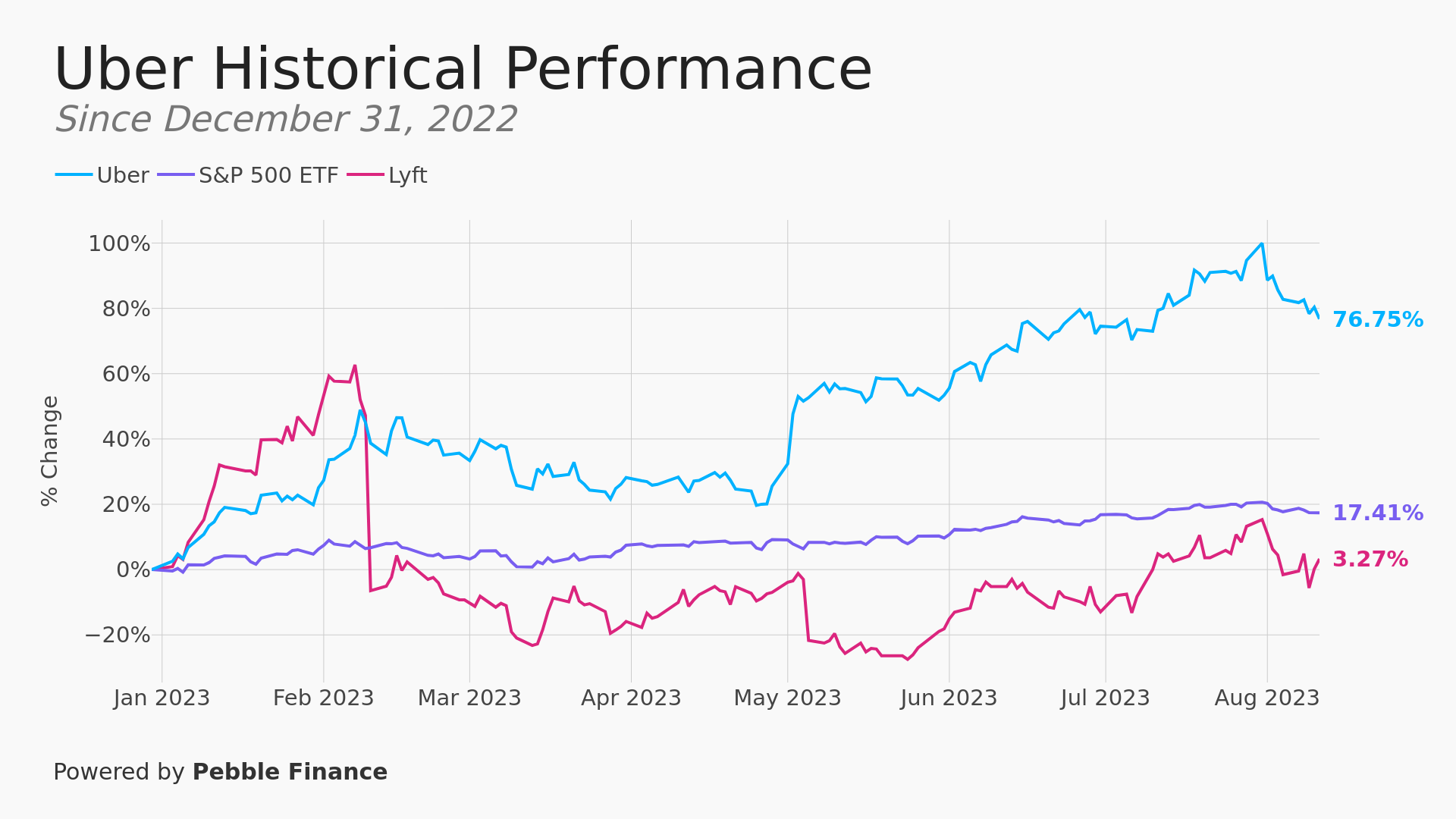

The stock had done really well this year before the earnings - it had nearly doubled as you can see here:

This far supersedes the S&P 500's very respectable 17% gain and obliterates its great though far smaller and narrower rival, Lyft.

And so perhaps the sell off was just a function of profit taking and unreasonably high expectations but we were still surprised.

That is because from our perspective there is one factor that was NOT discussed on their earnings call but yet became far more likely because of it that could meaningful impact the ride-hailing company's stock price in the months and year to come.

Namely, Uber could now qualify for inclusion in the S&P 500.

This could be a huge development for the company. The S&P 500 is, of course, the ultimate stamp of approval for big American companies that they have made it and symbolizes the ultimate "seat at the table" achievement.

Now, it is also true that Uber have more to do: A stronger balance sheet, an investment grade credit rating and especially a (real) operating profit are all required. However, the ride-hailing firm has either achieved or is likely to achieve all of these in the coming months. This would clearly put the company in the zone for inclusion.

And the reason that this matters is, regardless of when it happens, Uber is reaching both the size and the type of business that can creates the conditions for it to benefit from the so-called S&P 500 "inclusion effect."

This occurs whereby a company benefits from the expectation that millions more passive or benchmark focused investors and billions more dollars will flow into buying shares.

There is a long history of showing that, despite it being quite public knowledge, this inclusion effect having a statistically real and meaningful effect on company share price.

Some analysts have pointed out that this effect has shrunk over time and that is true in a narrow sense that it has diminished around the actual inclusion date.

But the effect is still very real, in our estimation.

What has happened instead is investors, knowing about the impact of making it into the S&P 500, have bid up the shares months or even quarters ahead of a company being included in the most widely traded and held stock market index in existence.

Investors have moved the window for the inclusion effect earlier and earlier as people front run the expected inclusion in the S&P 500. Ironically, this is sort of similar to what has happened to Uber's stock prices this year. It was up ~85% in 2023 before their earnings on the expectation that they would make a profit which, in turn, would raise the probability of inclusion etc etc.

This can also lead to a self fulfilling prophecy. A positive review from stock market can make a company look better and better which can lead to inclusion which can lead to a higher share price.

As we always say, indexing matters and it is difficult to find a more important use case than when a company is included in the most significant index of large companies in the world's largest stock market.

So, we thought we come on and say that, despite the long history of losing money and also the fact that the stock has only recently cratered nearly 6% in a single day, Uber is still looking up both as a company and as a stock.

It isn't the only company shocking analysts to the upside.....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.