2023 Theme - Commodity Inflation: Are Grain Prices The New Oil?!

Last week we flagged that, after months of trading sidewise, energy prices have finally begun rising steadily.

This is still happening. US Gasoline prices had another great week:

By Friday, the US national average at the pump had reached $3.82 per gallon, which is the highest it has been since late October of 2022. In many coastal, high tax and low refinery states it is already well north of $4/gallon

This is pain.

But away from that, as we wrote then, higher energy has various potential implications, many of them inter-related:

It can send inflation higher.

It can make average US consumers feel poorer by eating into their available earnings through higher energy prices.

It can feed into higher costs elsewhere in the economy.

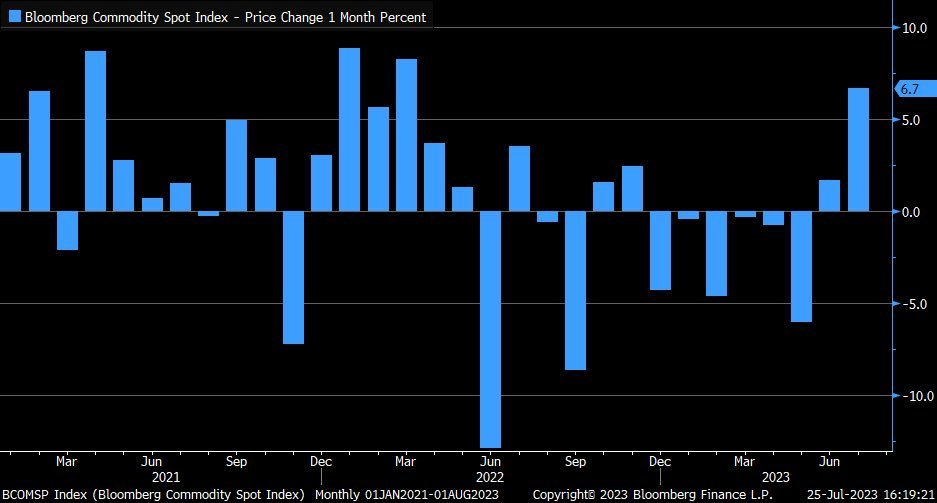

It wasn't just energy that perked up in July however, the broad based commodity complex had a great month overall:

(Each bar represents a distinct month's performance. The bar at the far right is the July, 2023 performance.)

In fact, the Bloomberg Commodity Index had its best month since March of 2022 or the very heart of the shock after Russia's invasion of Ukraine.

One of the reasons for that great performance is agriculture prices which have also been rising as a combination of punishing drought in the West and geopolitical fears in Russia and Ukraine.

The latter fear has intensified considerably since Vladimir Putin unilaterally withdrew from the UN-backed Ukrainian grain export deal that has done so much to keep agriculture prices down over the last year and feed the world's poor.

In true bad-guy-in-the-movie energy, the Russian army has also commenced a fierce escalation against southern cities and port and grain export infrastructure. As they have in Syria, Chechnya and elsewhere, the Russian regime seemed determined to bomb anything Ukrainian they don't control to complete obliteration.

So, does all this add up to another prong of commodity-based inflation to keep an eye out for?

We aren't sure but we doubt it.

Why?

Two reasons:

Russia cannot afford to upset the poorer Southern countries, especially in Africa, that rely on Russian (and Ukrainian) grain.

Though still a problem in Canada and parts of Europe, the risk of a severe drought and massively reduced yields for the spring wheat, corn, soy crop in the US has lessened considerably.

You can see a decent shot of North American soil moisture levels here:

It is still a bad time to be a Canadian boreal forest (or the creatures that inhabit them), but it is actually a pretty good time to be an Indiana corn crop or North Dakotan spring wheat field.

This was NOT the situation across most of the American Midwest as recently as late June.

So, if it isn't drought in the West then what about the other big recent driver of spiking grain prices: the Russian withdrawal from the UN-backed export deal and in parallel bombardment of Ukrainian cities and export infrastructure:

The timing and purpose of that really reveals what is going on here:

Russia is trying to take Ukraine's customers and further impoverish their enemy by destroying their export infrastructure and refusing to abide by the UN deal at a critical time.

The aim is to keep Ukraine from earning hard dollars on international markets for their wheat and sunflower oil and, ideally, substitute their own exports to those same customers.

This is bad. Especially for the poor Ukrainian dock and other infrastructure workers who work trying to get their grain to market.

But it needn't be terrible news for the global wheat market.

We have managed the lat year very well and the global agriculture market has had the necessary time to adapt to the possible loss of Ukrainian supply. In fact, in some respects globally, farmers are growing more Ukrainian staples and eager to get a good price for them on the global market.

They likely wouldn't put it this way but the current issues in Ukraine might be very welcome. This is the zero sum world of a global food market. As an Iowa farmer friend puts it: My grandmother used to say "we pray for rain in Iowa and drought in Indiana."

Anyway, you can see the lack of concern most clearly in the fact that global wheat prices are now cheaper than before Russia walked away on July 17th from the Black Sea Grain Initiative:

2022 this is not....

For wheat you can also insert global corn prices as well.

The problems of climate change, the war in Ukraine and, most especially an immediate severe drought can all influence grain prices but are, at least this summer, unlikely to cause spike(s) like we witnessed when the war began.

It is somewhat sad to say but global markets and agri-businesses have adapted to the Ukraine conflict.

As usual, the real issue might be whether fear over staple grain price rises and associated hunger could lead to countries bringing in tit-for-tat protectionist policies.

For instance, India recently did this by banning the export of non-Basmati rice on July 20th. That quickly caused fears to ripple through the global rice market and even caused panic buying in countries like Canada and the US as people worry that prices will only rise further and supplies will be difficult to secure.

Though small scale for now, this kind of unhealthy cycle can show that it is government protectionist policies that harm the ability of free trade to supply the market that are the real threat to both inflation and global food security.

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.