The US Stock Market Is Rotating: What Does That Mean? And Will It Continue

The Dow Jones Industrial Average finally ended its win streak at 13 days on Thursday.

Incredibly, that makes thus streak the longest since 1987 which shows what an exceptional about face we have just experienced in investor sentiment. From people thinking the recession was a near-lock in March it had flipped to being a near impossibility by June.

It is likely somewhere in between but all of this reinforces just how truly dramatic the shift in expectations has been. Investors of all stripes, both passively buying stocks and actively hunting for bargains all over the public markets.

It also demonstrates there is a significant sector rotation occurring.

We have mentioned that word "rotation" few times over the last few weeks. Most recently, we pointed out in our introduction last week that the previously unpopular Dow Jones was outperforming both the S&P 500 and Nasdaq Composite.

Before that we argued that, if inflation was going to fall and growth was going to stay strong, then some very different types of stocks and stock market indices could benefit more than others.

This isn't just happening between indices though, it is also happening inside of them.

This was especially clear over the last month where the market's sectors that have done well all year long took a back seat while, instead, the companies and industries that have long underperformed has their moment in the summer sun.

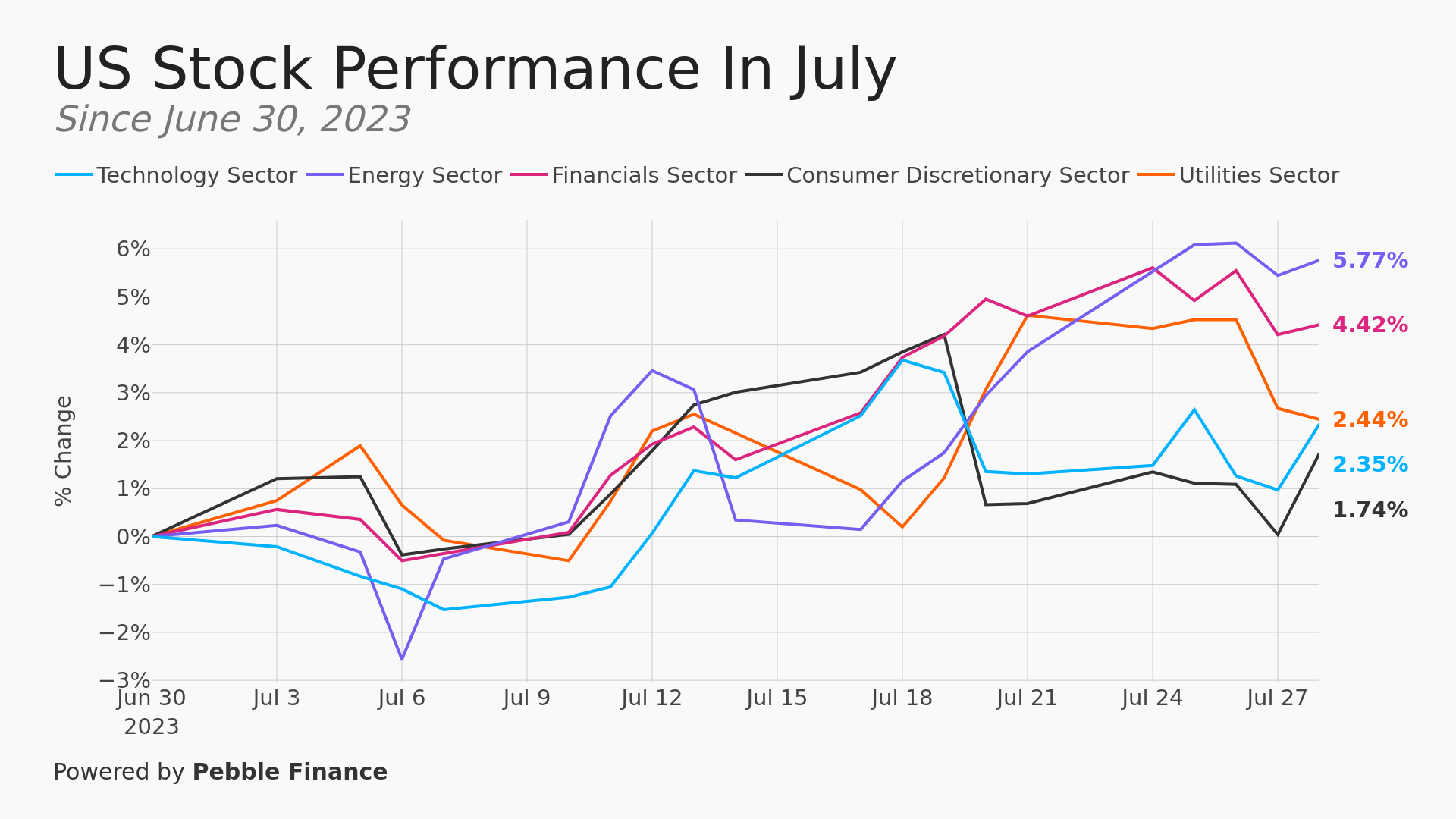

Here is a chart comparing some prominent US stock market sectors over the last month:

As you can see, energy and financials are easily and consistently outperforming the previously very popular Tech and Consumer Discretionary sectors last month.

This was almost exactly the inverse of the 6 months preceding it. Energy and financials have had a very poor 2023 until the last 6-8 weeks or so.

Truly a "the last shall be first and the first shall be last" type situation.

Interestingly and most importantly, this rotation has only gathered steam during earnings season when public companies are forced to reveal a lot of information about their operations.

Microsoft is a great case in point. They had their earnings this week and, guess what, they still make a ton of money.

However, the tech giant also disappointed versus the (sky high!) expectations and so the stocks had a "meh" week, trading down after its earnings before recovering later in the week.

That is decent though rough analogue for a lot of previously high flying companies. They are doing sort of "meh" while other laggards are suddenly doing very well indeed.

See the stunning performance of General Electric, for instance.

Why is all this happening?

There are a few reasons:

The first is, as we alluded to earlier, there is simply the fact that the economy is doing much better than expected.

We got further evidence of the fundamental strength of the US economy when second quarter's GDP number was released at 2.4%. That was leaps ahead of the 1.8% expected and demonstrates that the US economy is still both alive and kicking and also has a simply an uncanny ability to do better than professional economists are predicting.

Obviously, as expectations around that growth trajectory have changed then so have expectations for individual companies. It isn't just the biggest tech companies that are expected to do well from the incipient "Generative AI revolution" anymore. Rather lots of "regular" companies are expected to make more revenue from doing, well, pretty regular company things.

We made mention of this in passing during our airline piece a few weeks ago. In short, despite all sorts of problems in the travel sector - and they are real problems - they are not really harming airline profits overly. The reason? Despite the real issues around delays, cancellations and record heat, passengers are still clamoring to fly. In fact, record numbers of customers is allowing airlines to charge a lot more for many flights.

Those profits are reflected in US airline stocks which are up a collective 26% over the last 3 months which is more than double the S&P 500 so far:

Next up:

Another related reason is that other sectors and stocks are dramatically cheaper than the Super 7 Big Tech companies we have talked about so frequently.

By "cheaper" we mean that these companies are priced far less ambitiously for how much each company earns in revenue and profit.

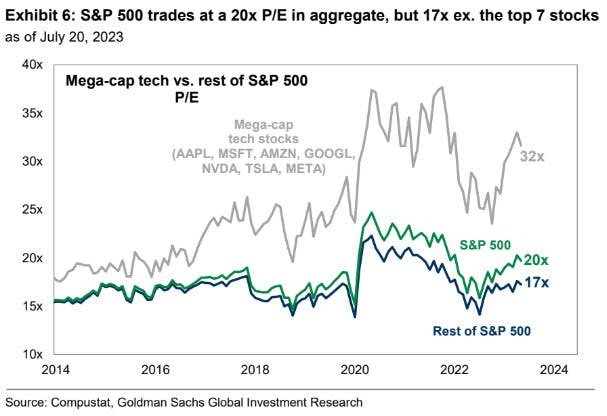

Here is what this looks like in practice comparing the price/earnings ratio for different groups of stocks:

Don't get to bogged down in what a P/E ratio. It is essentially tries to put a number down around how expensive a stock is by comparing its current price (the "P") with how much the company earns (the "E").

Essentially it shows that the Pebble Super 7 Big tech companies are at an average of 32 times their forward revenues while the rest of the S&P 500 is at a far cheaper and more palatable 17 times those same revenues.

The fact that the S&P 500 is at a 20x PE belies this simply HUGE shift and bears thinking about. A lot can be hidden in a simple average!

Lastly, the FOMO is real, as the kids say.

A lot of people - including many of the so-called experts and people not subscribed to this fine newsletter! - have stayed un or underinvested to the stock market all year. The fear was: inflation was still super high and interest rate hikes and the recession that would inevitably follow meant stay away.

We were more constructive than that but let that be a lesson to you either way, just stay invested.

Now a lot of those people - retail and professional investors - have a different type of fear: the Fear. Of. Missing. Out. As a result, many of them are chasing a rising market that keeps rising. Some of them are basically forced to because they are judged compared to a benchmark that is crushing them at this point.

This phenomenon has a few consequences:

It helps support markets!

It means that people will be looking for ways to catch up not just ride the waves.

It does weird things!

Investors hurrying to catch up can send even expensive stock prices higher still. Keep that in mind if and when it occurs. It arguably already is happening with chip maker Nvidia rising again and again even as Microsoft and other Big Tech companies have just tempered expectations about just when to expect significant profits coming from the Generative AI revolution.

Further, professional investors are not just behind but looking to catch up to the overall market that is likely the benchmark against which they are measured. This means they are hunting for companies that are cheap or, for whatever reason, could do well going forward.

Lastly, weird results can occur.

For instance Tupperware the unfancied and supposedly near bankrupt maker of plastic containers, rose over 200% in a few days this week.

Or take General Electric, a company that has been a disappointment this entire century that is up well over 70%+ this year and shows no signs of stopping.

The positive is that you can now do something about all this!

If you are nervous about just how sky high some of those Big 7 companies' stock prices have become you can easily exclude those 7 from your portfolio and just keep the cheaper (and rapidly advancing) rump 493 companies that constitute the remainder of the S&P 500.

If the market keeps going up, you will likely keep "catching up" as the arms of the pincers close between cheap and expensive stocks. Further, if the stock market corrects, what you own will likely fall less quickly and less overall compared to some of the VERY aggressively priced technology companies.

The broader rotation is on and cheaper stocks are not the only thing perking up and taking notice.....

*******

Have questions? Care to find out more? Feel free to Download our App (!!) or reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.