When Inflation Falls, Stocks Rise: Why?

Away from America's endless political pyrotechnics, we had another edition of the most important number in the world again this week.

It was good news, once again

US inflation fell for the month of May and continued a trend that has lasted nearly a year at this point.

The details:

US May CPI was 4.0% year over year versus 4.1% expected.

On a month-over-month basis it was 0.1% (vs. 0.2% expected)

Core inflation increased 0.4% month-over-month and was 5.3% year-over-year.

Add it all up and, while may not feel like it yet, this makes 11 straight months of US inflation declines. US Inflation peaked at 9.1% last June and has now fallen by well over half just under a year later.

That is a great trend. It means that, as this newsletter has argued before, we can increasingly move on from what was the most concerning economic trend out there and also perhaps the single biggest driver of asset prices around the world.

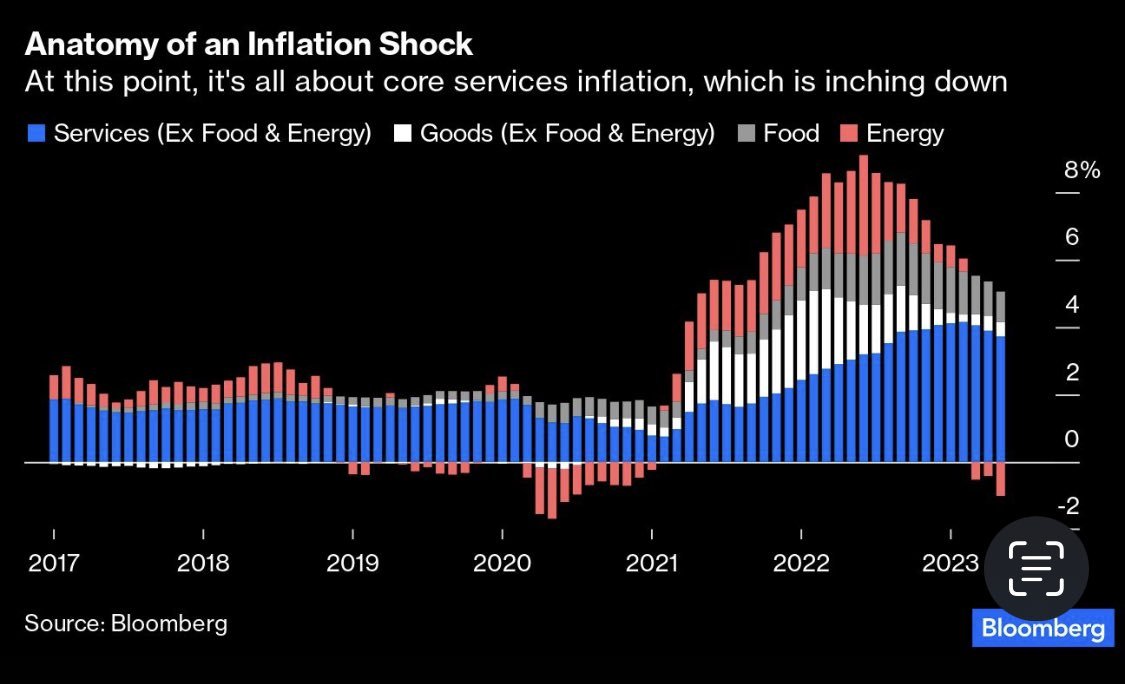

Here is what an ebbing inflation shock looks like:

As this graph makes clear, one of the most striking things about this collapse in inflation is not just how steadily it has progressed but also how quickly it has unfolded.

In fact, the fall in inflation has been even faster than its rise which is remarkable. At the time of writing, over 42% of the CPI basket is now in deflation. i.e.: the prices of those items are falling rather than rising.

We might expect this in an economy that was really struggling but not in one that is still growing relatively strongly and adding new jobs.

Here is another simpler and more impressive way of visualizing the overall trend since the peak last summer:

Taking a step back, there are two important takeaways on the above chart(s) and, interestingly, they are partially in tension:

The first and most obvious is that as inflation has steadily receded, stocks have continued to rise.

The second point is that, as the chart makes clear, goods inflation has nearly entirely disappeared but services inflation still remains strong.

On the first, just remember that the reverse development would almost certainly be true.

On the second, stubborn services inflation is especially the case for the lagging shelter component (housing or rent) which is over a third of the CPI basket. As you may remember this component typically operates with a lag which means it takes time to rise OR fall.

There are A LOT of assumptions that this will also come down and there are obviously some evidence that it will. But just be aware that if that proves either more difficult than imagined or outright impossible then that assumption will quickly reverse.

What about the future? What should we expect going forward?

Good question!

As a practical matter, it obviously raises the question of whether we are simply done with interest rate increases here in the US?

In short, no. It strikes us as very unlikely.

This belief is the case regardless of whether it should be over or not which we would also argue against. Inflation is still high and the economy is still growing. That argues that more increases in interest rates are both possible and advisable. As we have said before, the Federal Reserve cannot afford another mistake and they have the justification to keep going.

So, the day after the inflation print, the US Federal Reserve held interest rates steady but already there is speculation that they will continue to "hold serve" in July.

So, will they?

Tough to say but we doubt it. After the banking issues this spring, the call for the June pause was very clear. As those worries recede, so does the justification for the pause.

The US central bank will continue to be nervous enough that inflation will become "sticky" and entrenched. That suggests hikes will be back on the menu shortly.

Lastly, why has this all happened? Why has inflation fallen so quickly and consistently?

There are a few significant drivers but if we had to pick one it would be the collapse in oil and energy. This is something we have stressed before but it is worth repeating.

The steadily falling price of oil has been like a huge release valve for the entire world and especially the global consumer. Nothing puts a bit more money in your pocket than spending less of your income on heating your home or filling up your vehicle or simply lowering the cost of every day items.

And, so far, the fall in energy has been the single biggest reason for the fall in inflation.

See here:

This looks set to continue. On Friday, the average price of a gallon of gasoline was around $3.59 in the US according to AAA. A year ago the price was over $5. In some high tax coastal states it was nearly $7 or higher.

Why did this happen?

In short, global demand hasn't been there. China's reopening has been far weaker than expected and their economy is in serious trouble. This has meant that there has been simply less oil consumed than many analysts expected (including this newsletter).

Furthermore, there has been plenty of robust supply as well. As we have pointed out, despite sanctions and the "ban" in Europe, Russia is quite happily exporting record volumes of oil to finance its ruinously expensive war in Ukraine.

It is pretty simple, more demand and less supply has led to a huge easing in the price of energy. Ironically, this declining price is leading to greater stress and budgetary pressure in Russia and plenty of other oil producing autocracies.

Perhaps we should all thank Xi Jinping and his disastrous management of the Chinese economy? You first....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.