2023 Theme: Why Does The Stock Market Keep Rising?! And Will It Continue?

In one word: positioning.

This is super basic and sort of "well, duh" point but also intuitive and often very powerful factor that frequently drives asset prices.

Succinctly, if a large majority of investors are positioned one way and then, for whatever have to change, it can lead to a huge shift in prices. This can be especially the case if they are waiting for something specific to occur and then it doesn't and everyone has to stampede from one side of a binary issue to the other.

This positioning point also dovetails with what we mentioned last week about surprises. If investors expect something to occur then they will logically position themselves for it happen. And if it doesn't, they will find themselves caught out and have to change their views and also, how they are positioned in the market.

It is like when you pack for a Memorial Day Weekend trip to the beach expecting sunshine and warm temperatures but instead discover nothing but rain and brisk sea winds. That likely won't be a fondly remembered vacation but more importantly than that, you may need to go and buy some rain gear.

People are finding that their portfolio is like that long weekend suitcase: full of the wrong clothes. In their case, the asset mix is wrong. That doesn't just leave them wet and miserable, it also sends them out into the market to do some shopping....

As we alluded to above, investors being wrong footed most often happens around a binary event. The 2016 US Presidential election or the Brexit vote in the United Kingdom are great examples. In both cases, the majority of investors thought that one particular outcome was more likely and then suddenly discovered they were quite wrong.

When it became clear very late in the evening (or morning depending on your time zone) that Hilary Clinton and Vote Remain would both lose then the previous assumptions were shown to be false setting off a mad scramble in financial markets around the world.

Got it. So, what is happening this time?

Well, everyone has been waiting for a recession. And so they have been positioned for such: i.e.: defensively.

The reason for this was simple: everyone believed that the brutally high inflation would force the US central bank to increase interest rates very quickly. This tightening of monetary policy would, very predictably, cause something to break in the economy unsuited to rapidly rising interest rates (like, say, a bank) and this would, in turn, send growth sharply down and the economy would enter into a recession.

The expectations was:

Very High Inflation -> Interest Rate Hikes -> Medium-Sized Bank With Bond Losses From Those - > Bank Run/Failure -> Tightening Of Credit Conditions -> Recession.

All of that has happened except for the recession part.

In fact, as this newsletter has faithfully recorded, the US economy has not cooperated. Instead of growth plunging as rate hikes have quickly stacked up, it has instead stayed either robust or gently slowed, depending on your lens.

That wasn't just unexpected. It is also proving very expensive. The reason is that many investors have been waiting for a recession for well over a year. Like the rain or a bus, one will eventually arrive but every month that investors have been positioned for it to arrive and it hasn't, has been costly almost no matter who you are or how your portfolio has been constructed.

You might feel like a fool if you head to the beach and it rains and you forgot your umbrella. But it can feel equally foolish to show up prepared for a storm and be met with a perfectly tranquil sunny day and you didn't bring your sunscreen.

As the quote at the start of this newsletter reveals, it can be very, very difficult to watch others get rich and stand on the sidelines and do nothing. Misery loves company for a reason. Misery next to complete and utter joy is intolerable.

Losing money is very hard under any circumstances but there might be nothing worse than watching something you could have easily owned zoom upwards. And keep in mind, a stock can only lose 100% of its value on the downside but it can easily gain many multiples of its present value to, well, infinity.

That asymmetry is present in a lot of investors minds, even if they do not realize it.

Every day you wait feels like another day of lost wealth and so even though you likely know that it could be a mistake. As kids say these days, "the FOMO is real."

We have written about this phenomenon before and you saw this "Fear Of Missing Out" on Wednesday of this past week where US chipmaker Nvidia, a company that had already appreciated well over 100% this year, reported earnings and jumped another 25% after hours as investors piled in having already missed 100%+ gains this year.

This mismatch between expectations and reality obviously happens all the time but the key differentiating factor is timing. It isn't always immediately clear that you are wrongly positioned. Unlike the US Presidential election or Brexit, with many events can often take weeks or even months to demonstrate that the majority opinion was wrong.

Investors have been patiently waiting for that recession and holding out hope month after month.

When this slow unfolding occurs - as it likely has in this case - the very opposite happens. Rather than a large jump one way or another you instead get what you have had of late, a slow but very steady appreciation in equity indices.

That "grind higher" is very painful because it never feels like conditions have really changed for the better and so it is difficult to have a lot of conviction either for or against. In fact, it is often far easier to be negative. There are plenty of threats out there and the imperceptible slow improvement is hard to get behind.

Today is exactly like this scenario. As this newsletter has faithfully documented, today, there are many possible threats to economic growth (and therefore market performance) but gradually they have fallen by the wayside and stocks have continued their grind higher.

This dynamic has been at work for months. The bank failures were only the most example. The bears hoping for a recession finally thought their time had come only for the market to stabilize and then begin rising again....

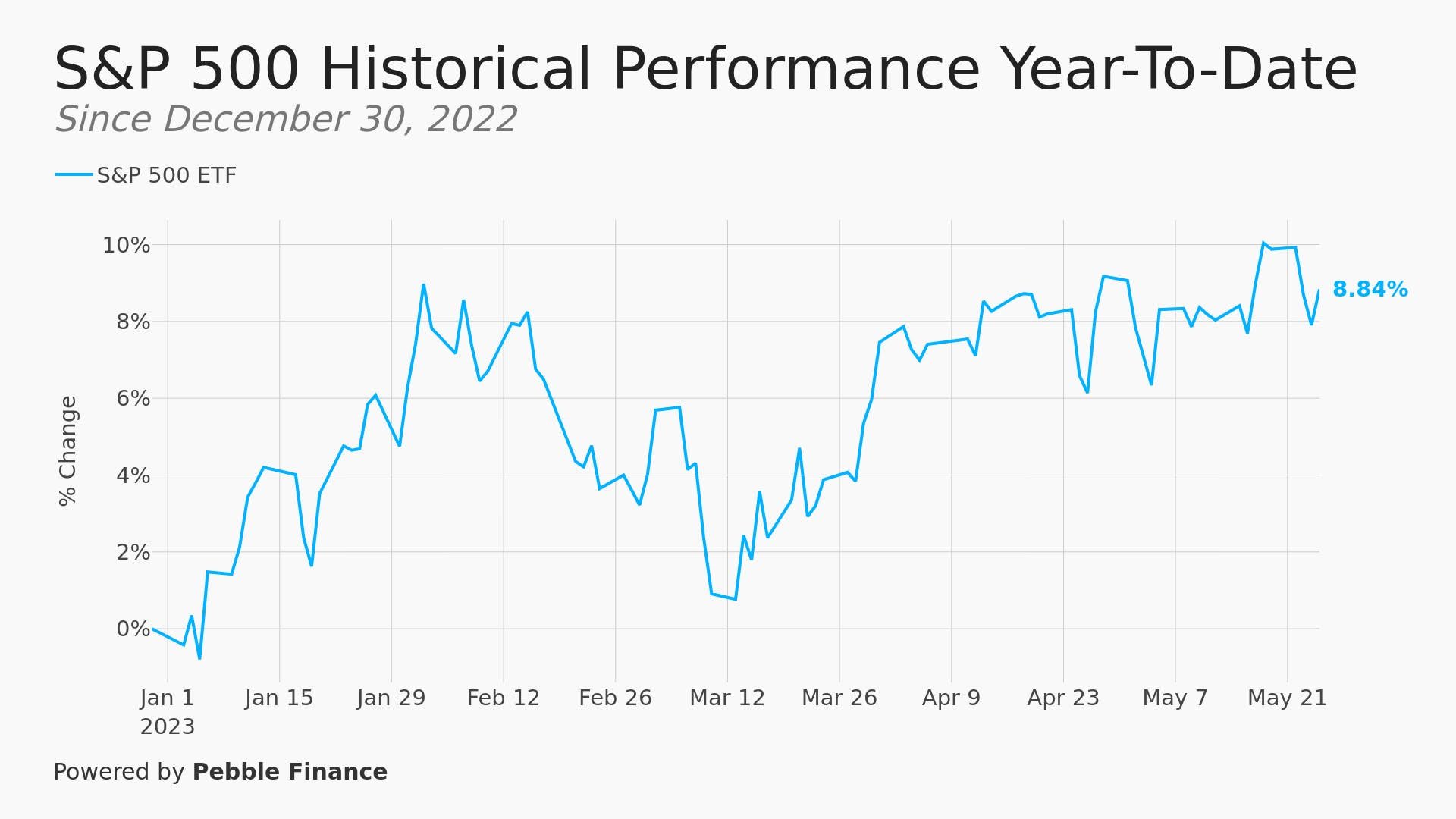

The S&P 500 is now ABOVE its pre Silicon Valley Bank high:

We have somehow shrugged off a whole banking crisis with multiple (very large) bank failures.

Slowly but surely that negativity is proving to be very costly for investors who are either a) underperforming their targets and benchmarks or b) simply sick and tired of watching others get rich.

In other words, it is less about conditions being that favorable for stocks and more about investors being underinvested in stocks and feeling they are missing out or what is now around a 10% return, year-to-date. 10% is not nothing!

This isn't just retail investors either. As a timely report from Goldman Sachs revealed this week, most mutual funds are underperforming their benchmarks largely because they have shunned Big Tech stocks this year. That is a problem for professional managers who must now try and chase and either catch up or possibly face the music at the end of the year.

Imagine trying to explain to your boss that your bright idea for 2023 was NOT to own Apple or Microsoft or Nvidia, three of the world's strongest, richest and most innovative companies.

One of the lessons here is to be very careful about just going along with something just because "everyone knows that...."

In this case, "everyone knows that really quick interest rates increases will cause a recession just as quickly" has proven stubbornly wrong for well over a year. Eventually an economic downturn will occur but the longer it doesn't occur raises the probability that an epic bout of FOMO could cause a mind bending rally to occur.

Regardless of whether they are negative (rate increases = recessions) or positive (stocks only go up) these types of market assumptions are always dangerous but humans can't help but fall in love with narratives about how the world works.

And that brings us to our next story....

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.