Why Are Market Narratives So Important? And What Is The Dominant Narrative Right Now?

Human beings love stories. It is how we invent our world and give the incredibly rich and nuanced reality around us some context and structure. It helps us understand and also arguably keeps us sane. We are also engaged in a constant struggle against uncertainty and so it is not a surprise that human being have used their greater intelligence to create shared stories, myths and the values that are associated with them.

Investors are no different. They love and use stories all the time. There is nearly always a dominant story - and a dominant set of assumptions behind them - and, as this newsletter frequently discusses, you should be very, very careful about blindly swallowing them.

As we have detailed above, one narrative to describe 2023 so far might be:

US share prices gradually overcome widespread fears of an economic recession.

As we have detailed many times, the resilience of the US economy and in particular its labor market has kept Americans employed and therefore spending money, especially on services. This, in turn, has propped up company profits especially as they have been able to pass along impressive price increases to the end customer. i.e.: you.

Another narrative, however, might be:

Excess savings from pandemic-era earnings and government fiscal transfers have propped up the US consumer and allowed them to ride out inflation and keep spending, against expectations.

A strong job market, lower energy costs this year and high savings over the last 2 years have enabled American consumers to keep their spending level high even as inflation eats into their living standards.

But perhaps the simplest narrative to explain this year performance - so far! - might be:

We are witnessing a classic mania around a very small group of artificial intelligence-related companies.

You might not have noticed until very recently but really all year long, a huge boom in the price of artificial intelligence (hereafter AI) company shares has represented nearly the entire slice of the S&P 500's ~10% return throughout 2023.

This isn't an exaggeration whatsoever. As of the time of writing, Apple, Microsoft and especially American chip manufacturer Nvidia account for ~65%+ of the S&P 500 gains for the year.

i.e.: When you look at the S&P 500 being up ~10% for the year. 65% of that 10% is down to 3 stocks.

Stunning.

Here is what that looks like graphically since the end of November of 2022:

We have written about the rise of Big Tech (against our expectations) earlier this year here.

The reason we picked that date is that November 30 was that this lines up with the release of OpenAI's incredible ChatGPT product. The arrival of this new tool and the excitement about its potential has caused a dramatic reevaluation of some of the biggest and most advanced tech companies.

The reason is excitement that an entire new industry could - and we stress that word: could - lead to both new businesses and dramatic higher profits as "generative AI" causes humans to become ever immersed in a virtual world that can not just provide better answers, but increasingly do a lot of thinking for them.

The list of companies expected to gain - so far - is very short and ranges from Microsoft that has invested significantly in OpenAI and has signed a deal to integrate OpenAI's products with their own, to chipmakers like Nvidia that produces the GPU processors (especially their A100 and the subsequent version, the brand new H100) that power so much of what makes this technological revolution possible.

Nivida's H100 cost $40,000 a pop and are used to train so many of the large language, video and image generative AI models that are changing expectations about what is possible. Its stranglehold on that niche and the expectations of the investment in this sector as well as the company's announcement that it expected to make ~54% more over the three quarters to July sent its shares - already up over 100% for the year - up another 25-30% in a few days.

This added nearly $200 billion to Nvidia's market cap in the matter of days. It is now worth nearly $1 trillion joining a very select group. For context, that $200 billion additional jump is larger than many entire companies in the S&P 500.....

The idea behind NVDA's sudden popularity is that, in a gold rush, the smart move is to own the company that provides the "shovels" to the miners rather than try and pick whatever company succeeds in striking gold.

That ^^, of course, is another popular market narrative.

We first wrote about Nvidia in December of 2022 arguing that the company seemed like the answer to every question.

Nvidia is a shovel maker par excellence because it has a monopoly on a key implement for finding AI riches. Google and Microsoft (and others) are the miners, in this analogy. The thinking is Nvidia will sell to all of them indiscriminately and profit regardless who ends up with the artificial intelligence-derived gold (though not to Chinese companies, we should add. No H100's for them....)

It isn't just these 3 companies that are benefiting but, to return another theme of ours, largely the very largest tech firms. Big, as we have mentioned a few times this year, is very "in" right now.

Here is a list of the "Super 7 companies" that also exist on our app as a dedicated theme. Click here to see some new functionality.

These 7 are Apple, Microsoft, Nvidia, Meta, Google and Amazon that are all expected to have the scale, the market size and the research budgets to be able to compete and eventually win the contest to dominate the generative AI space.

Whether that happens, however....

Another term for this is that we are experiencing a tremendously narrow market.

Here is what narrowness looks like:

This is a color coded snapshot of a days performance in the S&P 500 (taken on Thursday afternoon) with the size of the square correlated to the size of the company and the strength of the color related to how they are doing.

Here is another way to frame this narrowness:

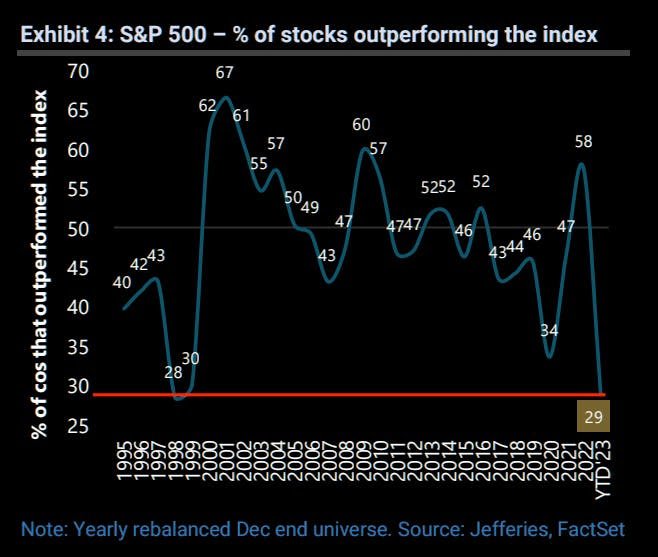

The S&P is up ~10% for the year but the number of names actually rising is very small. The number of companies in the index that are doing BETTER than 10% this year is at nearly a record low:

There are a few takeaways from this picture:

Indexing is a good idea! Owning the whole index, as we always suggest, saves you the risk of missing out on these types of experiences.

Conversely, this also underlines the tremendous difficulty inherent in stock picking. If you are buying and selling single name stocks you better be able to consistently pick correctly.

A few "AI" stocks are experiencing a true mania. By that term we mean that their share prices are disconnected from their company's underlying company. For instance, Nvidia now trades at 37 times its current sales and 202 times its current earnings. That is not "to the moon" territory but rather "to Saturn" land.

Timing is very difficult here. This mania could last for awhile as it is driven by human psychology and that is impossible to accurately model and very difficult to predict. Once company share prices are divorced from reality it can be very hard to know with any certainty when too much is too much and will require some sort of event to prick the frenzy.

Lastly, narrow markets are typically vulnerable markets. Be very careful. Manias only add to this vulnerability because it can. Narrow markets and manias both tend to end in the same place: with a sizable move downwards in the broader market.

On the vulnerability angle, just to reinforce this point: this past Thursday the tech-Heavy NASDAQ index ROSE by over 2.5% for the day., However, the number of companies in the index that were above their 50 day moving average FELL from 50 to 47. That is tough to do and speaks to the great narrowness in this rising market right now.

That is like a huge warning sign flashing over this steadily rising market. The reason being that if sentiment changes on only a few companies then the overall picture for the entire index could suddenly be proven far moire vulnerable than appearances had suggested.

It is the ultimate "castle built on sand" scenario.

Here is how famous market historian Charles Kindleberger defined a mania in his eponymous book on the subject:

"Manias and panics, I contend, are associated with general irrationality or mob psychology."

As Kindleberger's argument suggests, the mob could push this pretty far and do so very quickly to boot but it could fall just as quickly. Already people will be very tempted to short Nvidia at these levels. Remember our earlier point about positioning. If everyone owns and then decides to sell...

We have recommended caution a few times over the last month as there is less and less good news to price in and more and more reasons to be very careful going forward.

How to put this vulnerability together with the earlier point about the market grinding grinding ever higher?

Well, we have been ambitiously positive about the S&P 500 and broader US equity markets all year until very recently. As the good news around profits and recession has become "priced in" that has changed.

We didn't count on a full on speculative mania around the Super 7 and AI stocks but that doesn't change the fact that the S&P 500 is only becoming more, not less narrow, as this mania takes hold. Every percentage point that the market heads higher led by only a few companies make it more, not less vulnerable.

The index may rise every day but the gains are not broad based. Rather it is very few companies surging. Sadly, no matter how high Nvidia's share price rises, it will likely not help other, non-AI companies.

Beware.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.