Omicron Update #3: What Does The Latest Information Mean For Stocks

We would prefer not to have to talk about the Covid-19 coronavirus Omicron variant but it is difficult to find anything that matters more at present.

As before, we will really just focus on the two key variables:

The first is that the transmissibility of this variant of the disease continues to be incredibly potent.

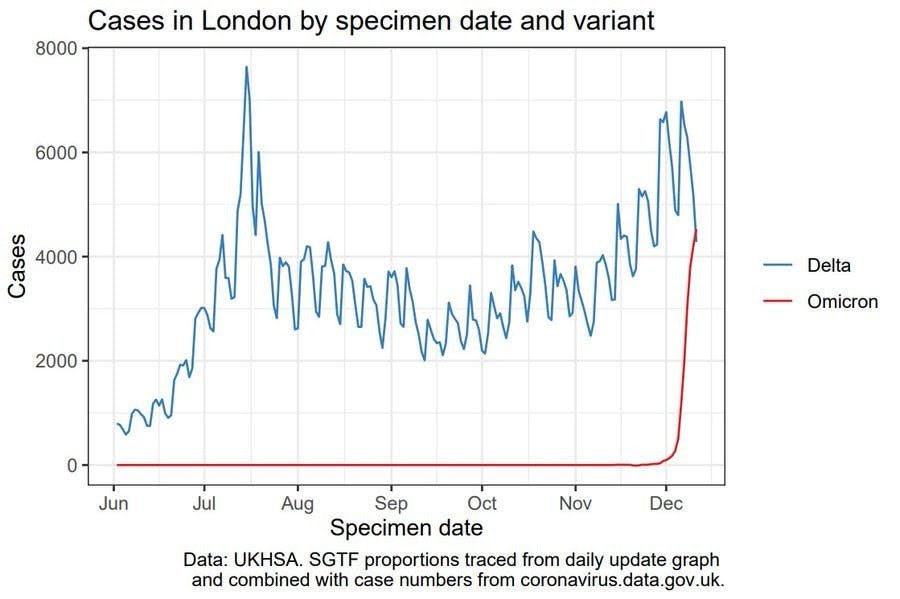

Here is the chart of London's cases this week to illustrate the scale of the problem:

via Theo Sanderson

London reported nearly 80,000 cases on Wednesday. This is a single day record for the entire pandemic and over two thirds of these cases were Omicron.

As we have repeated before, there is still lots of work to do on this version of the virus but it is becoming clear that the innate contagiousness of this variant is far, far higher than anything we have seen in this pandemic.

Technically speaking, it seems as if the number of people who will get infected by a single individual is called the effective reproductive number or "R".

The UK government released a technical briefing on December 10th where they suggested that the R number for the Omicron variant was 3.7. So, 3.7 people per infection. Others have suggested it could be as high as 4 or 5.

That is why that London graph is so parabolic. The virus is spreading faster and more effectively than it ever has before. But that isn't the only key piece of information to consider:

The second variable, as we have covered earlier, is that so far, this variant still seems blessedly less deadly.

Below is the latest data from the Gauteng province of South Africa where the variant emerged and therefore has the longest running data:

This graph is a bit messier but it shows the South African case numbers rising but both the ICU percentage and the number of patients on ventilators have both fallen steeply.

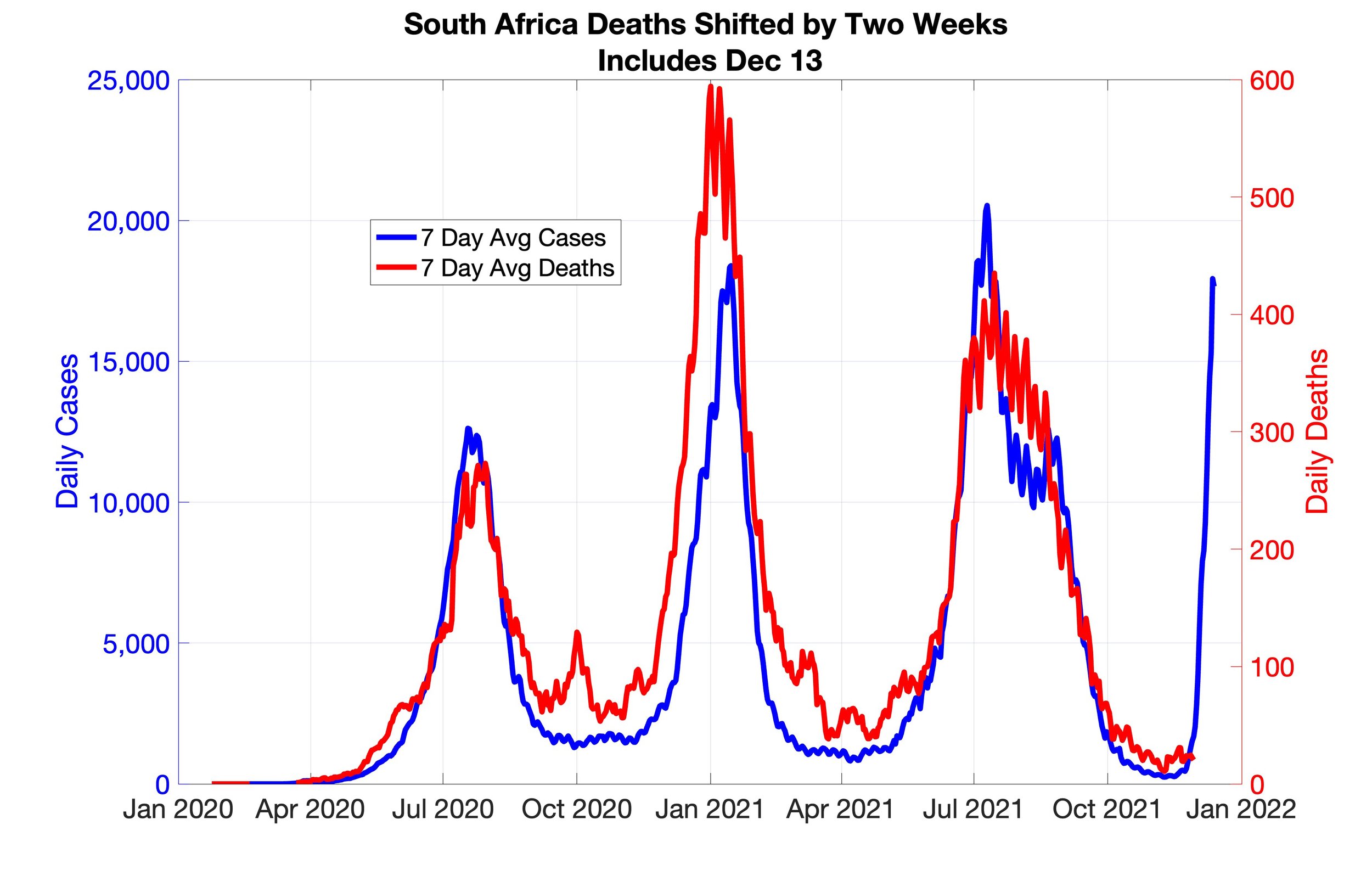

Lastly, the all important South African case rate vs fatality rate is also pretty clear and very welcome.

The red line of deaths and the blue line of cases have very clearly diverged:

So far, it seems as if age-adjusted mortality rates for omicron in South Africa are running at only 1/5 of prior waves:

This is very welcome.

For now, we are focusing on South Africa above because, thanks to it being Omicron's origin location, there is more and, crucially, longer running variant data in that country.

We will expand this is in weeks to come, if it stays relevant.

In summary, what information we have continues to show the disease becoming endemic (a negative) but also less deadly (a positive).

Where does this leave us?

Not too much has really changed from our earlier analyses. The variant is proving nearly impossible to stop at this level of R and so the answer must be to continue to vaccinate (and boost) individuals who require it so that everyone is protected against the latest version of Covid-19.

Zero covid policies will likely not work and while some more restrictive policies will likely come into place, the best protection for nearly everyone will be the immunity that either catching the disease (unwise) or vaccination confers. The biggest change may be simply that people will do less out a sense of caution or fear.

This may be not be the merriest of Christmases for a lot of people.

Thanks to this more modest economic activity, it will be difficult for the market to make new record highs, let alone advance strongly, as long as the fear of lockdowns, travel bans and people modifying their behavior from yet another coronavirus wave. Defensive sectors and covid friendly stocks will continue to come back from the dead.

The rotation from some sectors (such as tech) to others that do well under higher interest rates (such as financials) AND pandemic spending and nervous investors (healthcare) will be the prevailing mood until more clarity about Omicron's impact is available.

Whether that will be weeks or months is a big question we will return to in the New Year.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.