Bitcoin Bust: If It Is Not An Inflation Hedge, Then What Is Crypto Good For?

In January, we wrote to someone in a personal capacity that, "every time I saw the Matt Damon crypto ad I need to do everything in my power not to run out and short every single aspect of the entire industry."

If you don't know the ad you are a) lucky and b) it can be found here:

The tagline was - shudder - "Fortune favors the bold" and was part of an entire genre of ad campaigns in which highly paid A-listers cashed major checks from the roster of newly flush crypto enterprises.

It was a classic "arriviste industry most people don't understand tries to buy quick credibility and familiarity with familiar faces" scenario and one that represented, as we are now finding out, the top of a certain type of folly.

I was kindly reminded of this utterance this past week when a loyal reader sent my words back to me with the fact that Bitcoin has fallen 55% since the ad debuted and 35% since my January remark.

The idea here isn't particularly to hammer Matt Damon. After all, he is hardly alone. Everyone from Tom Brady to Spike Lee to Reese Witherspoon to Lebron James and - shudder again - Kim Kardashian have shot similar campaigns for other crypto companies.

The main takeaway from the Damon angle seems to be that if a celebrity as thoughtful and careful about his image and reputation as the actor at the heart of the Bourne franchise got pulled into such a campaign, then his payoff must have been exceptional.

And that really feels like the theme here. The crypto world was, until very recently, so awash with cash that even sensible people got pulled in - by the potential payoff, by the allure of being part of the movement, by the cool kid vibes, by the marketing or, just, like Mr Damon or Mr James, by the fact that someone waved a check so large in front of you that it was impossible to turn down.

We get it.

It is very unlikely that your humble author will ever come close to Damon's career, let alone reach or wealth but in the event that such a trajectory does occur, we firmly hope that we have better sense. But we are hardly THAT assured in our will power.

Even in the 21st century, money is still money.

But all of this tut-tutting and celebrity commentary is secondary. The main point is that alongside the present stock market declines, we may also be finally witnessing the meltdown of the last post-Covid financial bubble.

The decline has been swift, though somewhat delayed compared to many other assets:

If you had invested with Mr Damon's crypto.com into Bitcoin on the day it first erred with $1000 you would have less than $500 barely just over 6 months later. That doesn't just feel like a lot. That is a lot.

Crypto currencies are, in many cases, the final domino of the Covid excesses to fall. The industry is joining the meme stonks, the extra-ply toilet paper resellers, the lockdown stocks like Zoom being worth more than Exxon and the idea that a clip art image of a rock was worth 1.3M dollars.

This subsiding crypto bubble is generally to the good. The longer a bubble lasts the more collateral damage it can wreck. But it isn't an absolute good. It is of the relative sort.

Because the very real costs of this action is only just starting to be tallied.

Despite the uncertainty around the final bill there are three basic conclusions that can already be drawn:

The costs will be massive. And there is a real question about how much damage will spillover into the real economy.

They will fall unevenly and largely on the poor, the ignorant and the desperate.

These losses were partially and perhaps largely unnecessary.

The point about financial contagion we will flag as potentially critical and will likely return in the future. It could be big.

But it is the last point that we have been thinking about the most.

The first conclusion is that already well over a trillion dollars in wealth has evaporated. The second will be as true as it always is in these situations.

But these unfair losses could have been lessened. After all, they happened largely to regular people. People without private bankers, accounts in the Caymans or the capability to make things happen in haute finance.

And there are people charged with protecting this same constituency. After all, we have a large and very powerful regulatory state in this country. One that has grown ever larger in the post Dodd Frank era.

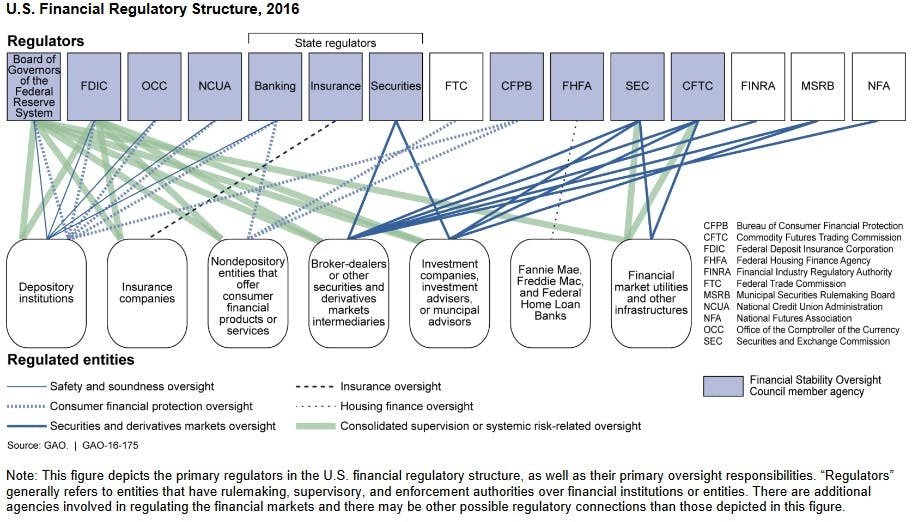

What is the raison d'etre of the alphabet soup of regulators, oversight bodies, boards and institutions that populate our capitol's broad avenues and spend their days producing voluminous reports and rulings?

What, in other words, is the point of all this?!

This also isn't a political point. Responsibility (or the brazen lack of it) most certainly falls on both US political parties but that is also a distraction. The criticism is also larger than who was sitting in this chair or that.

What is the existential purpose of a regulatory state that does everything but regulate effectively? If institutions do not exist to protect the poorest and least able to afford it then what is the point of these institutions?

And we haven't gotten to whether there will be wider contagion than just the poor folks who bought a jpeg of a cat with their life savings.

Crypto also isn't exactly a new issue or threat. Your author was first tasked with presenting on Bitcoin to a former employer in 2012. 2012!

We must do better here. Government rarely works well and never works efficiently but if it is going to be ham fisted, it might as well at least protect our most vulnerable rather than endlessly prevaricate.

Is it any wonder that people have lost their faith in the state when the newly created "Consumer Financial Protection Bureau," a key new post-Dodd Frank institution has been singularly unable to protect consumers from this financial alchemy?

Two final thoughts:

1) Before the hordes of crypto admirers among our readership write in and argue that this isn't the end of cryptocurrencies or the blockchain or the wider industry that has sprung up around them, we agree.

It is a cool technology and will eventually resurrect itself, hopefully in a new and more regulated form whereby there will be more emphasis on real creative innovation and less on pure financial speculation.

In fact, our assessment is that, structurally, exactly this type of bloodbath is necessary to bring in proper (any?) regulation, drive out the scam artists and criminals and help the true innovators and entrepreneurs properly answer the overlooked question:

What are crypto currencies and decentralized finance actually good for, in practical terms?

It can't just be a get rich quick scheme.

We just feel both regret and frustration over the fact that this clarifying moment had to mean so much real financial pain for millions of people who, unlike most of the industry, can't truly afford it.

Disagree with us? Great! Email us at contact@pebble.finance and let us know what you think and also there are plenty of hefty discounts out there.

2) Despite our bright idea, there was no investment placed against the price of Bitcoin or crypto.com or any other aspect of the industry. That is.....disappointing!

There are no points for bright ideas, not executed. In fact there are negative points because you spent time coming up with an idea you then didn't implement.

Ideas are cheap. Execution is hard. And there are no prizes for woulda, coulda, shoulda.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.