Shipping Logjams & Rising Sneaker Prices

US inflation may indeed be transitory.

That scenario could even be likely. The pandemic re-opening boom happens, companies re-stock and people go out and enjoy life, the right stuff is in the wrong place and there is a hectic period where prices bounce back hard and then companies scramble to add more capacity.

This is how capitalism is supposed to work, at least in theory. The market hits snags but then gradually works itself out. Supply rises to meet greater demand as if guided by Adam Smith's famous invisible hand. Happy days are here again.

The good news is that price rises moderating is happening in some places. Lumber is a very welcome one. Food is another. There are others.

The bad news is that there are some sectors that this does not appear to be occurring. Shipping is one. And an important one.

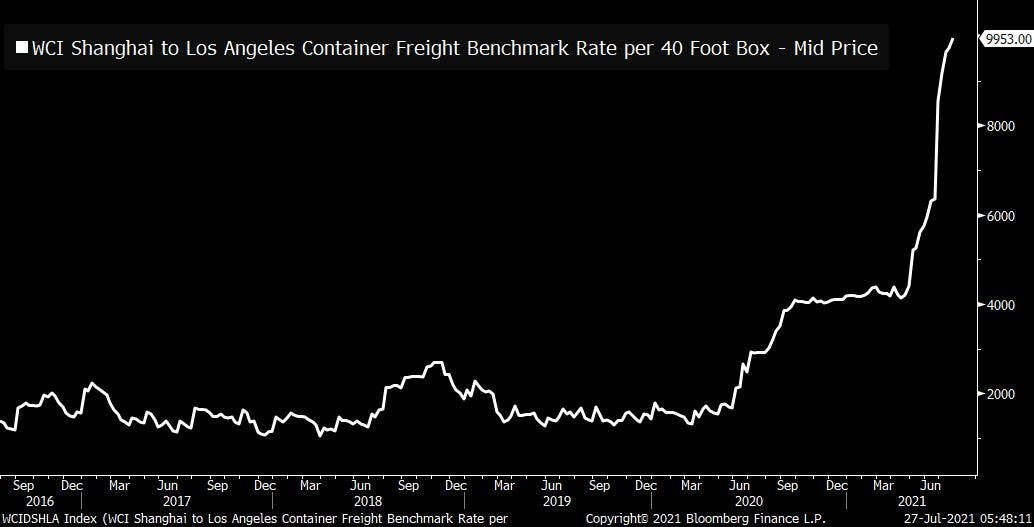

We talked about shipping way back in Pebble 2. The early days! Well, shipping costs are still very high (see Chart 1).

In fact, since then they have only risen.

At present, these costs are not just expensive relative to recent expectations. They are all time expensive. For context, the daily spot rate including premium surcharges for a 40-foot container from China to the U.S. West Coast as of Wednesday was $18,346, compared with about $2,680 last July and $1,550 in July 2019, according to the Freightos Baltic Index.

Why? Well, the combination of:

Covid outbreaks in vital ports.

Logistics bottlenecks along routes with ships or containers or both in the wrong place.

Many businesses trying to order and re-stock all at once.

In combination, these issues are proving tough to overcome quickly or cheaply. So, costs are staying exceptionally high.

In the past we mentioned that these shipping delays may severely challenge the vital holiday season in the US. This is still true. Toy prices are going up and there will likely be shortages of tinsel. Forewarned is forearmed.

But there is another, more immediate problem now facing many businesses: the back to school shopping rush. Especially for one item in particular: sneakers.

Covid outbreaks in Vietnam - which produces over 50% of sneakers for brands like Nike and Adidas - are snarling sneaker supply chains and leading to shortages across the industry.

So, inflation may be transitory. Jay Powell and the Fed may be correct but that won't help you out if you are hunting for a new pair of running shoes or looking to get your kids some fresh kicks.

Sadly, the hypebeasts have noticed as well. The sneaker re-sale market will likely be rising and limited supply will become further limited - at least over the short term. For now, remember that the early shopper gets the Nike Air Force Ones and may the odds forever be in your favor.

Chart 1:

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.