Is The Job Market In Trouble Or Not?

As our introduction discusses, with layoffs piling up it can easily feel as if the sky is truly falling for the US economy.

That could still happen but it is worth keeping in mind that there are a number of positive indicators as well. They may just not be getting the front page treatment that prestigious companies firing thousands of highly compensated employees receives.

Negative news sells. There is limited mileage you can get out of news stories like : "Hey, the legendary American shopper is still shopping till they drop!"

But aside from media we think the preponderance of evidence suggests the economy is actually doing pretty well and perhaps even improving.....

What is doing well? And improving how?

Well, for instance:

The US labor market is still strong. The unemployment rate is at a 50 year low.

Indeed, that "legendary" American consumer is still strong and consumer sentiment is improving as inflation ebbs.

The widely predicted deep recession in freight and transportation rates and volumes hasn't occurred.

As we discussed last week, even the housing market could also pick up if interest rates continue to ease. Homebuilder stocks have started the year very well and confidence may follow if interest rates fall rather than rise.

Perhaps most amazingly is the fact that crypto prices are also rebounding and we are not just referring to Bitcoin. Shiba Inu, a joke "shitcoin" is now collectively worth over 6 billion.

It is true that there are also negative data points. For instance, millions of Americans are apparently falling behind on their car payments but right now, on balance, it would seem as if the economy is still hanging in there.

As we wrote at the outset, you wouldn't know this from the steady stream of negative headlines however and so we thought we would examine the core of those headlines - the US labor market.

The top line takeaway is probably something like:

While there are some signs of cooling in the US labor market, generally it remains very robust.

The fact that the job losses are, so far, being concentrated in wealthy and high profile companies and positions means they are getting a lot of attention (especially in elite circles) but they aren't necessarily more important than other jobs.

In fact, they may be distracting a lot of commentators, analysts and media elites from the real story out there.

Overall things are pretty good in the US jobs market.

Not very sexy perhaps but this is nonetheless a pretty important point!

For those who live in a highly educated coastal city it is likely that these much publicized layoffs will be hitting close to home. They could even be affecting you personally (we obviously hope not). But for much of the country and most employees these news stories are just that, headlines. They are negative but the news is often negative. Last year's inflation has been replaced by this year's labor market retrenchment.

Here is some evidence that things are pretty good:

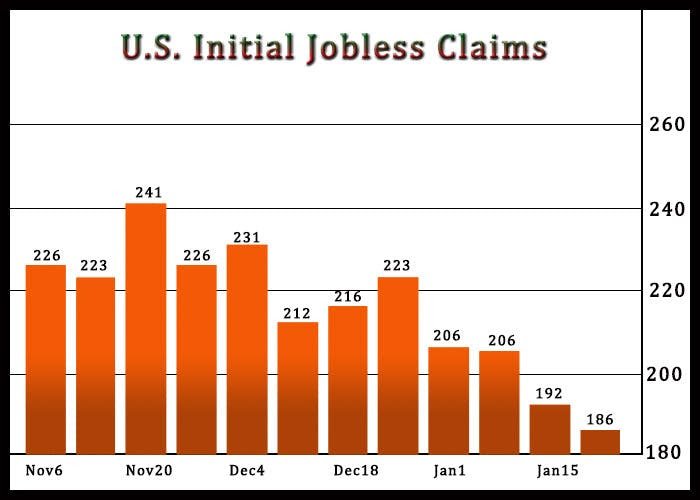

First, it is important to remember US Initial Jobless Claims continue to go down, not up. In fact they are at a record low. An Initial Jobless Claim number measures the number of individuals who filed for unemployment insurance for the first time during the past week.

Second, there is also the fact that many companies are still hiring. Many are even hiring for the many open technology positions they have according to Indeed.

They got less press this week but there were a handful of other announcements alongside those layoffs:

Chipotle apparently needs 15,000 workers for the annual "burrito season" (whatever that is!) this spring

Even hapless Boeing is planning on hiring 10,000 new workers this year.

Walmart raised their starting wages (again) and added new positions in technology.

Here is another great chart that helps put this in context. Here is the number of companies talking about layoffs and job cuts over time during their earnings announcements.

As you can see these are rising right now but are still nothing compared to the (admittedly brutal) recessions in 2008 and 2020.

But nor are they that bad even compared to, say, 2019 or 2015-2016. We are at an all time low in the unemployment rate for a reason!

That could change in the months to come. There are some indicators of a slowing jobs market out there but it also suggests that some much needed perspective needs to be brought to those banner headlines on media websites.

Lastly, the above chart has the Jobless Claims number over time overlaid on top (it is a thin red line). As you can see, other than 2020 and 2008, this number barely moved during these other periods of moderately elevated job cut announcements.

To conclude, above all, it seems clear to us that there are a lot of boo birds out there rooting for the US economy to crack. A certain segment of people in markets and in the media seem almost obsessed with predicting a recession and competing with each other to make it as dire as possible. They seemed to have leapt from the "inflation is coming" call to a "dire recession incoming" prediction and are not considering any other possibility.

That could still happen in 2023 but there is precious little real evidence for it at present. And, perhaps this is just us, but it is sort of weird to be cheering for a brutal recession? And even weirder to not be talking about both sides of a very balanced issue.

Grow up, we have plenty of real problems. Such as the issues with the war in Ukraine.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.