2023 Theme: Its Earnings, Not Inflation

Over the last few months we have consistently argued that the biggest theme of the last two years - inflation - was slowly receding in importance.

That isn't to say that inflation is no longer a significant concern. It is. We are simply arguing that it isn't the primary concern.

The thinking is pretty simple:

Inflation was such a concern for companies and consumers not because it was just so high but also because it was so volatile. You just didn't know where prices might go next quarter/week etc.

That volatile change more than the absolute level was the biggest challenge for, well, everyone.

These days that is no longer the case. Provided that keeps occurring (always a risk!) this development changes the calculus for investors, consumers, businesses and policy makers.

Because if inflation continues to slow then -> the Federal Reserve will hike less and then -> the US Dollar will stop appreciating -> everyone's dollar denominated debt will become cheaper and global companies' dollar profits will also rise -> companies and countries and eventually people will get some more breathing room to make money and service their debts.

The whole circle will start going in reverse - US dollar weakening is what the world needs in 2023.

We have written about the role of the US Dollar and why a stronger dollar is bad news in some depth here.

This is all to the good but if inflation is no longer the most important question in the global economy right now then this raises the obvious follow-up question:

Well, okay then, if not inflation, what is the focus in markets right now?

There are a few good candidates (the labor market for one! see the next story....) but as we argued the other week we are still voting for company earnings being critically important in the next few quarters.

Here is some very neat evidence from Bank of America's Strategy team:

Company earnings in the S&P 500 are starting to have a far more significant reaction on stock prices than either US inflation data (CPI) or the latest Federal Reserve meeting.

The CPI data or "one chart to rule them all" we have spoken about frequently is no longer quite the power it once was. Rather, investors are far more focused on the revenues, profits and projections from companies.

As we argued two weeks ago, we still think earnings will hang in well enough but this focus also raises the risk.

What if US company earnings decline in the quarters ahead?

On this very subject, we had a relevant question come in on this subject from the Pebble-verse this week.

(Brief aside: We love hearing from those readers though. Feel very open to writing in at contact@pebble.finance)

Back to the question at hand....

Do you really see a lot of people piling into the (stock) market at this point to pay 18x on the S&P 500 for zero earnings growth??

Good question!

What this means is that, despite last year's brutal collapse, US stock market valuations are still very high and yet, as we discussed last week, company earnings are not projected (by the companies' own executives) to grow.

US company share prices are around 18 times their present earnings, on average. This is right above their long term average which would suggest that the market is still slightly expensive on a historical basis.

Considering the fact that inflation - wage AND commodities - are still squeezing margins as well as the fact that just about everyone thinks that companies will only make less money in the months ahead.

Grim!

Now, to be clear we are not disagreeing with this problem.

In fact, we would state very clearly that our single biggest worry after an irrational act by Vladimir Putin or Xi Jinping might be that earnings per share comes in far beneath the already low expectations. Hence our concern last week and our recommendation to watch the current earnings season very, very closely.

We know earnings will decline but, as we argued the other week, how much and how sharply is critical.

But historically at least minimal earnings growth - while hardly something to cheer for - doesn't necessarily mean lower share prices.

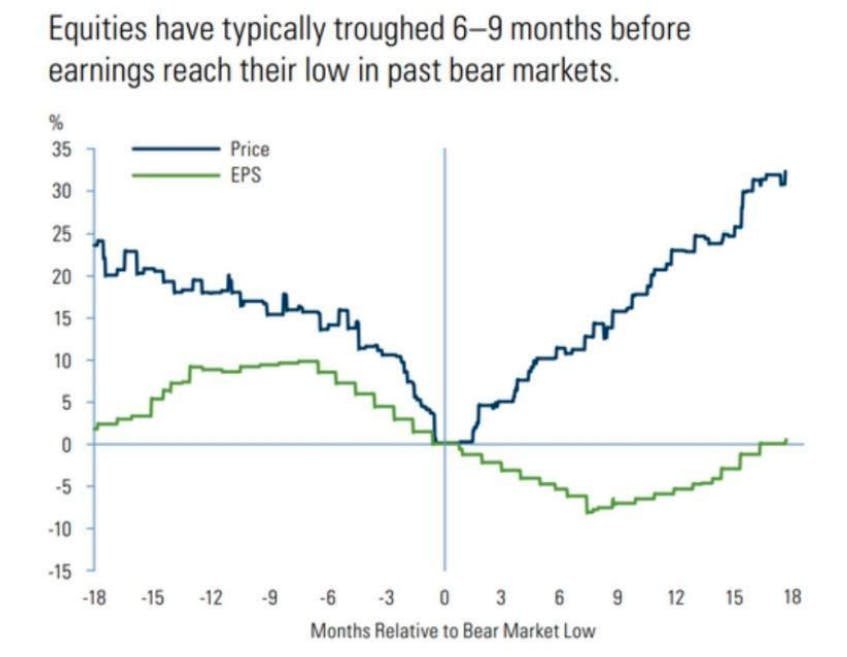

Here is a good chart that captures this:

The point is simply that on the whole, company earnings per share can fall and the market can still (counter-intuitively) rise.

Why?

Simply because the economy can strengthen while earnings continue to weaken. This counterintuitive situation occurs because company numbers have an inbuilt lag in them since they are, inherently, looking at the last quarter's business performance.

So, while we do think it is important to watch company earnings - as we suggested last week - as long as they are not calamitous we don't think they are telling us much about where the economy is headed in the future. They are important to watch for the present rally not for the longer term direction of the economy or the market.

If that is the case then that point and the above chart directs our attention to finding the answer to the obvious follow up:

If not earnings and not inflation then what can we watch in the months to come to get a lead on the economy.

For that we turn to the US labor market.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.