US Inflation Rises Again and Reveals the New America

We had another official US inflation data release this past week.

It came in HOT.

The biggest shock might be that it was high and some people were actually still surprised.

In terms of details:

Month-on-month US CPI Inflation rose 0.9%, compared to 0.6% expected.

The annual measure rises to a stunning 6.2%. So average prices are now up over 6% versus a year ago.

It is official: US inflation is now the highest it has been in 30 years.

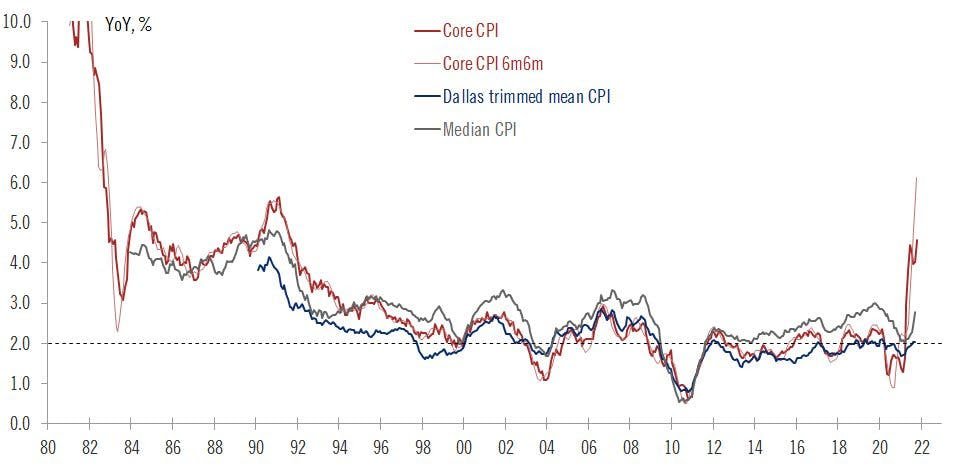

Here is the chart, including with Core CPI (excluding energy and food) and some other derivatives:

Source: BLS

A lot of endless debate around the whole transitory/not actually transitory concept is pretty asinine and not terribly useful.

What can be said rather simply is that a lot of the breezy arguments around why inflation:

Wouldn't last,

Wasn't a big deal anyway,

Or, our personal favorite, was a made up scare tactic more than a economic reality....

Have been blown out of the water. You can see the "Meme of the Week" if you want a good progression of the coverage from those arguing against higher US inflation being a "thing."

The new talking head hot take is: "inflation is here but it is actually a good thing" which gets a double prize for being both foolish and condescending.

Put simply, it is far from clear as to whether it is a good thing for most Americans. For that to be true, you need wages to keep pace.

See the second Pebble story we are following, for more detail on this important topic.

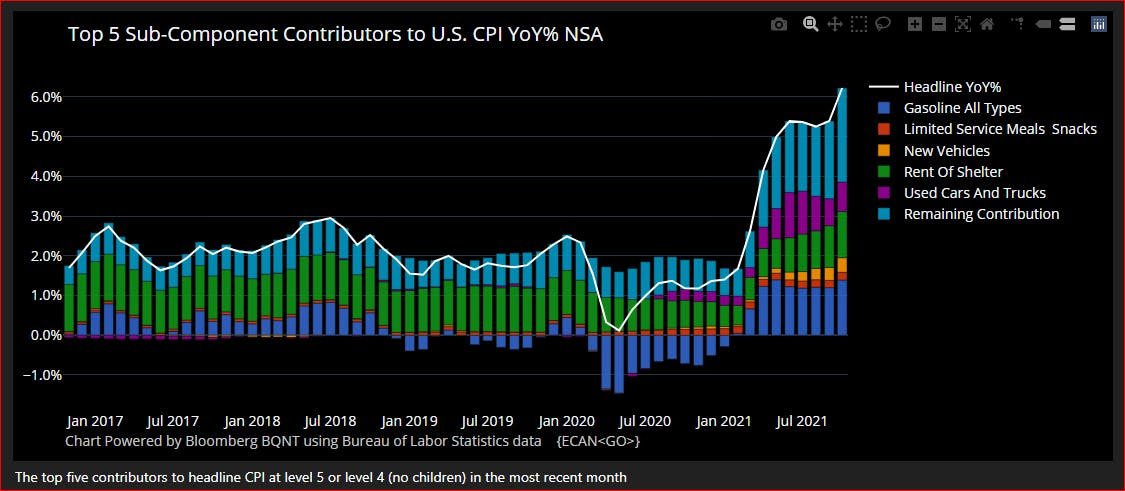

For now, here is an update of our previous chart about what is contributing to this trend of strong inflation and why it is not "just" re-opening from the pandemic anymore.

But if are doing less debating around its existence, how should we think about this trend of rising inflation?

The most important questions now are:

Is the inflation self sustaining?

And are wages keeping up?

More broadly, if inflation is indeed "here to stay," what is the impact of this phenomenon that causes such heated debate and discussion?

This bring us to the new "American Divergence" we alluded to in our introduction.....

The New America:

Americans are employed and wages are rising but so are prices. Many hard working folks are therefore watching (or worried about) their standards of living being eroded.

Despite the lecturing tone (and misleading statistics) used by some of the commentariat, this isn't just in our imaginations.

Here are real wages or wages minus the rate of inflation:

Ouch!

Rising prices and falling living standards - though just beginning - is already leading to changes in how the US economy and society functions. You see this all over the place and frequently discussed in the editions of this newsletter:

Rising house prices and rents.

Many industries and job markets unable to find or retain staff.

Other companies forced to either raise prices or lower their margins.

etc.

******

But there is a deeper transformation occurring as well.

Here is a very insightful chart on the current situation in the US right now - and across the Western world.

There are two lines that have typically followed each other very closely:

The yellow line is the Conference Board's Labor Differential index, which represents US workers' confidence in the job market. It is at an all time high.

The white line represents consumers overall confidence in the economy. It is a good proxy for how positive people are feeling about their working lives and the direction of the country.

The latter is moving sharply lower.

As you can see, normally, these lines move in near lockstep.

Which makes sense.

Traditionally, if you had a job and were able to make ends meet you likely at least feeling okay about the economy and if you believed you could advance or do better then you might even feel positive.

Today is quite different.

Many people have jobs. There are also many job opportunities - and hiring bonuses and higher wages! - for those looking.

Finding a job, even a good well paid job is no longer the issue.

However, there are a host of other problems:

The pandemic has revealed the hidden danger and difficulties of doing a lot of jobs. Firefighters sign up for personal danger, daycare workers and waiters do not.

There is also the inflation we have covered frequently, including today. If the likes of food and gas are rising and also volatile then people may be employed but they are watching their bills march upwards and so they feel poorer despite working hard.

The latest CPI print is telling. The single largest component was gasoline. The second was shelter, broadly defined (see chart).

Unsurprisingly, house prices (and apartment rents) are another related source of anxiety. If the cost of your shelter is leaping ahead of your salary then no amount of job will make it better. Housing insecure might be the only threat that gives job insecurity a run for its money.

CPI components:

The other big takeaway might be a little squishier and that is that, for most Americans, the health of the economy used to be defined by its job market. That is clearly no longer the case.

Having a job - even a good job - doesn't necessarily mean you can feel secure, let alone comfortable.

As we have stated before, this divergence is a real challenge for the current Biden Presidency and the smooth functioning of his administration.

If you want a lead on the midterms or simply to understand why President Biden's approval is so low (43%) when the economy is doing well, this chart is a good place to start.

The flipside of this situation is that if this divergence closes then suddenly a lot of issues could resolve themselves, not just politically but also economically.

That is clearly what the Fed is banking on (and praying for?). Higher growth and fewer "transitory" one offs could leave the economy - and also regular Americans in a great spot.

In other words, there may not be much of a silver lining to this week's inflation print but if this divergence could close in 2022 then that could suddenly leave us with a strong job market and a quickly growing economy.

This would obviously be great and has to be President's Biden overarching goal for 2022. For now, however, everything is pretty messy and the political situation is getting fraught.

This high inflation combined with low approval ratings - and the recent real losses in Virginia and elsewhere - will be raising the pressure on both elected politicians like President Biden and his team as well as independent policymakers like Jay Powell and the FOMC.

The latter especially will be very conscious of not making a hasty mistake that creates more economic problems than it solves.

Taking a step back, this chart bears watching and thinking about in the months and years ahead. If a key driver for how the American economy is behaving very differently from normal then it is very likely to have an impact on life around us.

Speaking of having an impact on our lives.....

US Stock Market Kicker:

This brings us to the stock market.

It may be that strong economic growth is a necessary but not sufficient condition for American economic prosperity and political peace.

It is however good enough for the stock market, which has been reaching record highs on a near daily pace.

********

We seem to be moving from a period of rational exuberance to potentially irrational financial mania - if we are not already there - and doing so at a record clip.

Whether we get and stay there does depend on a host of factors - will growth accelerate higher? - and explicit decisions from policymakers - will the Fed withdraw stimulus and raise rates more quickly?

For now, despite our political divisions and economic stresses, we march upwards at an ever more incredible pace.

As blogger/author Matt Taibbi put it this week:

As America Falls Apart, Profits Soar.

Taibbi and the investors are also not alone.

Financial analysis and data firm, FactSet, published a report this week that noted that company profits are also at record levels.

The firm recorded that companies in the S&P 500 are on track to post net 12.9% profit in the third quarter of 2021.

They pointed out this was the second-highest result since the firm began tracking the number in 2008.

The actual highest? Q2 2021.

These record profits have, impressively, allowed investors to look beyond the supply chain issues and threats to margins:

In the last two weeks, the S&P has:

Reached new highs eight straight trading days, tying the longest streak since 1964;

Risen 19 of the last 23 trading days, a feat surpassed only once in 90-plus years, and

for only the second time since 1950, taken less than a month to rebound completely from twin fragility shocks (these are sharp selloffs).

So, the front page of the newspaper may not be reflecting it, but these are boom times for investors and financial speculators.

So what next? Or, better put, how long can this go on for?

Tough to say, of course.

But the "Fear Of Missing Out" type markets we have written about before (see here) are still very clearly with us.

So are the familiar themes:

Options volumes, trading volumes, retail trading flows, easy financial conditions, all suggest people are piling in more capital into publicly traded equities now matter the problems, threats or, most importantly, expensive fundamentals valuations.

Here is an update we have shown before, the Goldman Sachs Financial Conditions index:

And seasonality suggests it could continue through the end of the year. This is often one of the best times of the year as investors hold on trying to either catch up to their index or segment greater gains into end year.

See here:

The one significant fact to keep in mind is markets can stay irrationally exuberant for quite a while certainly longer .

For context, in the last 5 months of the 2000 stock market dotcom bubble, the NASDAQ was up 110 percent.

So, buckle up and stay very alert. Our present frenzied and seemingly endless rip could actually go on for quite some time.

The present day challenge is markets are now seriously expensive and the labor market is tight and inflation, as we have covered in depth, is high.

This gives the Fed a reason to advance their plans to withdraw stimulus and raise rates. If not, they risk allowing inflation - self sustaining or not - to keep rising and hurt the poor.

Can Jay Powell and the FOMC risk the political backlash? Can President Biden and his party allow people to "feel" that their lives are getting harder every month? Heading into midterm elections?

Will the US elites start to understand that if the stock market and the economy are distinct, that the former may have to profit at the expense of the latter?

Either way, it suggests 2022 will not - can not - look very much like 2021.

*******

Have questions? Care to find out more? Feel free to reach out at contact@pebble.finance or join our Slack community to meet more like-minded individuals and see what we are talking about today. All are welcome.